CAP ready to accelerate Hawsons Iron Project

Published 25-MAY-2015 11:39 A.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Carpentaria Exploration Ltd (ASX:CAP) is ready for a Bankable Feasibility Study (BFS) at its flagship Hawsons Iron Project after achieving a 20% reduction in cost estimates for its supply and export chain. The recent study presents CAP as a high potential, low cost producer of high-grade iron concentrate for Asian steelmakers seeking higher quality products.

CAP is focused on developing the Hawsons project near Broken Hill as the basis of a long life, low cost premium iron business. Steelmakers are increasingly seeking high quality, low impurity iron products to increase quality, boost efficiency and curb pollution, giving the project a growing market for its high-quality iron products.

The high-grade magnetite ores at Hawsons have been found to be unusually soft with unusually low energy usage, meaning it can be produced at significantly lower costs than rival producers.

Metallurgical test work has also shown CAP’s soft ores can produce a +70% Fe product in bulk, which could attract significant premiums from steel makers and set Hawsons apart from other projects as a low cost, high-grade producer.

CAP ready to begin BFS

CAP’s Hawsons Iron Project has a world class ore body with a JORC resource of 1.8 billion tonnes of magnetite ore at 15% mass recovery for 263Mt of 69.7% Fe, 2.9% SiO2 concentrate.

CAP is planning to create a working mine and processing facility that can deliver 10Mtpa of highest quality iron ore concentrate of over 70%Fe, less than 2.0% SiO2 +Al2O3 and 0.004% P and similar high grade pellets.

The company is targeting an all in FOB cost range of $39-47 USD/t for a plus 70% Fe concentrate product. The resource is homogenous and CAP says there is the potential to extend its size through further exploration.

All aspects of the Pre-Feasibility Study are now complete, and CAP says it’s now “BFS ready” on all fronts.

The 1.8 billion tonne JORC resource that CAP controls is large enough to support an operation of more than 100 years.

The project is surrounded by high quality, modern infrastructure with a combined value of over $1BN including an electrical grid and railway lines connecting to the export point of Port Pirie. This is a boon for CAP, which is seeking to create a low-cost yet high-yield operation. Drawing on this infrastructure, CAP can concentrate instead on mining and production rather than transport issues.

Carpentaria Exploration (ASX:CAP) is developing the Hawsons Iron Project near Broken Hill

The key to CAP’s plan is to capitalise on the rising demand for its products around the world, particularly the high-grade products found in abundance at the Hawsons Iron Project.

Low cost advantage for CAP

The aim of the PFS was to prove that CAP can produce very high quality high-grade pellet feed and pellets, and to support this, the company conducted extensive metallurgical test work.

This testing showed that the ore at Hawsons is unusually soft, providing industry low grinding costs, which is the major cost component of magnetite mines.

CAP estimates that it can grind its magnetite ore for as low as US$8 a tonne, far below the typical industry range of between US$15 and US$35 a tonne.

The company’s soft and easily ground ores also allow the opportunity for CAP to produce much purer concentrates compared to rival projects.

Carpentaria Exploration (ASX:CAP) is planning to make iron ore concentrate and pellets from Broken Hill

Pellets show the way for CAP

CAP is planning to make iron ore concentrate and pellets from its world-class resource at Hawsons, and use these products to target the high-grade blast furnace and direct reduction markets for steelmaking.

The high quality of the pellets CAP anticipates it can produce could allow it to deliver into the worldwide market for the product, which has a limited supply, yet steady demand.

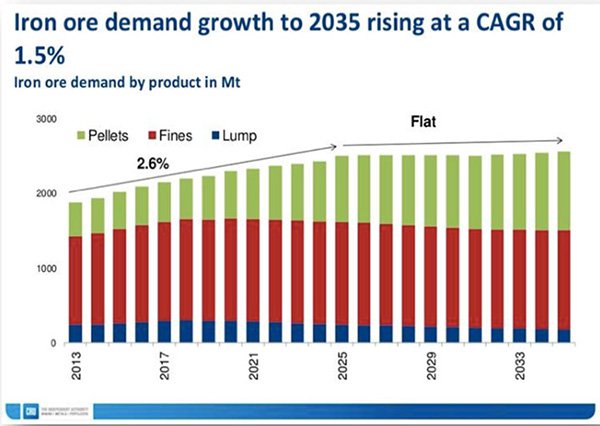

Iron ore demand growth to 2035

Global pellet demand is predicted to rise to 90Mtpa by 2020, and 200-400Mtpa by 2030 – and when CAP brings its 10Mtpa operation on stream it will be able to carve a niche within the high value market.

65% Fe pellets attract a $30-35/t premium to the base 62%Fe fines prices and CAP expects even higher prices for its low cost yet high grade +70% Fe product, which is typically expensive to produce and is much sought after by steelmakers.

Port Pirie ready for CAP export

With its iron magnetite resource ready to mine, and the market lined up for its future products, CAP is accelerating towards a Bankable Feasibility Study (BFS) for its 10Mtpa operation at the Hawsons Iron Project.

A key part of its preparation for this milestone is to find out what sort of operating and profit margins it could have.

Together with Port Pirie’s operator Flinders Ports, CAP paid for a supply chain Pre-Feasibility Study that assessed the costs of exporting through the port. It found that CAP can achieve a further 20% cost reduction in its initial estimates, going down from US$16 a tonne to US$13 a tonne.

The results also demonstrate a 20Mtpa export facility is both technically and economically feasible.

The Port Pirie Iron Ore Export Facility Pre-Feasibility Study Report produced by GHD investigated rail unloading, product storage, transfer to existing berths, barge loading and delivery to cape size vessels in the Spencer Gulf.

Pipe conveyor system at Port Pirie – this could be utilised by Carpentaria Exploration (ASX:CAP)

CAP’s Managing Director, Quentin Hill, says the study brings increased certainty to the project and boosts its prospects for development. “The substantial reduction in the transport cost assumption of USD$3/t is also very significant, potentially increasing our competitiveness and boosting the prospects of development,” he says.

“Given that substantial premiums (circa $20 USD/t) are being paid for high quality products, the project is highly attractive given current iron ore pricing dynamics and outlook.”

Power grid to connect to CAP

In another development, CAP has confirmed it can draw all necessary electrical power from the existing grid around the Hawsons Iron Project.

A Feasibility Study Report by the network owner TransGrid found that the existing poles and wires, plus the introduction of new voltage support, substation augmentation and communication systems can more than support the delivery of the 120MW required by the project, which is located only 35km from the existing power line servicing the city of Broken Hill.

Furthermore, additional studies have been proposed that may identify areas to optimise the connection arrangements and lower the costs, accelerating the work timetable.

CAP has identified a range of markets for Hawsons’ unique, high quality processed iron products, including high-grade blast furnace pellet and pellet feed markets in China, Japan and South Korea, as well as demand for direct reduction pellet feed in the Middle East, India and Southeast Asia.

“Hawsons has significant advantages, with a clear and achievable project pathway. By targeting a growing and undersupplied premium market, we are on track to build a long life and low cost premium iron business,” Mr Hill said.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.