Can PRL take Zero Carbon Hydrogen to the world?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Province Resources (ASX:PRL) formerly Scandivanadium (ASX: SVD) has today announced plans to acquire Exploration License Applications for a new green energy project located in Western Australia.

PRL has entered into a conditional agreement to acquire a company which holds seven license applications in the Gascoyne region of WA, which are suitable for developing a renewable green hydrogen project.

PRL is aiming to be Australia's first truly Zero Carbon Hydrogen (a term it has trademarked) producer.

Australia’s potential zero carbon hydrogen exports could reach $2.2 billion by 2030 and $5.7 billion by 2040.

PRL’s HyEnergy Renewable Hydrogen Project is proposed to generate 1GW (1,000MW) of renewable energy in Western Australia using wind and solar and to produce approximately 60,000t of green hydrogen or up to approximately 300,000t of green ammonia.

The result would create a clean zero carbon Gas or Liquid Hydrogen Fuel that according to Andrew Twiggy Forrest “could power the world for all of mankind’s existence”.

According to Forrest, by 2050 green (renewable) hydrogen could be the most important green energy source in the world.

“The green hydrogen market could generate revenues, at the very least, of $US12 trillion by 2050 — bigger than any industry we have now,” Forrest says.

There are several fundamentals now driving PRL in this ambitious aim:

- Chairman David Francis has a history of bringing companies into their next phase of life and turning them into highly sought-after acquisition targets. Winward Resources was acquired by the $4.6BN capped Independence Group Ltd (ASX: IGO) in 2016.

- The same people behind Vulcan Resources are invested in PRL, including VUL MD Francis Wedin.

- The rise of green hydrogen. According to Andrew Twiggy Forrest, “Green hydrogen (is) the purest source of energy in the world — and one that could replace up to three quarters of our emissions, if we improve the technology and had the scale.

- PRL’s project. The company aims to be the first significant West Australian producer and exporter of 100% renewable hydrogen and ammonia, making Western Australia’s market share in global hydrogen exports comparable to its share in LNG today.

- WA’s solar is amongst the highest irradiance in the world and, due to being on the western edge of the continent, it has excellent wind resources, which makes this project an excellent proposition moving forward.

- Adoption of ‘green economy’ strategies is accelerating rapidly with Australia pouring $300M into the Australian Government Advancing Hydrogen Fund. This is on top of UK PM Boris Johnson investing 12 billion pounds in green energy, and banning the sale of all fossil fuel engines by 2030. Europe allocating a trillion Euros to reach zero emissions by 2050. The US pledging $US2 trillion and China, Japan and South Korea combining to pledge to put almost 8 million hydrogen fuel cell cars on the road.

- Further to that, investment in ESG focused companies continues to rise.

A new push for hydrogen solutions: Is PRL at the forefront in Australia?

The days of using hydrogen as an ingredient for industrial processes will soon be behind us, as will, potentially, hydrogen made from fossil fuels.

Green hydrogen, generated from wind and solar, and which has so far been ignored by the economic world, could fast track the fight against climate change.

Australia’s Chief Scientist Dr Alan Finkel AO who was also Chair, COAG Energy Council Hydrogen Working Group said, "The potential to export clean hydrogen is substantial, with the International Energy Agency and the World Energy Council both identifying Australia as a potential hydrogen production powerhouse. We can become a leader in the new industry I call 'shipping sunshine', with our hydrogen exports being additional to our other energy exports."

Here is Twiggy Forrest, explaining exactly how a green transformation using green hydrogen can occur:

Forrest explains that, “If we wait until 2050 to act, our planet will be toast... Green energies need to be available at an industrial, global scale — and at a price that competes with fossil fuels.

“When fossil fuel energy becomes more expensive than renewable energy, that's when we'll reach the tipping point. That's when the world will begin the journey in earnest to become zero-carbon.”

