Fundamentals of PDZ’s Jan Karski Project enhanced by latest study

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In the last six weeks, Prairie Mining’s (ASX: PDZ) share price has increased circa 30% from 47 cents prior to the release of its Debiensko coking coal project Scoping Study to hit a high of 60 cents, but there appeared to be some profit-taking occurring last week as the company’s shares closed at 52 cents on Friday. This could represent a buying opportunity, particularly in light of the promising news released by the company today in relation to its Jan Karski ultra-low ash coking coal project located in Poland.

PDZ’s shares traded approximately 4% higher in the first hour of trading on Monday morning in response to the Jan Karski study.

There could be more upside to come given that the consensus price target is $1.45, representing a premium of approximately 170% to this morning’s opening price of 54 cents.

However it should be noted that price targets are only estimates and may not be met. Also, share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

Strong fundamentals of Jan Karski further enhanced by latest study

To provide some background, in March 2016, PDZ announced the results of a Prefeasibility Study (PFS) for the Jan Karski mine, confirming the technical viability and robust economics of the project, as well as highlighting its potential to become one of the lowest cost, large-scale strategic coal suppliers to be developed in Europe.

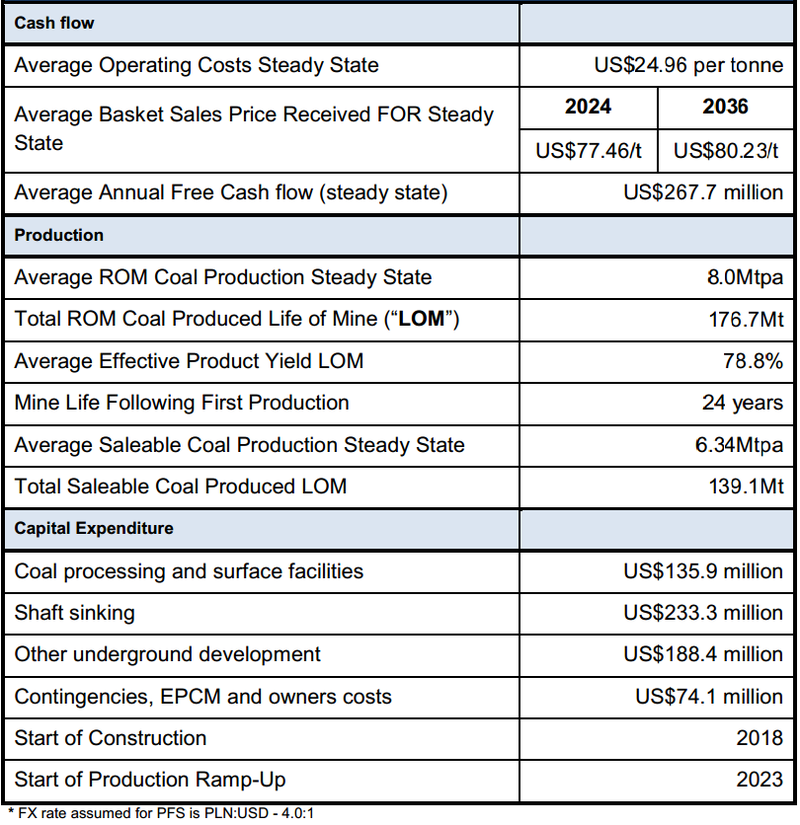

The strong project fundamentals and significant margins above steady-state operating costs are demonstrated below, but it needs to be borne in mind that SSCC that commands a premium price would substantially bolster the average annual free cash flow indicated in the following table.

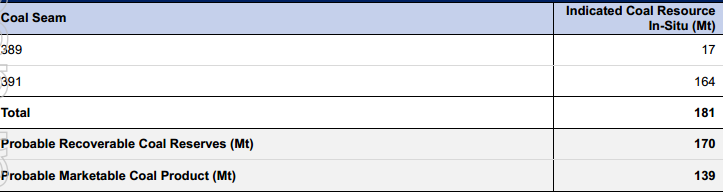

The study utilised an updated coal resource estimate (CRE) for the project which comprised a global CRE of 728 million tonnes including an indicated resource of 181 million tonnes from two coal seams. The PFS incorporated a mine plan based on an initial marketable ore reserve estimate generated from the indicated resources within seams 389 and 391 as shown below.

How Jan Karski stacks up against its peers

Being competitive and realising above-average prices in the coal industry is very much a function of quality of product.

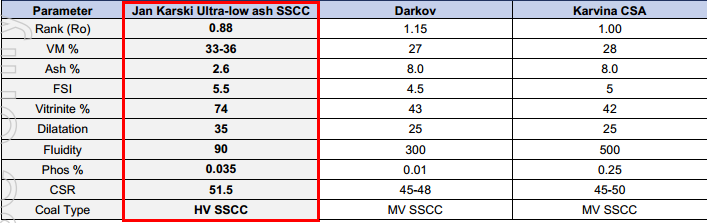

The independent analysis of Jan Karski semi-soft coking coal (SSCC) demonstrated that it has the ability to produce ultra-low ash (less than 3%), making it highly sought after by steelmakers due to the considerable commercial advantages of enhanced value in use and lower carbon dioxide emissions.

As well as demonstrating low ash qualities, coke oven tests demonstrated exceptional results with Coke Strength after Reaction (CSR) of 51.5, exceeding typical CSR parameters of internationally traded semi-soft coking coals.

Preliminary discussions with select European steelmakers have confirmed the suitability of Jan Karski’s ultra-low ash, high CSR SSCC to be utilised in coke oven blends.

Benchmarking against similar products currently produced by OKD in the Czech Republic (as indicated below) demonstrates the potential of the Jan Karski product to replace these coals in the regional market.

The key features to focus on in the table above are the percentage ash and CSR numbers. The percentage ash of 2.6 is well below coal produced from the two OKD mines, and the CSR of 51.5 is significantly above the midpoint of coal produced from both Darkov (46.5) and Karvina CSA (47.5).

Jan Karski could come into production as supply of SSCC contracts

The next step for PDZ is to conduct additional drilling at Jan Karski in order to provide more detailed coking coal analysis and develop a comprehensive marketing strategy around its premium product.

With the project only in the early stages it is important to consider the medium-term supply demand outlook for this coal. Importantly, the two Czech Republic mines produce approximately 1.8 million tonnes per annum of semi-soft coking coal, but reportedly these mines will cease production by 2022.

This would see Jan Karski potentially enter the market as supply, particularly to the heavy industrial hubs in Europe, is contracting.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.