Dual share price catalysts drive Lion Energy higher

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

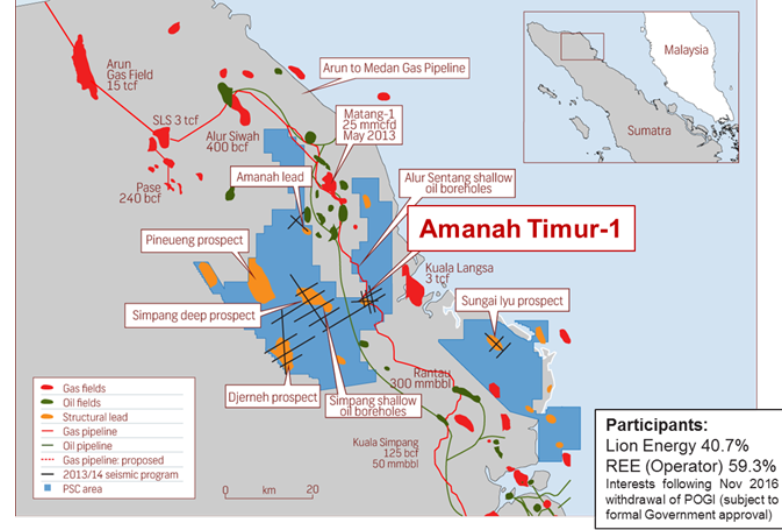

Shares in Lion Energy (ASX:LIO) spiked 15% last Thursday after the company announced that its Amanah Timur-1 well had been spudded on January 3 and was expected to take only 10 days to drill to a total depth of approximately 570 metres.

The potential near-term catalyst of exploration success in a low risk region adjacent to essential infrastructure with prospective resources of up to 9 million barrels of oil (gross recoverable) has no doubt excited investors, particularly given a positive income would generate near-term cash flow.

In highlighting the significance of Amanah Timur, LIO Chief Executive Kim Morrison said, “The drilling of Amanah Timur represents a key milestone for Lion as we have led the technical effort on this prospect which represents a highly attractive opportunity with near-term cash flow potential”.

However, investors should note that LIO is an early stage exploration company, and share price movements, as well as forward-looking statements by management and/or analysts should not be used as the basis for an investment decision. Independent financial advice should be sought if considering this stock.

Double dose of good news

What may have been equally instrumental in driving LIO’s share price higher was news that a record total lifting of just over 500,000 barrels of oil from the Seram (non-Bula) Block PSC had been completed on December 25.

This news was released on the last trading day prior to New Year’s Day, and was likely missed by many investors. LIO’s share of revenue from the sale was nearly US$500,000, but just as important is the fact that management has forecast full-year production to exceed 1.39 million barrels, equivalent to 3800 barrels of oil per day.

Resultant cash flow combined with proceeds from the recent capital raising of $650,000 is timely as the company embarks on an aggressive exploration program in 2017.

Analysts see Lion as undervalued

In November, Peter Strachan from Strachan Corporate assessed a risked value of $24.5 million or 25 cents per share based on the share structure at that time, after allowing for farming down to fund exploration work.

Broker projections and price targets are only estimates and may not be met. Also, historical data in terms of earnings performance and/or share trading patterns should not be used as the basis for an investment as they may or may not be replicated.

While there has been some dilution relative to his valuation as a result of the capital raising conducted in December, this only had a nominal impact on his valuation and it is important to note that this will possibly be offset by recent developments at Seram and/or success at Amanah Timur.

Strachan views the company’s South Block A prospect as particularly promising, saying, “The North Sumatra Basin is one of the most prospective hydrocarbon basins in Indonesia with discovered hydrocarbons amounting to 22 trillion cubic feet of gas plus 1.6 billion barrels of liquids”.

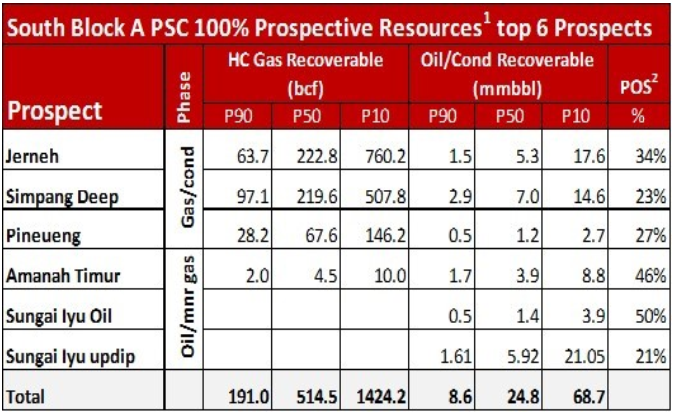

He highlighted the fact that LIO has identified six high priority drilling targets within this permit, which have P50 prospective resources totalling 514 billion cubic feet of gas plus 24.8 million barrels of oil and condensate. Importantly, LIO has rights to both conventional and unconventional petroleum resources found within the perimeters of this permit.

LIO has a 40.7% interest in the project. Strachan lists below the metrics relating to each prospect on a 100% ownership basis.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.