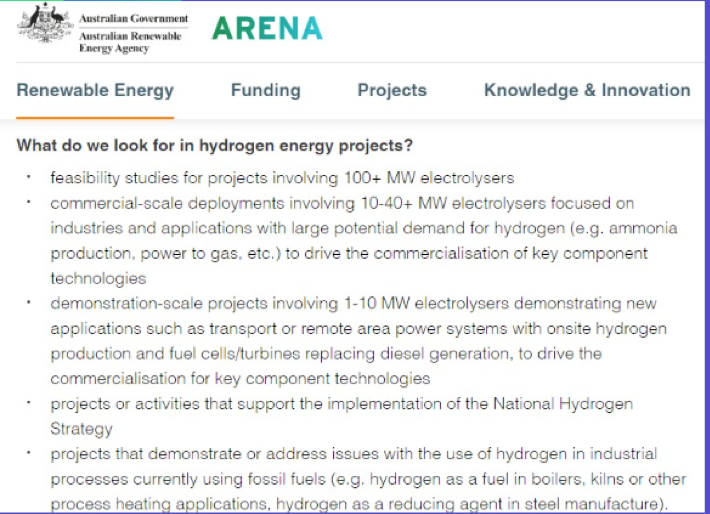

It is handy to know that Australia is already on the case. Not only through Forrest, but also through government bodies such as the Australian Renewable Energy Agency (ARENA).

ARENA has been taking a long hard look at hydrogen projects believing it could be out next great export:

Here’s what ARENA is looking for in a hydrogen project:

It would seem that PRL could fit the bill.

In the next 12-18 months, the company will:

- Execute a heritage agreement with the Yinggarda Aboriginal Corporation (YAC) to govern the conduct of site resource monitoring investigations

- Undertake numerous key stakeholder discussions, including, Carnarvon Shire and Community, WA government, Federal government and Indigenous representatives (YAC)

- Assemble a highly capable project team including local & international experts

- Commence feasibility studies for both renewable power generation and green hydrogen production

- Execute a binding MoU with an IPP (Independent Power Provider) to develop the renewable power required for the H2 plant

- Initiate discussions with potential offtakers and AGAIG – Australian Gas and Infrastructure Group (owners of the DBNGP).

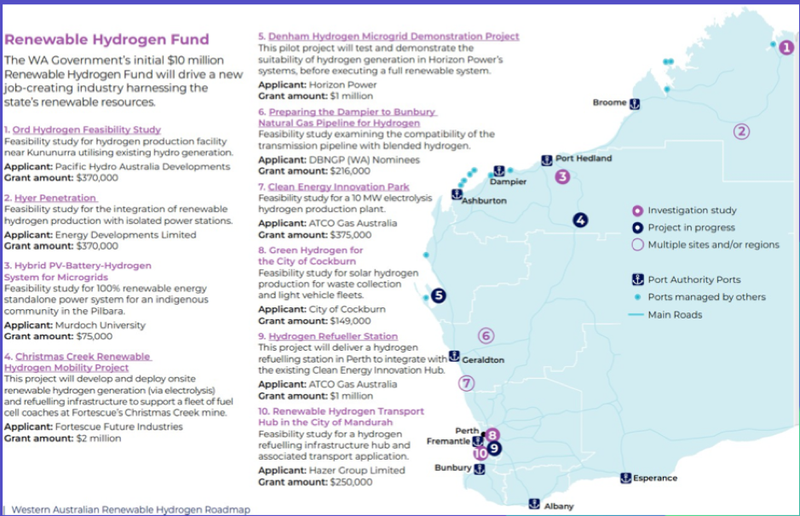

There has been plenty of investment by the WA government of late in WA hydrogen projects:

So much so, the state has developed its own roadmap. Here’s a look at the investments made so far:

The WA state government isn’t the only body, investing.

$5BN development financier NAIF (Northern Australia Infrastructure Fund) provides loans to infrastructure projects in the Northern Territory, Queensland and Western Australia.

In the last financial year, NAIF made 11 investment decisions worth more than $1.4billion, focusing on driving public benefit, economic and population growth and Indigenous involvement in northern Australia.

NAIF can lend up to 100% of the debt and has a higher tolerance for the unique risks of investing in northern Australia including but not limited to, distance, remoteness and climate.

