Positive market reaction to EYM acquisition

Published 24-OCT-2017 14:46 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Investors have responded positively to Elysium Resources’ (ASX:EYM) proposed acquisition of Hardey Resources which was announced on Tuesday morning.

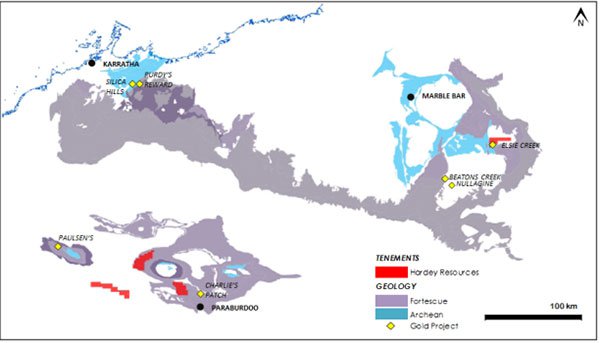

The acquisition provides EYM with exposure to gold and base metal projects located in the Pilbara region of Western Australia that were previously owned by Hardey. These were the Bellarey, Hamersley, Cheela and Elsie North projects, covering 512 square kilometres of Fortescue Group Rocks, as well as the Grace project located in the Paterson province in Western Australia.

All of the Hardey projects are prospective for gold and base metals, though management cautioned investors that further work is required to confirm the gold-bearing nature of the prospective conglomerate sequences which have been identified within the tenements.

As this project is in its early stages investors should seek professional financial advice if considering this stock for their portfolio.

It was in November last year that Hardey applied for an exploration licence covering 163 square metres of ground prospective for Witwatersrand-style conglomerate-hosted gold and high grade orogenic gold in the Paraburdoo region of Western Australia.

Since then, a number of ASX listed explorers have identified Witwatersrand type mineralisation in that region, prompting a rush for land that may host extensions to the orebodies currently being explored.

This was the catalyst for Hardey to identify further licences, resulting in a tenement package which comprises 512 square kilometres of Fortescue Group Rocks and the underlying Pilbara granite-greenstone terrain.

Elysium to follow in the footsteps of Artemis, Novo and De Grey

Commenting on recent developments in the region and underlining the significance of this development for EYM, management said, “Subject to completion of the acquisition, Elysium will hold a significant tenement package that is prospective for Paleo-Placer ‘Witwatersrand-style’ conglomerate-hosted gold mineralisation similar to the discoveries reported recently in the region by Novo Resources Limited (TSX-V:NVO) and Artemis Resources (ASX:ARV) at Purdy’s Reward and OscarWits and, most recently, by De Grey Mining (ASX:DEG) at the Loudens Patch prospect.”

Management highlighted the fact that the discoveries by Novo/Artemis and De Grey, included a significant quantity of gold nuggets found at surface. This style of mineralisation is traditionally associated with a regionally extensive geological formation known as the Fortescue Group of rocks (Fortescue Group Rocks) which includes the lower “Hardey Formation” and the Mount Roe Basalt.

Importantly, the Hardey Formation has been mapped extensively throughout the Bellary project tenements by the Geological Survey of Western Australia.

In order to gain a more thorough understanding of the geology and the prospectivity of the region, both Hardey prospectors and an Elysium geological field team will immediately commence exploration activity.

Given the early stage exploration results achieved by the likes of Artemis, EYM could be the subject of further near-term news driven share price reratings. Today’s news resulted in the company’s shares spiking 150 per cent in the first two hours of trading.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The Witwatersrand style mineralisation is often located near surface in the form of gold nuggets, leading to economical and speedy exploration progress, at times only requiring a handheld device.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.