Caeneus Minerals completes detailed survey of its lithium operations

Published 14-JUN-2016 18:16 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Caeneus Minerals (ASX:CAD) has completed a detailed ground-bourne gravity survey of its Lida Valley Lithium Project.

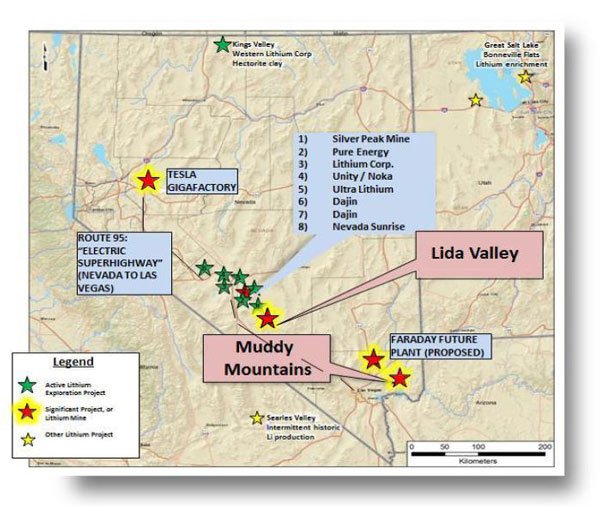

The Lida Valley Project is 220km northwest of Las Vegas and 50km southeast of the Clayton Valley lithium operation in Nevada, United States of America.

Since acquiring the Lida Valley and also the Muddy Mountain project from Nevada Metals back in late March 2016, CAD has been focused on moving forward in finding potential lithium resources in the region.

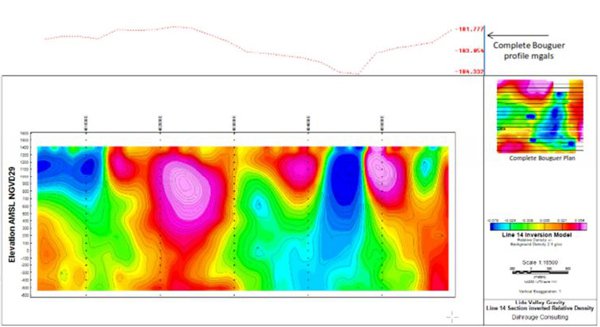

The detailed ground-bourne survey confirmed the presence of a significant gravity low in the east of CAD’s claims. Gravity lows typically indicate the presence of a sedimentary basin often containing evaporate sediments and lithium-bearing brines.

Stretching 1.5 to 2km wide and 3km long, CAD is confident that the gravity low indicates the presence of these lithium brines.

The basin discovered in the survey extends beyond the northeast boundary of CAD’s initial leases which have since been amended to include the unclaimed portion of the basin.

Data from the ground-bourne survey confirms the presence of a significant gravity low in the east of the Lida Valley Lithium Project.

With surveys now complete CAD is confident on where drilling needs to take place in order to potentially intersect the resource.

Drilling evaluation is planned to commence in July 2016, where 7 to 10 drill holes will be performed in the aim of intersecting lithium brines.

Further drilling will be planned based on these initial results.

Lithium market

The lithium market is booming largely thanks to Elon Musk’s Tesla Motors which is driving demand in recent months. Batteries used in Tesla’s automotive and home batteries require lithium.

Situated near the US$5 Billion Tesla Motors Gigafactory, CAD plans to piggy back on this growing demand.

Tesla Motors are proposing to commence large scale production of lithium-ion battery cells in 2017, further increasing demand for the resource. The automobile manufacturer has previously indicated they intend to source their raw material requirements exclusively from North America, making CAD well positioned to service this demand should a commercial size resource be discovered.

CAD’s Muddy Mountain and Lida Valley Projects in West Nevada, United States showing location of the Tesla Motors Gigafactory and other lithium explorers and developers in the area.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.