De Grey surges despite tough day for gold

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

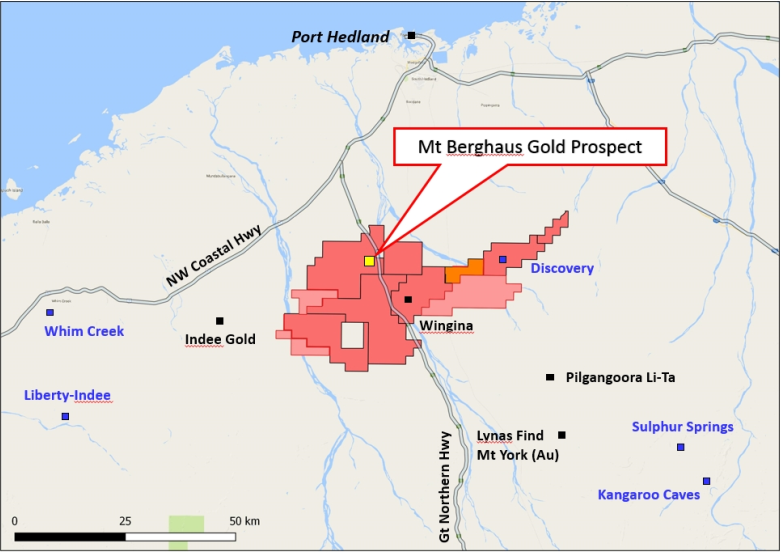

Shares in De Grey Mining (ASX:DEG) surged nearly 10% on Friday morning after the company released promising exploration results in relation to its Mt Berghaus prospect, part of the Turner River project located in relatively close proximity to Port Hedland in Western Australia.

With the gold index slumping more than 7% on Friday, one can only imagine how its share price would have responded if this news was released amid more positive sentiment.

Indeed, Beer & Co. analyst Pieter Bruinstroop likes the look of the project, recently saying, “In our view DEG will be able to increase the total resource significantly over the next six months, with a feasibility study about end of 2017 and first gold 12 months later”. He has a speculative buy recommendation on the stock.

Potential investors should not make assumptions regarding future share price fluctuations, nor should they use forward-looking statements provided by the company or brokers as the basis for an investment decision. DEG is a speculative stock and independent financial advice should be sought prior to investing in this company.

With regard to the broader project, DEG is planning for gold production from an initial series of oxide open pits and a centralised CIL plant. With numerous gold targets and 100 kilometres of prospective shear zone in close proximity to essential infrastructure, the Turner River project has plenty going for it.

Good grades and thick intersections bode well for the future

It isn’t surprising to see the market respond positively to today’s results which featured robust grades across relatively broad widths at fairly shallow depths.

These included 12 metres grading 11.36 grams per tonne gold from 5 metres and 31 metres grading 2.07 grams per tonne gold from 8 metres.

Deeper drilling yielded 12 metres grading 2.2 grams per tonne gold (51 metres) and 4 metres grading 7.95 grams per tonne gold (28 metres).

Results such as these align well with management’s near term strategy of developing an open pit operation.

Further potential outside the existing resource

It was also encouraging to note that drilling intersected multiple sub-parallel gold lodes, with many drill intersections outside of the existing resource boundary, suggesting the exploration upside could exceed current expectations. Importantly, the resource remains open along strike and at depth.

Management noted that shallow oxide mineralisation extends to surface with rock chip samples of quartz veins returning results of up to 62.5 grams per tonne gold with an average grade of 7.1 grams per tonne from 31 samples.

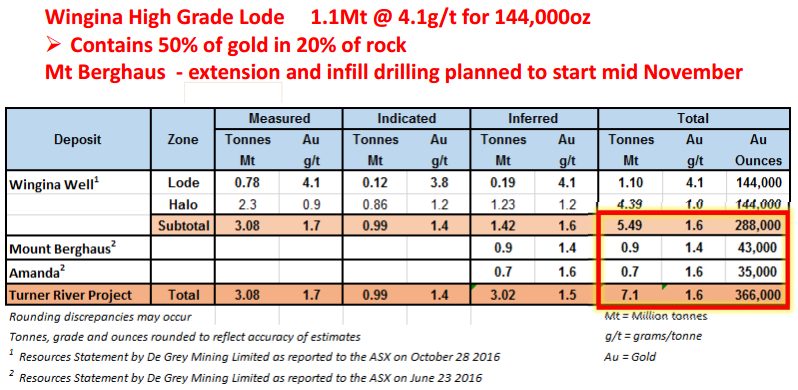

This news suggests that there is the potential for a substantial upgrade of the existing Mt Berghaus gold resource and on this note the group’s geology manager, Andy Beckwith said, “Growing the Mt Berghaus shallow oxide resource is the second step in De Grey’s strategy of defining 500,000+ ounces of gold at Turner River, given we are currently 70% there with 366,000 ounces already defined”.

From a broader perspective Beckwith said that Mt Berghaus has the hallmarks of a large gold system with multiple parallel lodes, excellent grades and many untested targets remaining.

The release of final assay results for the remaining 42 holes which is expected in January is a potential share price catalyst.

While these results in isolation could provide share price momentum, they will also provide the foundation for an updated resource estimate, an important development in its own right.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.