CAD increases its bets in Nevada

Published 19-JUL-2016 09:48 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

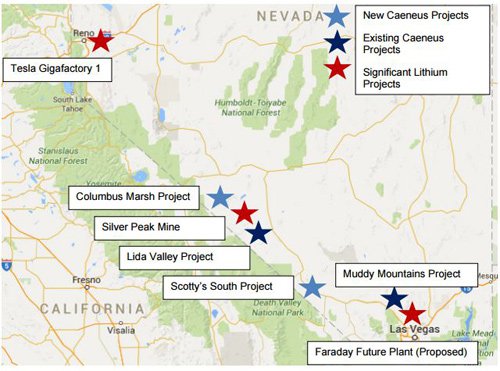

Caeneus Minerals (ASX:CAD) has doubled down in Nevada – using a pot of cash to acquire more lithium brine projects in the same state as Tesla’s ‘Gigafactory’.

It told its investors this morning that it had moved to acquire a 100% stake in Perth-based private company ATC Resources Pty – therefore grabbing the Sarcobatus Flats and Columbus Marsh lithium brine projects.

News of the acquisitions comes at a time when lithium activity in Nevada continues to heat up as Tesla’s Gigafactory draws closer to completion – making access to lithium land a premium.

It is thought the acquisition is the result of a mini war-chest recently announced by the company, in the form of a $1.2 million raising.

The deal is a scrip deal – but the raising allows CAD to not dilute shareholders in the shorter-term to grab working capital.

The deal effectively means CAD now holds lithium brine ground in three of the best emerging basins in Nevada.

While it has beefed up its holdings, CAD said it may not be done on the acquisition front by telling shareholders that managing director Steve Elliot is currently flying to Nevada to “assess and potentially stake more highly prospective ground in an effort to position Caeneus as the largest ground holder in the region.”

There is no guarantee that the prospective ground will translate into ultimate success though, and CAD remains a speculative stock so seek professional financial advice when considering this stock for your portfolio.

About the new ground

Caeneus Limited’s Nevada projects

Scotty’s South – Sarcobatus Flats

The project consists of about 200 claims and covers roughly 4000 acres, with source rocks thought to be quartz-rich volcanic which contain an unusual amount of lithium.

Sediment sampling done in the area has shown values of lithium ranging from 50 parts per million to 340ppm.

CAD told its shareholders that Sarcobatus Flats was showing signs of being a ‘Clayton Valley’ style lithium brine deposit.

The Clayton Valley is thought to be the premiere lithium brine basin in the state – and CAD said Sarcobatus Flats was showing signs of simply being an ‘under explored’ version of Clayton Valley.

Columbus Marsh

There’s something in the water at Columbus Marsh, if the analysis is to be believed.

CAD said that analysis of water at Columbus Salt Marsh found high lithium and potassium concentrations.

It said that at least part of these waters is probably derived from the leaching of tertiary rocks containing saline minerals.

Reconnaissance sampling indicated water samples reaching lithium levels of 64mg/1.

The water is a good lead, and CAD said it would need to do more exploration to see if lithium-brine exists at depth.

More on Caeneus Resources (ASX:CAD)

CAD is currently running the rule over two projects in Nevada thought to be rich in lithium-bearing brines, the Lida Valley and Muddy Mountains projects.

CAD is attempting to cash in on the buzz currently being generated by lithium’s role in the lithium-ion battery revolution which is in part being driven by Tesla’s electric cars.

Tesla currently has a so-called ‘gigafactory’ in Nevada, and has previously stated its preference to source materials from North America.

Muddy Mountain is a potential high impact ‘district-scale’ lithium clay project, with strongly anomalous lithium up to 1000 parts per million lithium previously hit as part of historical drilling.

The Lida Valley Project is a significant regional Intermontane Basin with a drainage area of approximately 150km2.

It is considered by CAD to be an ideal location for the development of lithium rich brine deposits.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.