Former Tesla Head of Battery and Energy Supply Chain joins VUL

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Vulcan Energy (ASX:VUL) has appointed a former Tesla executive to provide consulting services to Vulcan in relation to the lithium market, battery supply chain and offtake.

The appointment of former Tesla Head of Battery and Energy Supply Chain, Annie Liu is a major coup for the company.

Ms. Liu led and managed Tesla’s multi-billion-dollar strategic partnerships and sourcing portfolios that support Tesla’s Energy and Battery business units including Battery, Battery Raw Material, Energy Storage, Solar and Solar Glass, including raw materials sourcing efforts such as lithium for battery cells.

Ms Liu’s advice is expected to be paramount in Vulcan’s goal to become the world’s first Zero Carbon LithiumTM producer.

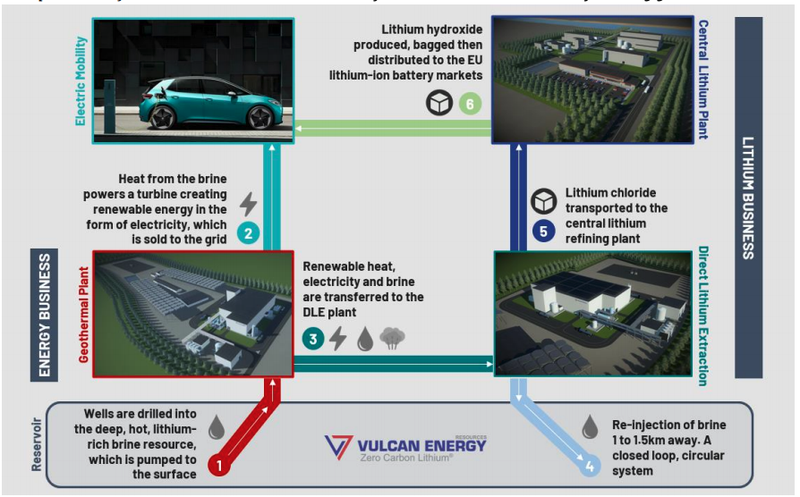

To do so, Vulcan is producing a battery-quality lithium hydroxide chemical product with net zero carbon footprint from its combined geothermal and lithium resource.

This is Europe’s largest lithium resource, located in the Upper Rhine Valley of Germany.

“Vulcan has a ready market on its doorstep with OEMs in close vicinity, Ms. Liu said.

“I’m excited to help Vulcan with its premium product branding around Zero Carbon LithiumTM to meet the EU’s requirement for ethically sourced, sustainable battery metal supplies with a low carbon footprint.”

Ms Liu brings 20 years’ invaluable experience with Tesla and Microsoft to the Vulcan table and has built and led teams from product incubation stage to mature market.

Ms. Liu is also a co-founder of Alto Group Inc and a trusted advisor and counsellor to many of the world’s influential businesses in the EV value chain.

Alto Group also serves private and institutional investor clients in deal generation and due diligence with a focus on sustainable energy sectors.

Vulcan is clearly excited by the appointment of Ms. Liu.

“Annie Liu has a deep knowledge and understanding of battery supply chains and the lithium marketplace. Her profound insights into OEM requirements will provide invaluable assistance to the Vulcan Board and Management,” Vulcan Chairman Mr Gavin Rezos commented.

Vulcan will use of its unique, net zero carbon process to produce both renewable geothermal energy, and lithium hydroxide, from the same deep brine source.

With that in mind, Ms. Liu will help guide Vulcan to address lithium’s EU market requirements by reducing the high carbon and water footprint of production, and total reliance on imports, mostly from China.

Vulcan aims to supply the lithium-ion battery and electric vehicle market in Europe, which is the fastest growing in the world. Vulcan has a resource which can satisfy Europe’s needs for the electric vehicle transition, from a zero-carbon source, for many years to come.

Tesla’s Battery Day and the more recent VW Power Day, highlight supply requirements for lithium.

VW plan to build six electric vehicle factories on the European continent by 2030... which will eventually chew up 200,000 tonnes per year of lithium.

The EU plans to have 30 million electric cars on the road by 2030.

Vulcan has been busy in recent months, achieving and capitalising on a range of milestones:

- EU sustainable battery & CO2 policy expert to join Vulcan as Advisor

- High lithium grades, low impurities from bulk brine sampling

- Agreement with DuPont to advance Direct Lithium Extraction

- Acquisition of world-class geothermal sub-surface development team

- $120 million placement endorses Vulcan Zero Carbon Lithium®

- Positive Pre-Feasibility Study

- German legislation embraces geothermal energy

- EU Regulation on batteries & CO2 footprint.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.