Tungsten delivers on Chile lithium strategy

Published 20-JUL-2017 13:22 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

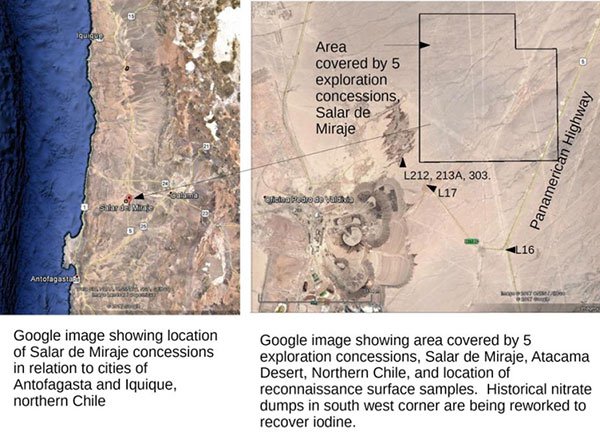

Carbine Tungsten (ASX: CNQ) has received official confirmation of the grant of five exploration concessions in northern Chile. The concessions are valid until May 10, 2019 and cover part of the Salar de Miraje, and enclosed drift basin in the Atacama Desert.

Management noted that on present evidence, this area is geologically analogous to the Salar de Atacama rift basin, located 150 kilometres to the south-east, a source of a third of the world’s lithium from brines within the sediments deposited in the basin.

Of course, it should be noted this is an early stage play and investors should seek professional financial advice if considering this stock for their portfolio.

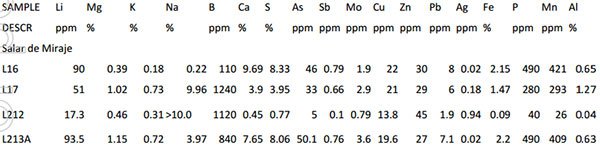

Analyses of surface samples taken by CNQ of evaporative saline crusts in Salar de Miraje indicate that the crusts contain anomalous lithium, boron and potassium. In reconnaissance sampling (see below), CNQ has determined that lithium values in saline crust samples that exceed 50 ppm lithium appear to be anomalous.

The significance of these anomalous values will be tested by drilling proposed for later this year. This will be aimed at sampling brines anticipated to be contained in early rift fill sediments within the Salar.

Importantly, Salar de Miraje has been a significant historical producer of nitrates from the margin of the Salar, and iodine is currently being produced from mine dumps left by nitrate margin of the Salar, and I dined is currently being produced from mine dumps left by nitrate mining just west of the concessions granted to CNQ.

Acquisition of Salar de Mar concessions consistent with management’s strategy

Leading up to these developments, CNQ had outlined intellectual property developed by Doctor Andrew Wright and Rado Jacob Rebek constituting radical insights into the geological habitat of lithium.

It was noted that lithium brine is occurring in internal drainage basins in continental rifts, and that lithium is one of many metals introduced in solution into the basins as a consequence of rifting.

CNQ highlighted that Chile in particular encompasses a continental rift of the right proportions, though this had not previously been recognised.

While Chile is a major producer of lithium from brines that occur in modern internal drainage basins in the Altiplano at elevations of more than 3500 metres, the existence of lithium brines in geologically older basins at much lower altitude (between 750 metres and 1000 metres) west of the Altiplano had not been tested.

These older basins are mostly covered by desert dust, although they have produced nitrates, borates and salt (Sodium Chloride).

The older basins have several major logistical advantages, including the fact that evaporation rates are higher for concentration of lithium brines to commercial grades. They are also closer to modern infrastructure such as power, sealed roads and ports.

As can be seen below, Chile is becoming an increasingly popular region for mining investment

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.