ERL confirms high grade gold mineralisation at Penny’s Find

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Assays from a recently completed six-hole diamond drill programme have confirmed high grade gold mineralisation at Empire Resources’ (ASX:ERL) Penny Find’s open pit gold mine, 50 kilometres northeast of Kalgoorlie.

ERL undertook the drilling programme with the aim of increasing its confidence in the gold mineralisation beneath the open pit, converting some Inferred resources to Indicated, and to obtaining important additional geotechnical data for ongoing underground mining studies.

Penny Find’s mineralisation extends to 250m below surface and remains open at depth. High grade gold mineralisation is hosted by quartz veins at the contact between sediments and basalt. Testwork has shown fresh mineralisation to be free milling with a high gravity recoverable gold component of 85%.

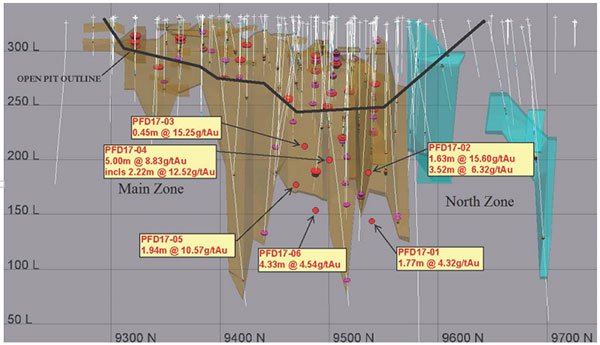

The best results from the six-hold diamond drill programme were:

- 63m at 15.60g/t gold from 168.37m in hole PFD17-02.

- 52m at 6.32g/t gold from 172.50m in hole PFD17-02, including 1.22m at 12.34g/t gold from 174.80m.

- 00m at 8.83g/t gold from 148.00m in hole PFD17-04, including 2.22m at 12.52g/t gold from 150.78m.

- 94m at 10.57g/t gold from 162.36m in hole PFD17-05.

These can be seen on the below long section with drill hole pierce points:

The new drill data has certainly increased ERL’s confidence in the integrity of the earlier drilling results from below the current open pit, which included 5m at 20.88g/t gold, 3m at 14.42g/t gold, 14m at 5.34g/t gold, 6m at 6.77g/t gold, 7m at 5.27g/t gold, and 3m at 8.89g/t gold.

The updated resource estimate is still to be calculated, but once it is done ERL will commence a final underground feasibility study that is expected to be finalised within a few months.

Empire’s Managing Director, Mr David Sargeant commented on the assay results:

“Results from the recent underground drilling have given us the confidence to move ahead with a final underground feasibility to extend Penny’s Find’s mine life beyond the open pit.

“With gold mineralisation open at depth, there is good potential to add to the current underground Indicated and Inferred resource of 170,000t at 5.40g/t gold.”

Any addition to the Indicated and referred resource is speculative at this stage and investors should seek professional financial advice if considering this stock for their portfolio.

ERL holds a 60% direct interest in the Penny’s Find gold project with the remaining 40% interest held by unlisted Brimstone Resources Ltd.

These drill results follow last month’s news that ERL had poured its first gold bar from the open pit operations, with the mine’s ore being toll processed at two nearby regional gold mills.

Going forward, there’s should be plenty of newsflow in the coming months with the updated Resource estimate and final underground feasibility study.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.