ESG investors provide strong support for VUL’s world first Zero Carbon Lithium™ Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Vulcan Energy Resources Ltd (ASX:VUL) has completed a significantly oversubscribed Placement to institutional investors, raising $4.8 million to accelerate the advancement of the company’s Zero Carbon LithiumTM Project in Germany’s Upper Rhine Valley.

Vulcan intends to produce a world-first Zero Carbon LithiumTM hydroxide product at the project which hosts the largest lithium resource in Europe and is located in the heart of the EU.

The company has been on an exceptional run since its March lows, delivering shareholders a 200% gain as it eyes the completion of its pre-feasibility study and development of a pilot plant at its geothermal lithium brine project.

The oversubscribed Placement was strongly supported by Environmental, Social, Governance (ESG) focused sophisticated investors, including new institutional and sophisticated investors from both Australia and Europe.

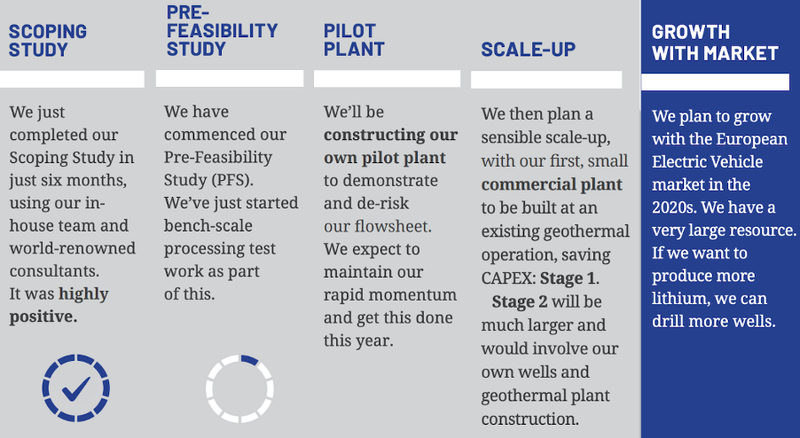

The funds raised from will be used for the completion of a PFS at the Vulcan Zero Carbon LithiumTM Project, including engineering studies and bench-scale lithium extraction testwork.

The Placement funds will also support engineering, construction and operation of a pilot plant, plus the purchase of seismic data to fast-track siting and development of geothermal production wells.

Vulcan Managing Director, Dr Francis Wedin, commented, “We would like to welcome a number of new ESG-focused and institutional investors, and to thank our existing shareholders for the support shown.

“We are excited to be joined by investors who share our commitment to decarbonising the battery raw materials supply chain as part of the global transition to electric vehicles (EVs).

“The last few months have been transformational for the Zero Carbon LithiumTM Project, as we saw Europe’s leadership in EV and lithium-ion battery production growth really take off. The EU is now the fastest growing lithium battery production centre in the world and has an unparalleled commitment to making this supply chain carbon neutral. Vulcan is positioned right at the epicentre of this very rapid growth, with a globally peerless product, process, and project, to produce Zero Carbon LithiumTM hydroxide for EV batteries.

“We have a highly active 6-12 months ahead as we accelerate our project development further, and look forward to keeping our shareholders, old and new, well informed of our progress.”

Vulcan received firm commitments to raise gross equity proceeds of $4.8 million (before costs) through the issue of 12,000,000 fully paid ordinary shares at an issue price of 40 cents per share.

The Placement price represents a nil discount to the 15-day Volume Weighted Average Price (VWAP), and an 8% premium to the 30-day VWAP up to and including 19 June 2020. Merchant Group and Viaticus Capital were Joint Lead Managers to the Placement.

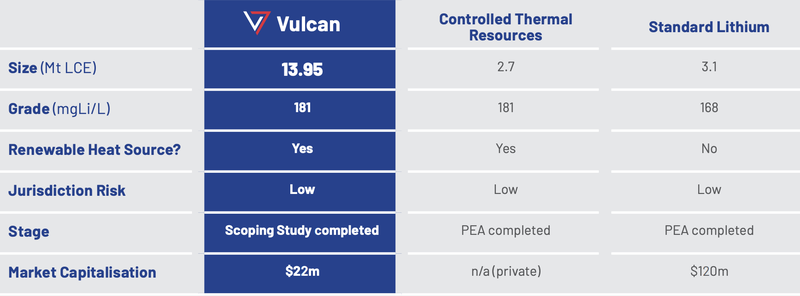

The Vulcan advantage: size, grade, heat, & jurisdiction:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.