NAIF has announced investment decisions for projects across a range of sectors and regions including Mardie Salt & Potash Project ($450m), Strandline Resources’ Coburn Project ($150m), Chichester Solar Gas Hybrid Project ($90m), Onslow Marine Support Base ($16.8m), Kalium Lakes’ Beyondie SOP Project ($74m (plus an additional $10m facility), AAMC ($12.5m), and Sheffield Resources’ Thunderbird Mineral Sands Project ($95m).

It is early stage, but PRL has a well-laid out plan of its own that should attract investor attention and funding.

The good news is that it has plenty of test cases to draw on.

Renewable hydrogen in WA is a big ticket item

Province isn’t the only enterprise eyeing off the development of a renewable hydrogen project in Western Australia, but it is the only ASX listed junior.

However, the other players are large in size and well advanced with studies that have proven even greater capacity can be achieved than originally thought.

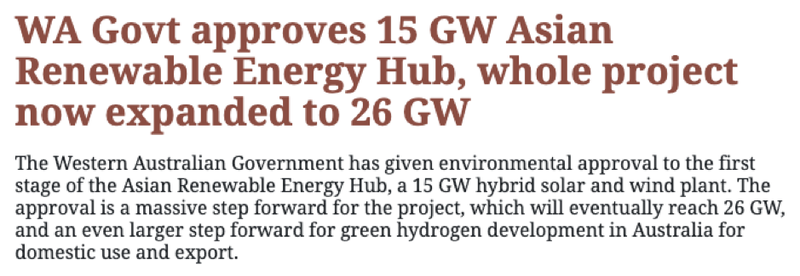

Asia Renewable Energy Hub, is backed by CWP Renewables, Macquarie Group, and the world’s biggest wind turbine manufacturer Vestas.

Vestas Wind Systems announced just last week that it had launched the largest offshore wind turbine, nudging out its key rival General Electric.

The Pilbara project is positioning itself to be in prime position as the green hydrogen export market takes off over the next decade or two, targeting a renaissance of Australian industry based on cheap and clean power, and also demand from power-hungry north Asian economies such as Japan and South Korea.

They have limited domestic renewable energy sources and find themselves between a rock and a hard place in terms of decreasing their reliance on both locally produced and imported fossil fuels.

There are also plans to develop a massive new renewable hydrogen production facility near Kalbarri in Western Australia, with up to 5,000MW of combined solar and wind projects to supply it.

This has the backing of Denmark Copenhagen Infrastructure Partners (CIP), and Hydrogen Renewables Australia has agreed to partner with CIP on the massive project, which is proposed for the Murchison House Station on the state’s mid-west coast, an area identified by engineering firm AECOM as a prime position for the co-location of wind and solar projects in Australia.

The goal of the project is to use the premium solar and wind energy resources, along with desalinated sea water, to produce renewable hydrogen to Asian markets, with an eye to Japan and Korea.

It is worth noting that Asian investment is central to the aforementioned projects and further it would seem that they also represent the likely destination for the end commodity.

However, let’s not forget the current spat with China, so an Australian built project that commits to supplying Australian consumers first would be a great vote winner.

Project details

PRL has outlined a three stage development process for its HyEnergy RH2 Zero Carbon Renewable Hydrogen Project.

Stage 1 - Foundations and Demonstration: advance priority pilot trial of green hydrogen and green ammonia production in Carnarvon region and investigate potential gas blending into the Dampier Bunbury Natural Gas Pipeline (DBNGP).

Stage 2 – Gas blending, scale up project to supply into the nearby Dampier Bunbury Natural Gas Pipeline. With the aim of helping meet the State Government’s objective of up to 10% green hydrogen in the DBNGP by 2030.

Stage 3 – Export, full scale production to supply Asian markets. Develop a Liquified Hydrogen and or Ammonia Loading Facility in the Carnarvon area. Subject to customer needs hydrogen offtake could be either in the form of ammonia or liquified hydrogen.

Stage 2 is an interesting one as the optimum end-game would be full-scale production to supply Asian markets, as well as multiple markets in Australia.

Driving Australia’s approach to green hydrogen is to create hydrogen hubs – clusters of large-scale demand.

