Cora completes stage 1 drilling at Sanankoro, identifies new targets

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. Finfeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

AIM-listed gold explorer, Cora Gold (AIM:CORA) today announced to the market that, following the drill rig mobilisation in November last year at its flagship Sanankoro Gold Discovery in Southern Mali, it has completed the Stage 1 reconnaissance drill.

The company is now awaiting assay results, which are expected before the end of the month. 29 drill holes have been completed for nearly 2,800 metres of mixed aircore (AC) and reverse circulation (RC) drilling, ranging between 68 metres and 140 metres in length.

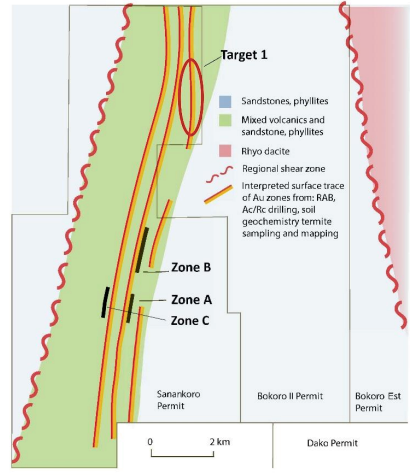

27 drill holes have been completed at the Sanankoro Target 1 over a strike length of nearly three kilometres, with two drill holes completed at Sanankoro Zone A.

Of particular note is the fact that visible gold has been observed in many of these holes, which indicates widespread mineralisation along the structures.

However, it is early stages for the company and investors should seek professional financial advice if considering this stock for their portfolio.

A new structure (Zone C), located to the west of Zones A and B, has also been identified at the Sanankoro Target through mapping of artisanal sites and surface sampling.

Stage 2 drilling is now commencing, with an additional 4,000 metres of combined RC/AC drilling and 500 metres of diamond core drilling focusing on Sanankoro Zones A, B and C – this is set to be completed in the coming months.

Map of drilling locations at Sanankoro (Source: Cora Gold)

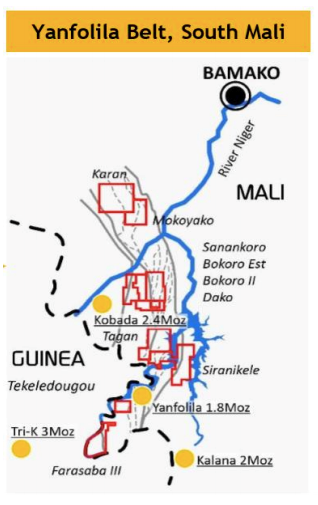

New, highly prospective drill-ready targets have also been identified at the Tekeledougou Project, which lies some 60 kilometres south of Sanankoro and is situated within eight kilometres of Hummingbird Resources’ producing Yanfolila Plant (Hummingbird Resources is a 33.85 per cent shareholder in Cora Gold).

Map of Yanfolila Gold Belt tenements (Source: Cora Gold)

The first target is the site of significant artisanal workings that have exposed a quartz shear structure approximately 30-40 metres in width along a strike length of approximately 600 metres. Here, the geology exposed by the artisanal workings comprises well developed, stacked, sheeted and stock worked, predominantly east-west oriented intense quartz veining.

Cora believes there is potential to extend the footprint, with a potential target of greater than one kilometre strike length. The company is planning to drill at Tekeledougou by end of Q1 this year.

Cora Gold CEO Dr Jonathan Forster said: “We are very pleased with the progress of the drill program at Sanankoro to date. The presence of visible gold in many of the drill holes along nearly 3km of strike is particularly encouraging as is the visual identification of key lithologies that appear to host gold mineralisation. I look forward to reporting the initial assay results which are targeted by the end of January 2018.

“We are now commencing Stage 2 of the drilling campaign, focusing on connecting Zones A and B into a single larger zone as well as completing the first stages of exploration at Zone C, a potential parallel repetition of these structures to the west. Zone C is a new structure identified by field work during Stage 1 of the drill programme.

“In addition, we have identified two extremely promising targets at our Tekeledougou Project within the Yanfolila Project area, which will be prioritised for reconnaissance drilling towards the end of Q1 2018. They represent exciting prospects over large, already identified strike lengths, within close proximity to Hummingbird Resources’ now operational Yanfolila Mine and Plant.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.