Cora Gold looks to Southern Mali for future allure

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. FinFeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

Cora Gold Limited, a UK-based and AIM-listed gold exploration company with a focus on West Africa, has just mobilised a drilling programme at its Sanankoro Gold Discovery in Southern Mali.

Cora listed on the UK’s AIM market in October, raising around £3.45 million (A$6.11 million) and intending to commercialise a 14 kilometre stretch of known gold-bearing tenure.

However, it is early stages for the company and investors should seek professional financial advice if considering this stock for their portfolio.

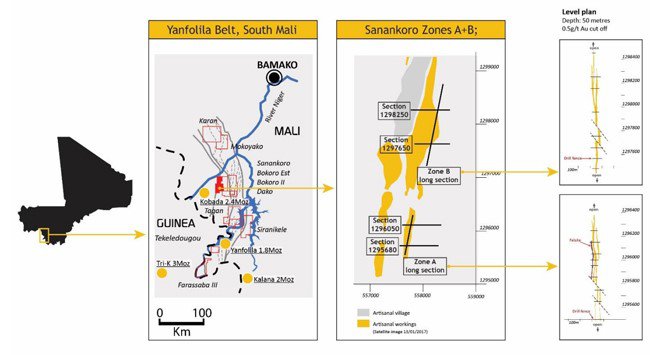

The Sanankoro property represents Cora Gold’s flagship project and consists of four contiguous permits Sanankoro, Bokoro Est, Bokoro II and Dako that encompass a total area of approximately 320 km2. Historical exploration activity to date includes soil sampling, termite mound sampling and ground geophysical surveying, which were completed by Randgold and Gold Fields between the mid-2000s and 2012.

Source: Cora Gold

The initial 3,000 metre combined AC and RC programme represents the first phase of Cora’s programme, currently planned for completion before the end of this year. Meanwhile, the full drilling programme of approximately 15,000m, is anticipated to complete sometime in Q2 2018.

More specifically, Cora’s drilling is targeting the 1.5km long ‘Target 1’ (as shown in the image above), located towards the north of Sanankoro and identified by shallow historical drilling which returned values including 6m at 2.7g/t gold, 3m at 5.9 g/t gold and 15m at 1.0 g/t gold.

Additionally, Cora is also conducting infill and confirmatory drill holes at Zones A and B, where it intends to change the drill-direction bearing from the traditional East-West to North-West, as a means of better testing all quartz veins at Sanankoro. At Zones A and B, the major focus is to test for extensions along strike following recent mapping of the area which indicated “the presence of a well-developed set of east-west trending, sub vertical, quartz veins that are believed to carry gold mineralisation” according to Cora Gold CEO Jonathan Forster.

A key aspect of Cora’s exploration programme is to clarify the status of previously targeted trending zones which have been unable to systematically test gold mineralisation potential at Sanankoro.

“Historical drilling was aligned on an E-W axis to test only previously targeted trending zones and has failed to systematically test, gold mineralisation potential from the E-W trending vein set. Anecdotal evidence, as well as artisanal workings, suggest the E-W trending veins carry gold,” says Forster.

Cora Gold CEO Jonathan Forster.

“We are very excited to have commenced the drilling programme at Sanankoro, building on Gold Fields’ positive historical results from Zones A and B. The programme is designed, in the first instance, to further highlight the potential scale of Sanankoro which we believe could be a >1-million-ounce standalone mining operation. I look forward to reporting on the progress of the drill programme and on further targets as we advance the 15,000m campaign.”

Exploration success at this early stage for Cora, is likely to provide further encouragement and maintain the company’s gradual development from explorative junior to confirmed producer at Sanankoro.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.