Cashed up Auroch Minerals completes first drill hole at Alcoutim on budget and on schedule

Published 29-JUN-2017 12:19 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Auroch Minerals (ASX: AOU) announced on Thursday that it had completed diamond drill hole ALFP001 at its base and precious metal Alcoutim project located in Portugal.

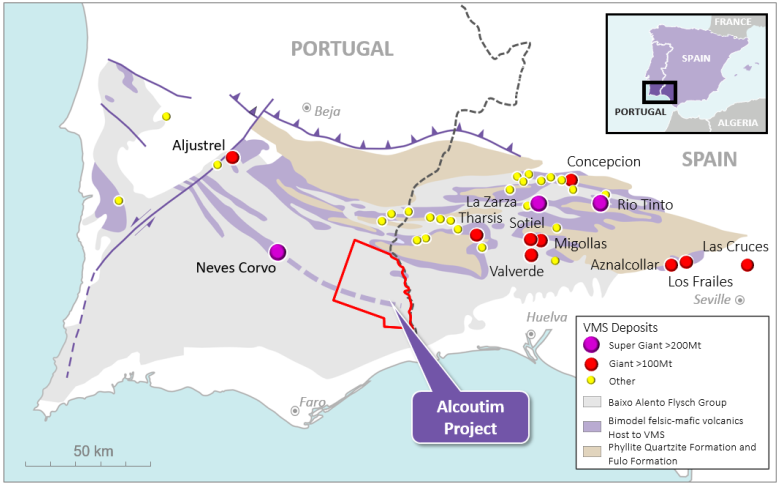

This is a highly prospective region, as it is immediately along strike from the supergiant Neves Corvo mine which is in the western half of the world famous Iberian Pyrite Belt (IPB).

Importantly, AOU is in a strong financial position to complete the upcoming five-hole drilling program with $7.5 million in cash and receivables, and a loan to Bolt Resources, holder of the Alcoutim copper zinc licence.

Of course, as with all minerals exploration, success is no guarantee — consider your own personal circumstances before investing and seek professional financial advice.

Initial drilling identifies Iberian Pyrite Belt type geological characteristics

Examining early stage exploration progress as announced today, ALFP001 was drilled to 1,156 metres, and finished in interbedded shales and greywackes of the Mértola Formation Flysch.

The hole targeted a magneto telluric (AMT) conductor at a depth of more than 800 metres. The conductor was interpreted to be massive sulphides hosted by a lower order black shale basin, surrounded by mafic magmatic rocks of the Foupana magmatic centre.

The Iberian Pyrite Belt is known to host several deposits in similar geological settings, and as such, the identification of these characteristics has buoyed management’s confidence.

Exploration drill hole data, along with Euler depth modelling of the magnetic data and several 2D Seismic reflection profiles throughout the licence suggest that the general depth to the top of the targeted Volcano Sedimentary Complex (VSC) varies from 700 metres to about 1000 metres in the vicinity of ALFP001.

However, the initial interpretation of drill core suggests the hole drilled into a thicker than expected sequence of flysch sediments, down faulted into the target Volcano Sedimentary Complex (VSC).

Intense faulting is known throughout the Iberian Pyrite Belt and leads to significant offsets of the target stratigraphy, which can be seen below in the complex faulted nature of the VSC-flysch contact throughout the Neves Corvo mining district.

Following the completion of ALFP001, AOU completed a two loop (1,000metres x 1,000metres) Down Hole Transient Electromagnetic (DHTEM) survey in the lower portion of the hole at depths between 736 metres and 1,155 metres.

In discussing the data gathered to date, AOU’s Chief Executive, Doctor Andrew Tunks said, “The integration of this down hole EM data with existing data such as magnetics, gravity, and magneto tellurics will be crucial to refining our geological and geophysical models, and best locating our subsequent drill holes”.

Tunks expects additional data from next four holes will optimise drilling locations

Tunks is on site with the exploration team helping to shape the geological and geophysical models and plan the next four holes going forward. He anticipates that as each new hole is drilled, additional data will be obtained to help optimize drilling locations.

A total of 22 potential VMS targets have been defined by integrating geology and geophysics

throughout the large Alcoutim license area, with the first five holes to test priority targets along the Neves Corvo Trend.

The Foupana magnetic anomaly (42 kilometres south-east of the supergiant Neves Corvo Mine) is the largest and most intense magnetic anomaly of the Neves Corvo Trend which is interpreted to be a large, submarine centre of bimodal magmatic activity.

Coincident magneto telluric (AMT) anomalies are interpreted to represent massive sulphide mineralisation. The first two hole locations will test this geological model, close to the magmatic centre and with a strong coincident AMT anomaly.

Down hole Transient Electromagnetic (DHTEM) surveys and geochemical assays will be collected from all holes when completed as part of continual refining of target selection.

Looking at the bigger picture, AOU is obligated to spend approximately $1.4 million to earn a 65% interest in the Alcoutim project. The company has the right, but not the obligation to earn a further 10% by spending a further $1.25 million.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.