Celsius Resources mobilises drilling rig to Opuwo project in Namibia

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in emerging cobalt play, Celsius Resources (ASX:CLA), doubled in the first six weeks of 2017, hitting a high of 4.3 cents in mid-February. While they held this level until the end of February, there has been a retracement in March which may represent a buying opportunity given that news flow from upcoming drilling could be a share price catalyst.

Of course, it should be noted that share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

The company announced on Monday that a drilling rig had been mobilised in advance of the company commencing an exploration program at its Opuwo cobalt project located in north-western Namibia, approximately 800 kilometres by road from the capital, Windhoek, and a similar distance from the Port at Walvis Bay.

There are good quality bitumen roads connecting both destinations and with the regional capital of Opuwo only 30 kilometres to the south, services such as accommodation, fuel, supplies, air transport and medical services are readily available.

The project’s power requirements can be met by the Ruacana hydropower station which supplies the majority of Namibia’s power.

Drilling targets relatively untested by previous explorers

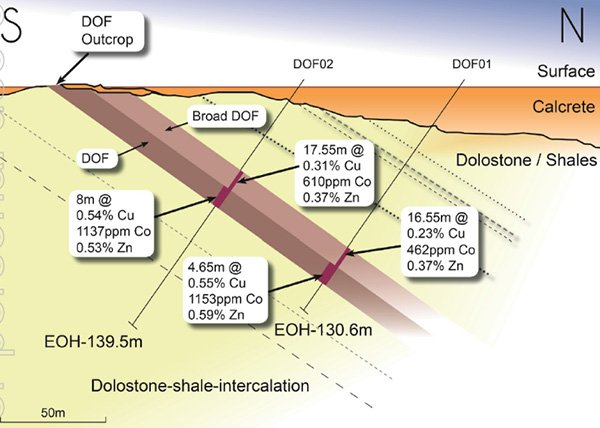

While there has been significant surface exploration by previous explorers, management recently highlighted the fact that only seven drill holes have tested the Dolomite Ore Formation (DOF) horizon, and only two of those holes were assayed for cobalt with promising results of 8 metres at 1137 ppm cobalt and 4.65 metres at 1153 ppm cobalt.

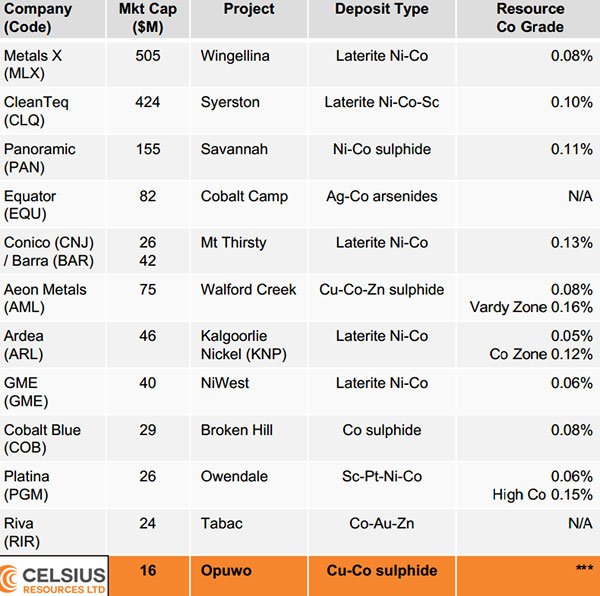

While insufficient drilling has been conducted at Opuwo to define a mineral resource, and it is not certain that further drilling will result in a mineral resource being defined, the following comparison with other ASX listed players provides a guide in terms of weighing up Opuwo’s drill intersections of 0.11% cobalt with resource grades defined by its peers.

There is a school of thought that mineralisation in the DOF may share similarities in style (and probably age) to that in the Lufilian associated deposits of the Central African Copperbelt and the Damaran associated deposits in the Kalahari Copperbelt, suggesting there could be an increased focus on northern Namibia, particularly given its more stable political environment as opposed to the Democratic Republic of the Congo (DRC), currently the major global source of cobalt.

The following highlights geological features and results from limited drilling to date.

The Opuwo deposit has a significant prospective mineralised horizon with an approximate strike length of 30 kilometres, indicating there is the potential for the deposit to contain large-scale sediment hosted copper cobalt mineralisation.

The following is a snapshot of management’s rationale for targeting cobalt in Namibia, as well as its strategic goals in terms of exploring the Opuwo project.

Supply demand dynamics should see further upside in cobalt price

The spike in the cobalt price started towards the end of 2016, and while the sharp increase of 50% could have some investors feeling that further upside is limited, the forward supply demand curve definitely doesn’t suggest that this is the case.

Analysts at Macquarie believe 2017 could be cobalt’s year as it takes over from lithium as the go-to power storage mineral. The broker recently cited increased demand from the core portable electronics sector as recovering while supply growth was relatively stagnant.

Macquarie noted that China has next to no domestic mine supply and is highly reliant on the Democratic Republic of the Congo where political events have a history of disrupting mining projects.

Discussing technological developments, Macquarie said, “Moreover, the prioritisation of higher quality battery development by the Chinese government may even open up the coveted new energy vehicle market to greater cobalt penetration.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.