Celsius Resources cobalt play starting to impress

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finfeed presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

Analysts at Aesir Capital have initiated coverage of Celsius Resources (ASX:CLA) with a Speculative Buy recommendation and a 12 month price target of 11 cents per share, a premium of circa 145% to Wednesday is closing price of 4.5 cents.

Though CLA’s shares are trading at a significant discount to Aesir’s target price, highly promising assay results from early drilling at the company’s Opuwo cobalt project in Namibia has driven a 20% rerating over the last fortnight.

However, there are several other facets to the company that impress Aesir with the broker explaining that comparisons between the Opuwo cobalt project and other emerging cobalt projects made it look attractive when taking into account issues facing its peers such as underlying geopolitical risks, lack of access to key infrastructure and the seemingly inferior grades.

It should be noted that share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

With regards to infrastructure, bitumen roads connect Opuwo with Windhoek/Walvis Bay, and a good quality gravel road traverses the tenement itself. The Oshakati railway is 150 kilometres by sealed road and links with the Walvis Bay port which the broker believes would have ample capacity for CLA.

The Opuwo project is also has ready access to essential services. The Kunene River provides water supply throughout the year.

The Ruacana hydro power station (320 MW), which supplies the majority of Namibia’s power is located nearby, and a 66 kV transmission line passes through the eastern boundary of the project.

Even a conservative production profile could see CLA capped at more than $100 million.

Aesir did acknowledge the need for CLA to complete its exploration program and define a JORC resource. On that note though, the broker made some positive early stage observations in saying, “CLA still needs to prove out the full 20-30 kilometre strike length and define a JORC resource but at a US$166/t basket price it is 1.4 times higher value per tonne than CleanTeQ (ASX: CLQ) and thus, if they could come up with an 80Mt resource it could theoretically justify a roughly comparable market cap of A$430m”.

While such a scenario may be stretching the bow a little at this early stage, Aesir crunched some numbers on a much smaller scale production model, saying, “At even 20Mt, which would seem extremely achievable given the strike length and the fact that 11 kilometres is already proven to be mineralized, that still equates to $107 million mkt cap for over 500% upside”.

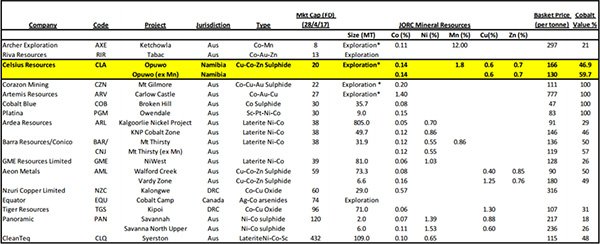

Some of the peer comparisons highlighted by Aesir are listed below.

Aesir is impressed with CLA’s DRC-like (Democratic Republic of the Congo) nature of its deposit without any of the associated political/sovereign risks. If management can continue to prove consistent grades across the entire strike of more than 20 kilometres Aesir is confident that it will be enough to develop Opuwo economically, particularly if they are able to define higher grade zones as well.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.