DTR acquires Raymond and Carter mines in Colorado

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Colorado gold mining and exploration company Dateline Resources Limited (ASX:DTR) has today announced it has significantly strengthened its Colorado metals portfolio with the acquisition of the Raymond and Carter gold mines. Both mines adjoin DTR’s Gold Links property, and are highly prospective historical gold mines covering approximately 1,300 acres.

This brings DTR’s total Colorado holdings to more than 2,000 acres.

The agreement stipulated a US$2 million cash purchase price and settlement in approximately 90 days. DTR has paid a refundable 10% deposit to the registered owner and has a 30-day period to exercise its right to walk away from the transaction for any reason.

At settlement, DTR will hold approximately 600 acres of leasehold land which has produced over 300,000 ounces of gold from narrow vein, high-grade ore-bodies — and has not been mined or explored in the modern era. Further, its combined mineralisation strike length will then exceed 3 kilometres.

It’s worth noting that DTR is an early stage play and investors should seek professional financial advice if considering this company for their portfolio.

Raymond and Carter mines: a bit of history

The Carter mine was in production until 1982 when the mill burnt down. Due to the low gold price, the decision was made to not re-build, however an Atlas Minerals non JORC compliant Estimated Mineral Resource report claimed that the Raymond and Carter properties hosted 1.5 million tonnes at 15.5 grams per tonne for a total of 750,000 ounces of gold.

However, this report cannot be verified by the company, and it has no JORC compliant evidence that this estimate is correct. All exploration undertaken by DTR will aim to provide JORC-compliant results.

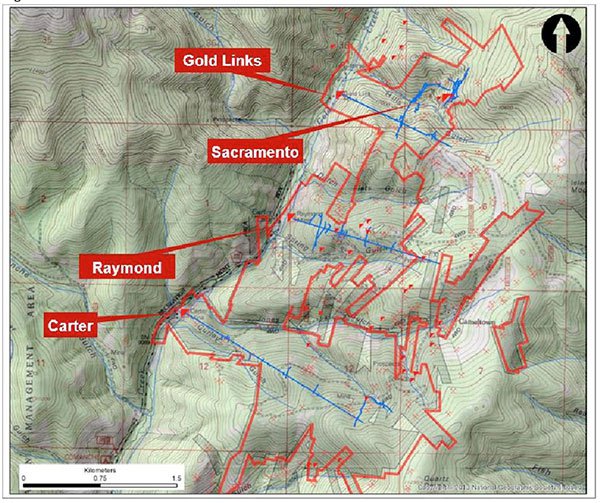

The below image illustrates DTR’s combined freehold landholding in the district that hosts the Gold Links, Raymond and Carter mines (red lines) and the map of the old workings (blue lines).

DTR is currently undertaking a program to digitise all of the old maps and workings that including assay results taken from surface samples. Once done, the data will be used in conjunction with a 3D seismic survey of the area.

Work completed last year at the Gold Links property (2150 vein) indicated that the high- grade gold shoots are associated with heavy sulphide (galena and pyrite) with the remainder of the vein being quartz and carbonate. The company stated in its announcement that “this mineral density contrast should make any mineralised shoots on our land clearly evident in a 3D seismic survey”.

DTR Chief Executive Officer Stephen Baghdadi said: “As exploration and project development work continues across our Gold Links Mine and the ongoing commissioning of our Lucky Strike Mill progresses, we have been actively securing surrounding properties to add scale and optionality to our growing portfolio in this district of Colorado.

“The acquisition of the Raymond and Carter mines is a clear reflection of Dateline’s confidence in this highly prospective district, and we are confident that modern exploration activities will add considerable value to our asset base.

“We have identified over 3km of potential strike across the combined acreage from the Sacramento to the Carter and there are potentially multiple high-value targets that we plan to test as part of our ongoing and active exploration and development program on this exciting goldfield.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.