Ports, cities, regional and remote areas will all be considered, and will provide the industry with its springboard to scale.

Hubs are designed to make the development of infrastructure more cost- effective, promote efficiencies from economies of scale, foster innovation, and promote synergies from sector coupling.

These will be complemented and enhanced by other early steps to use hydrogen in transport, industry and gas distribution networks, and integrate hydrogen technologies into our electricity systems in a way that enhances reliability.

PRL wants to create a hydrogen hub at Carnarvon that will contribute significantly to the national, state and local objectives for new investment, new jobs, renewable energy sources and new export markets.

Green hydrogen holds a place at the table in Australia's future

Green hydrogen is hydrogen produced exclusively from renewable power.

It is a clean-burning molecule that can help to decarbonise a range of sectors that are difficult to clean up. Thus, green hydrogen produced from renewable electricity, could be the solution to cutting our carbon footprint.

The following video explains how green hydrogen works.

This next video explains how Australia could lead the world in green hydrogen production and distribution.

This ABC article is also worth reading:

PRL is looking to become an Australian leader in green hydrogen production, through its Zero Carbon Hydrogen ProjectTM. It would be the only ASX listed junior to do this, giving investors an excellent early entry point into this growing market.

And as mentioned, PRL is setting up in the perfect location.

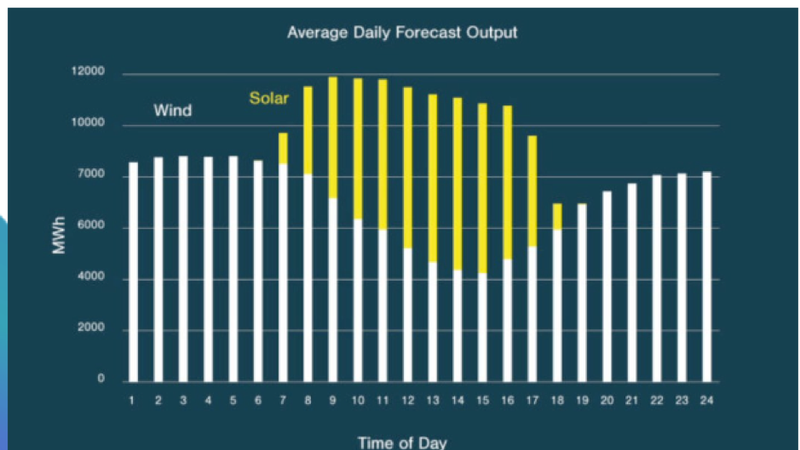

The Gascoyne region in Western Australia has world class solar and wind resources and significantly, those resources are perfectly complementary, with high incidence of sun during the daytime and high wind speeds in the morning, evening and night. This enables competitively priced predictable and firm renewable electricity output, 365 days a year.

Carnarvon has an annual mean windspeed of 25.5 km/h, making it the top 4th windiest location in Western Australia.

Further to this, existing windfarms at Denham and Coral Bay are operating proof of concept in the Gascoyne region.

The WA State Government is committing $8M to funding the Denham Microgrid renewable hydrogen project.

Meanwhile large scale wind farms are planned in Pilbara's 'Cyclone Alley', where cyclones crossing the coast are prevalent.

All of this supports the Carnarvon region as a preferred lower risk wind farm location in Western Australia and is one of the reasons why PRL is setting up here.

The other reason is the regions solar profile.

Carnarvon has a rich solar resource averaging 211 sunny days per year, with an average solar exposure of 22 MJ/m2 /day (or 6.24 kWh/m2 /day).

Its low competing land use and high solar resource makes PRL’s project area ideal for a large scale solar array network.

Discussing the benefits of hydrogen production, Hon Alannah MacTiernan MLC Minister Assisting the Minister for State Development, Jobs & Trade said, “Hydrogen provides a means to harness our world-class solar and wind resources for energy export, and help our international partners meet emissions reduction goals.”

PRL is an early stage play, however there is a real opportunity for it to take the reins in providing an all Australian green hydrogen solution that could have worldwide impact.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.