European Lithium delivers impressive resource upgrade at Wolfsberg

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

European Lithium (ASX:EUR) has released its much anticipated upgraded JORC compliant resource in relation to its Wolfsberg lithium project in Austria.

As a point of comparison, the lithium resource as outlined in the group’s prospectus prior to listing on the ASX this year was 3.7 million tonnes ‘inferred’ at 1.5% lithium dioxide at a cut off of 0.75% lithium dioxide.

The upgraded results feature a measured resource of 2.86 million tonnes grading 1.28% lithium dioxide and an indicated resource of 3.44 million tonnes grading 1.08 lithium dioxide.

The total measured and indicated resource is 6.3 million tonnes grading 1.17% lithium dioxide. The key takeaway is that the company has increased its compliant resource tonnes by 75% and the contained lithium at 73,799 tonnes represents a 33% increase compared with the previous inferred contained tonnes of 55,500.

It should be noted, however, that EUR still has several hurdles to jump with regard to their Feasibility Study and as such investors considering this stock for their portfolio, should seek professional financial advice.

Chief Executive, Steve Kesler, said that having established an increased JORC compliant measured, indicated and inferred resource was a key step for the company in terms of developing a resource model that will facilitate the initiation of mine design studies essential in determining the maximum rate of underground mining that can be economically achieved.

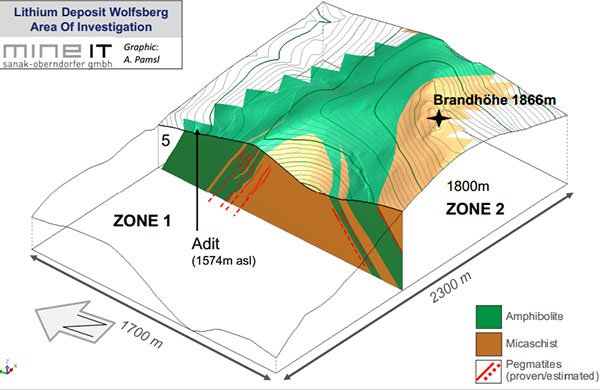

Kesler is of the view that the surface exploration program will confirm the continuation of the pegmatite veins with depth and extension into zone two (the southern limb of the anticline) which will be important to establish the longevity of the Wolfsberg project.

The following graphic highlights the geological trends that Kesler believes will be instrumental in the company being able to further upgrade the resource leading to an extended mine life.

Right place right time for European Lithium

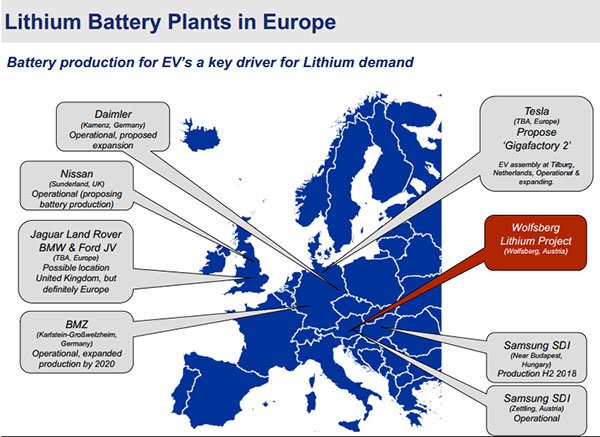

Austria is ideally located in terms of servicing the heavy industrial manufacturing countries in Europe. Germany is a prominent motor vehicle manufacturer, suggesting it will be a source of demand for lithium used in electronic vehicles.

Both in Germany and surrounding countries there are existing plants that are in the process of being expanded, as well as new manufacturers coming on stream. In November, Tesla flagged Europe as the site for its second gigafactory.

Samsung’s SDI manufacturing facility is expected to come on stream in the second half of 2018 and its Zettling plant in Austria is already operational. The following highlights the intense activity in the European region.

Several catalysts on the horizon

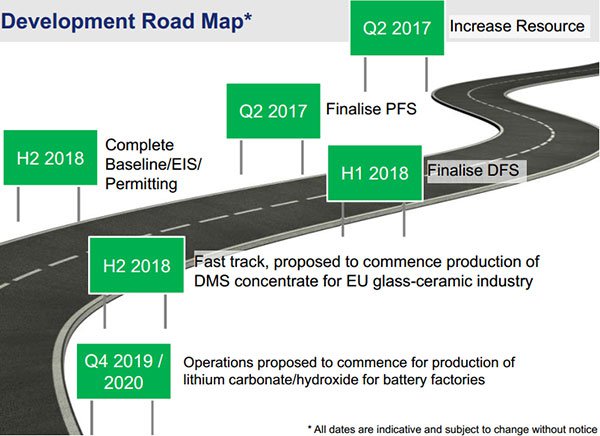

While EUR has been quick to tick a number of the boxes flagged in its prospectus, 2017/2018 will be a busy period for the group as indicated below. Consequently, there is potential for further share price reratings despite the fact that the company’s shares have increased some 20% in recent weeks.

However, it is impossible to predict share price movements and past trends should not be used as the basis for an investment decision. Furthermore, the goals mapped out below may or may not be met. Investors considering this early stage exploration stock should seek independent financial advice.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.