De Grey achieves one million ounce milestone

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

De Grey Mining (ASX:DEG), an advanced gold exploration company operating in the Pilbara region has provided an updated mineral resource for the Indee project announcing a one million ounce milestone, taking into account historical drilling data and bringing the estimate in line with JORC 2012 standards.

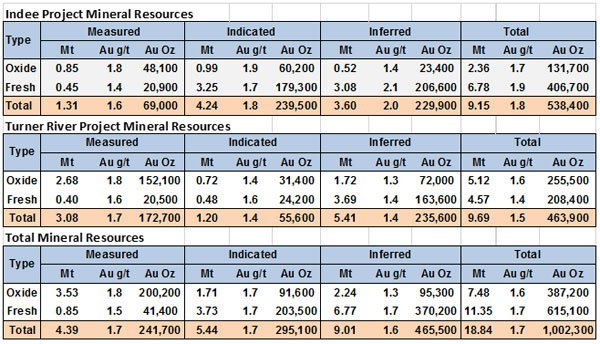

The total resource at Indee, as part of the overall 1 million ounce, is 538,000 ounces grading 1.8 grams per tonne, but there is scope for substantial resource extension based on already identified significant deposits, along with a reasonably well defined geological east-west trend.

The Indee project remains subject to an option agreement whereby DEG must pay $15 million to acquire the asset by July 24, 2018.

However, the project is already shaping up as a particularly lucrative deal for DEG with the acquisition metrics reducing from $43 per resource ounce to $28 per resource ounce. This is expected to fall further as drilling progresses at the site.

It should be noted here that DEG’s project is in the early stage here and investors should seek professional financial advice if considering this stock for their portfolio.

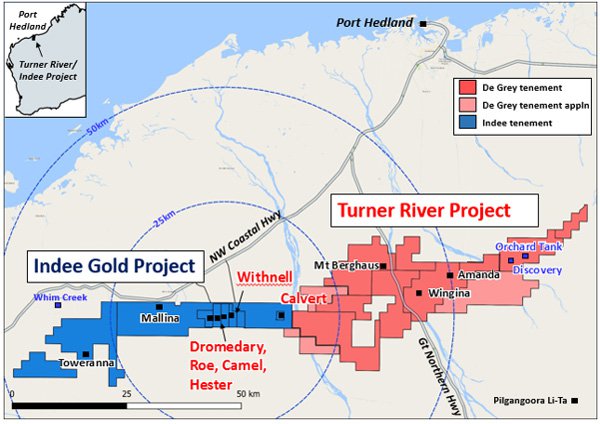

Should the acquisition go ahead as expected, the Indee project will become part of DEG’s overall Pilbara gold project which includes the 464,000 ounce Turner River project, situated adjacent to Indee as shown below.

The big picture demonstrates potential for attractive project economics and exploration upside

The total resource across the two projects is just over 1 million ounces grading 1.7 grams per tonne gold with 54% of the resource in the measured and indicated categories.

DEG has commenced a Scoping Study based on a proposed standalone operation with simple open pit mining and on-site processing. The study aims to define proposed project economics, plant throughput and design criteria, capital and operating costs.

Scoping Study findings are expected to be released late May. In the interim, a major drilling program will commence, targeting extensions to existing resources and advanced resource targets including Mallina, which can be seen in the above map lying to the west of the Indee’s established deposits at Withnell, Dromedary, Roe, Camel, Calvert and Hester.

The strong east-west structural trend suggests that there is exploration upside in Mallina and Toweranna, and this will be management’s focus in identifying resource extensions.

DEG already has a head start as previous drilling demonstrates mineralisation at the two deposits remains open at depth and down plunge. Furthermore, the high grade nature of the plunging shoots has given the company a degree of confidence in the potential for a longer term underground mining operation.

Summing up these recent developments and the group’s potential outlook, Geology Manager, Andy Beckwith said, “Across both projects (Turner River and Indee) the shallow resources are well drilled to measured and indicated categories and we expect a high conversion rate to open pit reserves as we progress through feasibility studies”.

Beckwith noted that deeper drilling at Indee completed by the vendors demonstrated considerable potential at depth, referring to the significance of the high grade plunging shoots in terms of supporting an underground operation.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.