Caeneus to evaluate “additional investment opportunities”

Published 05-JUL-2016 15:36 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Caeneus Minerals (ASX:CAD) has confirmed it is on the lookout for further investment opportunities after raising over $1.2 million from a placement.

The primarily lithium player told its investors today that it had raised $1.23 million from the issue of over 410 million shares at 0.3c each to sophisticated and institutional investors.

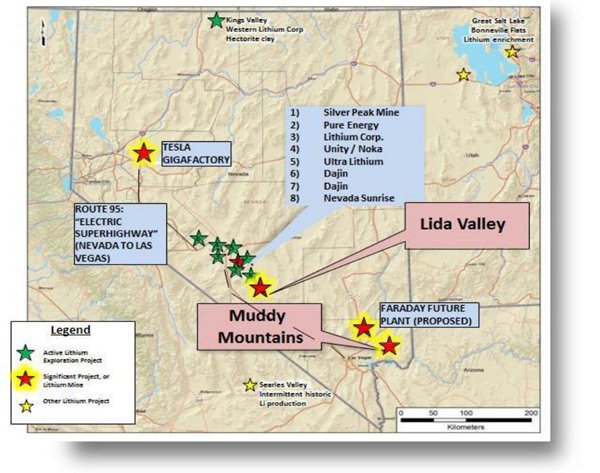

It said the raising was primarily aimed at beefing up its exploration budget at its Lida Valley and Muddy Mountains projects – but did not rule out using some of the cash for “additional investment opportunities”.

It is not guaranteed that the company will find an adequate investment, though.

At the very least, the boost in exploration cash will be a welcome development for the company as it seeks to ramp up its lithium efforts in the Nevada desert.

It acquired the projects from Nevada Metals in March this year – and has since been focusing on exploration in an effort to prove up a lithium resource.

Most recently it conducted a ground-borne survey – which confirmed the presence of a significant gravity low in the east of the company’s tenements.

A gravity low is read as a predictor of the presence of a sedimentary basin which can contain evaporate sediments and lithium-bearing brines.

Stretching 1.5 to 2km wide and 3km long, CAD is confident that the gravity low indicates the presence of these lithium brines.

The basin discovered in the survey extends beyond the northeast boundary of CAD’s initial leases which have since been amended to include the unclaimed portion of the basin.

More on Caeneus Minerals (ASX:CAD)

The location of the project is being read as a major bonus for CAD – as it’s within driving distance of Tesla Motor’s Gigafactory, which is being slated as possible re-shaping world lithium demand.

An overview of Caeneus Minerals’ lithium plays

Muddy Mountain is a potential high impact ‘district-scale’ lithium clay project, with strongly anomalous lithium up to 1000 parts per million lithium previously hit as part of historical drilling.

The Lida Valley Project is a significant regional Intermontane Basin with a drainage area of approximately 150km2.

It is considered by CAD to be an ideal location for the development of lithium rich brine deposits.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.