Capital Mining shares surge nearly 40% after negotiating option to acquire cobalt project

Published 10-MAR-2017 16:34 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Responding to an announcement regarding an important acquisition made by Capital Mining (ASX: CMY) after the market closed on Thursday, the company’s shares surged nearly 40% shortly after the market opened on Friday.

This spike occurred under some of the highest daily trading volumes experienced by the company over the last 12 months. While there appeared to be a hint of profit-taking on the back of the surge, CMY’s shares were still up 12.5% at midday.

However share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

Analysts are bullish about the prospects for cobalt in 2017, and it was an announcement by CMY that it had entered into an option agreement to acquire 100% of the Scotia cobalt-nickel project in the eastern goldfields of Western Australia that triggered interest in the stock.

The cobalt price has nearly doubled in the last 12 months and it is now closing in on US$50,000 per tonne. Analysts have identified a medium-term supply constrained market and a significant uptick in demand due to increased development of power storage devices which covers products from electronic tablets to electric vehicles.

Yet commodity prices do fluctuate and caution should be applied to any investment decision here and not be based on spot prices alone.

With regard to the acquisition, CMY will be completing due diligence over the next six weeks with an advance payment of 5 million fully paid ordinary CMY shares for the grant of exclusive due diligence during that period.

Should the transaction go-ahead, the consideration is 50 million fully paid ordinary CMY shares and 25 million options to subscribe for CMY shares for $0.02 each within three years of the date of issue upon completion of the acquisition.

In conjunction with this development, CMY has raised $1 million at an issue price of 0.9 cents per share with the proceeds providing working capital, as well as funding targeted exploration programs across the company’s project portfolio.

Scotia project located in highly prospective established cobalt mineral province

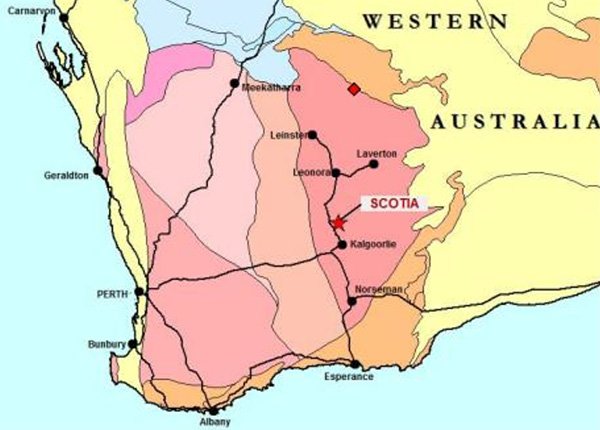

CMY views the Scotia project (highlighted below) as a highly prospective cobalt asset located in an established and active mineral province approximately 65 kilometres north-north west of Kalgoorlie.

As well as being a promising asset on a standalone basis, it complements the group’s other technology metal assets which are prospective for lithium.

These projects are located in Western Australia and the Republic of Ireland, and the company also has gold and base metal projects in New South Wales.

Looking specifically at the Scotia project, CMY Director Peter Dykes said, “An initial review of historic data has shown that highly anomalous cobalt mineralisation exists across the project, principally in association with higher grade nickel mineralisation”.

Examining nearby geological trends, the Scotia project is situated only 20 kilometres along strike of the Silver Swan and Black Swan nickel mines (185,000 tonnes nickel production and resource) within the Archean Kalgoorlie Greenstone Terrane of Western Australia.

Due to the historic prioritisation of nickel, prior mining at the project area focused on this metal, while CMY will be examining the numerous anomalies that remain untested, including those with cobalt potential.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.