Discovery of new prospect at CLA’s cobalt project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finfeed presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

Celsius Resources (ASX:CLA) has announced further positive developments at the Opuwo Cobalt Project located in Namibia, prompting a share price increase of circa 10%. A total of 50 holes have now been completed by CLA, demonstrating mineralisation over a strike length of more than 15 kilometres.

As a backdrop, the project has excellent infrastructure, with the regional capital of Opuwo approximately 30 kilometres to the south providing accommodation, fuel, supplies, an airport and a hospital. Good quality bitumen roads connect Opuwo to Windhoek and Walvis Bay.

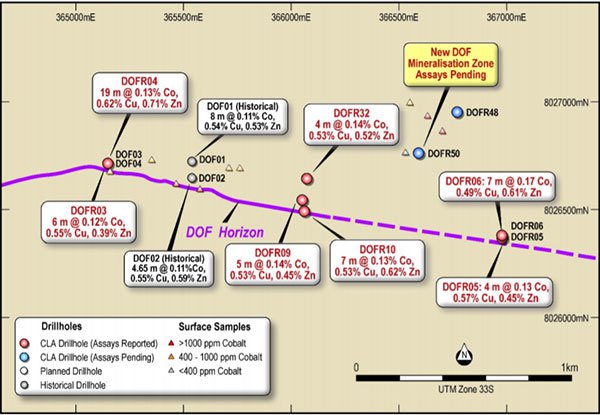

In the last week, CLA has discovered additional Dolomite Ore Formation (DOF) in a drill hole located approximately 350 metres north of the known and mapped mineralisation – with the prospect undergoing systematic testing through the current drill program. The location of the new mineralised zone relative to other drilling sites is shown below.

Further drilling will be required to determine if this is a parallel occurrence or a result of folding of the known DOF unit.

Results suggest scope for expansion

The initial exploration target, consisting of between 33 and 41 million tonnes, grading approximately 0.13% – 0.17% cobalt and 0.45% – 0.65% copper, covers a zone of approximately 11 kilometres in the central portion of the project area.

Management is of the view that the target has significant potential to be expanded given the drilling results from outside this zone, and the new mineralised zone announced today.

However this is an early stage play and as such any investment decision should be made with caution and professional financial advice should be sought.

However, CLA stressed that the potential quantity and grade is conceptual in nature, and that there has been insufficient exploration to estimate a Mineral Resource. At this stage, it is uncertain if further exploration will result in a Mineral Resource Estimate.

Though these uncertainties prevail, there is no doubt the drilling results have provided a degree of confidence regarding the Opuwo cobalt project.

“The identification of additional mineralisation approximately 350 metres north of the mapped and drill tested DOF horizon is an exciting development for the company, and we look forward to receiving the assays from these holes in the coming weeks,” CLA’s Managing Director, Brendan Borg said.

The receipt of assays could be another share price catalyst, and it is also worth noting that the company is now conducting follow-up drilling in this area to enhance its understanding of how this impacts the broader project.

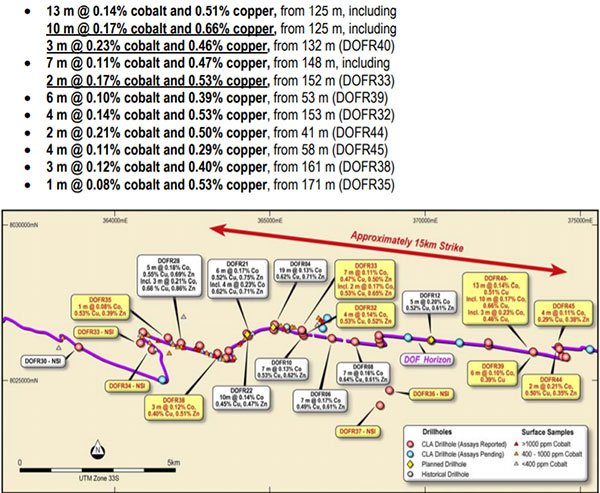

New sample assays have extended cobalt-copper mineralisation across a distance of over 15 kilometres as outlined below.

Consistency of results boosts confidence

These results are consistent with previous batches of results received, and importantly continue to show potential for higher grade zones within the extensive mineralised system. Mineralisation extends to surface or near surface along the entire strike length investigated to date, and has now been demonstrated to extend to a vertical depth of at least 150 metres.

This initial phase of reverse circulation drilling is designed to test a 20 kilometre strike length (part of a 30 kilometre strike) of the cobalt-copper mineralised DOF horizon, and is expected to be completed within the next two weeks. However, given the newly discovered mineralised zone, an additional two holes are being considered.

Diamond drilling is continuing, providing samples for first pass metallurgical testing. Three holes have been completed, with another five holes remaining in the planned program. The diamond drilling program is expected to be completed in August with sample test results, once again a potential share price catalyst.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.