EMN rides the high purity manganese wave

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Element 25 (ASX: E25) and OM Materials have negotiated offtake terms for the sale of all of the manganese ore produced from the Butcherbird Manganese Project in WA.

Under the non-binding term sheet agreement with ASX-listed OM Holdings' (OMH) subsidiary, OM Materials, Element 25 will sell up to 365,000 tonnes per annum of manganese ore produced at its Butcherbird Project under stage one volumes.

In tandem with this development, Element 25 has received firm commitments to raise up to a total of $9.75 million (before costs) through a placement of 12.5 million fully paid ordinary shares at an issue price of 78 cents per share.

OM Materials will advance a further $2 million under a convertible note which is currently being drafted and is expected to be finalised shortly.

This is a credible achievement for Element 25.

Pricing parameters

The parties have proposed a pricing mechanism which is calculated as a discount against the Fast Markets published 44 per cent manganese benchmark price.

They have also agreed to the specification and pricing formula for the delivered ore between a grade of 28 to 35 per cent manganese.

The Butcherbird Manganese Project has a current JORC resource in excess of 263 million tonnes of manganese ore.

Element 25 has recently completed a PFS with respect to developing the deposit to produce manganese concentrate for export to generate early cashflow.

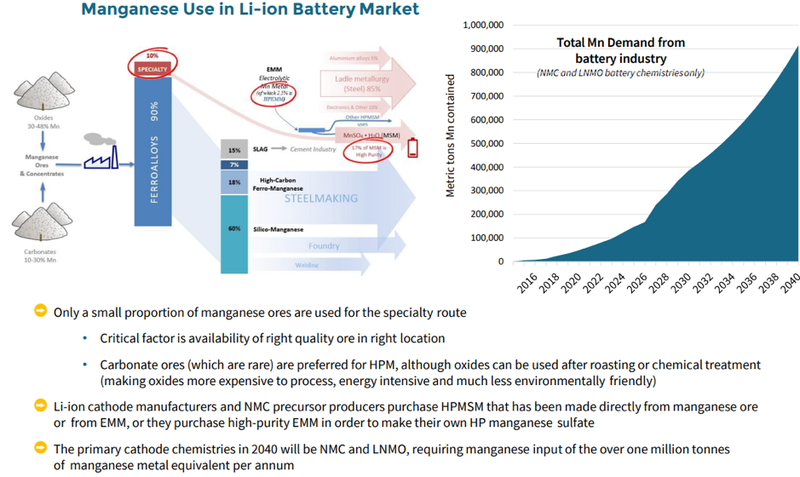

The company is investigating a processing solution to undertake downstream processing to produce high purity manganese products including Electrolytic Manganese Metal (EMM) and battery grade manganese sulphate (HPMSM).

Another company riding the manganese wave is EMN.

EMN offers advanced, ideally located, premium product, long-life option

Investors looking to gain exposure to the significant uptick in demand for high purity manganese could consider Euro Manganese Inc (ASX:EMN).

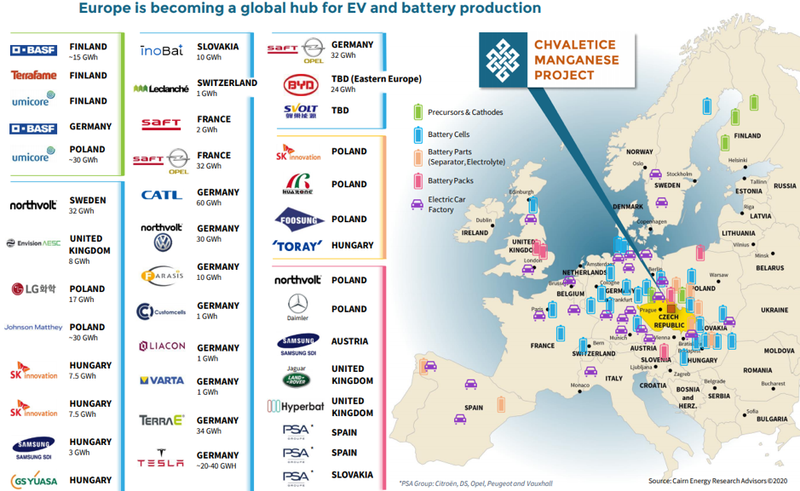

The location of Euro Manganese’s Chvaletice Manganese Project in the heart of Europe is extremely important.

The group is ideally positioned to sell its high purity electrolytic manganese metal (HPEMM) and high purity manganese sulphate monohydrate (HPMSM) to both lithium-ion battery manufacturers, as well as the auto industry which is increasingly focusing on the manufacture of electric vehicles.

At least six large battery factories that will consume manganese inputs are located between 200 kilometres and 500 kilometres of the Chvaletice Manganese Project - others are in the process of being built across Europe.

Musk flags high content manganese battery as the way of the future

Elon Musk’s recent comments regarding the use of a much larger proportion of manganese should see demand accelerate to levels not previously anticipated, providing premium pricing opportunities for a company such as Euro Manganese.

Musk said that he was seeking high purity manganese as a primary raw material for battery manufacture.

Tesla’s revolutionary new EV batteries will contain 1/3 manganese, 2/3 nickel and no cobalt.

Production is to begin immediately and will ramp up over the coming year to 10GWH of batteries.

Telsa’s giga-factory, currently under construction in Germany, is located around 400 kilometres from EMN’s Chvaletice Manganese Project.

Europe’s automotive industry employs more than 14 million people and there has been a recent political commitment to fast track green energy projects.

Chvaletice has an established manganese resource and with a 25 year project the group is expected to be Europe’s only primary producer of the aforementioned high grade manganese commodities.

Chvaletice has the necessary infrastructure on its doorstep, including power, water and transport.

The deposit is uniform and fully drilled, making it ideal for the production of high purity manganese using clean, modern and commercially proven technologies.

Pilot plant products have exceeded ultra-high purity manganese specifications required by the most demanding high-tech customers.

The group is targeting commercial production in 2024, coinciding with a significant uptick in manganese demand as illustrated below.

Foundations for long-term offtake agreements bode well for financing

Several prospective customers have expressed interest in procuring high-purity manganese products from the Chvaletice Manganese Project, and in conducting supply-chain qualification of the products of the proposed Chvaletice demonstration plant.

Euro Manganese has already signed five memorandums of understanding with major customers, which are intended to evolve into long-term offtake agreements.

These factors will be important as the group progresses towards financing the project that has been forecast to deliver undiscounted mid-range cumulative cash flow of $3.7 billion over a 25 year mine life.

A preliminary economic assessment delivered an after-tax net present value based on a 10% discount rate of $593 million, suggesting the potential for a strong share price rerating given the group’s market capitalisation of $43 million.

While this morning’s opening share price of 25 cents per share represents a four-fold increase in the last six weeks, this is a stock that has flown under the radar for some time, and as the attached research report indicates, there are numerous catalysts on the horizon.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.