Auroch Minerals expands highly prospective Namibian lithium holding

Published 12-JAN-2017 16:10 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Lithium exploration group Auroch Minerals (ASX: AOU) has strengthened its position in the Erongo Region of Namibia, one of the most prolific sources of lithium production in the country.

Namibia has proven to be a lucrative region to do business, hosting high profile projects such as Rio Tinto’s Rossing uranium project, Paladin Energy’s Langer Heinrich uranium project and B2Gold Corporation’s Otjikoto gold project to name a few.

Before we go too far, it should be noted that this project is located in a region which carries sovereign risk. As an early stage initiative operating in a high risk region where getting mining projects up and running is no simple feat, those considering this high risk stock as an investment should seek independent financial advice.

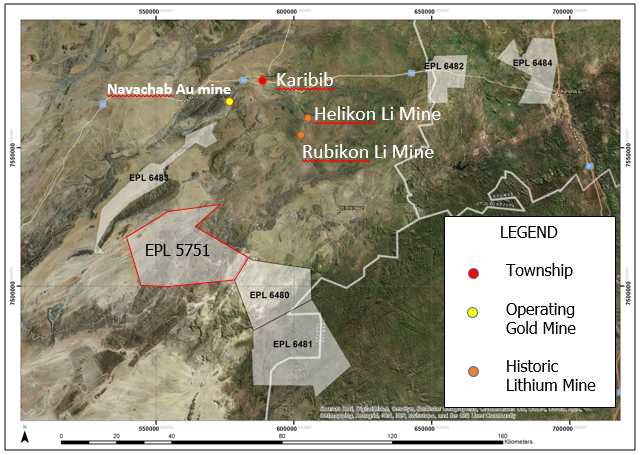

Through the negotiation of an option and joint-venture agreement over EPL 5751 the company has continued the growth of its Karibib Lithium Project, complementing and building upon the five EPL applications that were announced on November 14, 2016.

Highlighting the significance of this development, AOU Chief Executive, Doctor Andrew Tunks said, “Importantly, our reconnaissance work has already identified extensive pegmatites within the tenement and our goal is to rapidly identify and test large lithium bearing pegmatites of similar age and style to the pegmatites that host the nearby Rubikon and Helikon historical lithium mines”.

The proximity of Karibib to these high yielding lithium regions is shown below.

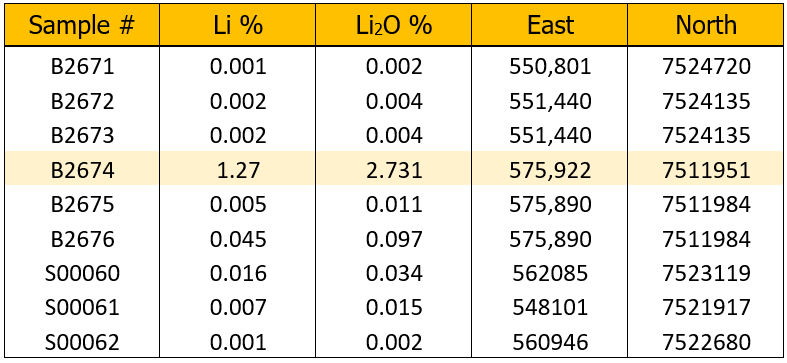

Initial inspection by the Company of EPL 5751 confirmed the existence of pegmatites outcropping at surface, with the largest observed to-date exceeding 300m in length. A rock chip sample (B2674) was collected from this pegmatite and assayed 2.73% Li2O.

However, investors should be aware that AOU is a speculative early stage company with proven revenue streams yet to be established. Consequently, those considering this stock should seek independent financial advice investing in this stock.

Lithium mineralisation evident in most pegmatites

Management highlighted that lithium mineralisation was noted in most pegmatites visited and this has been supported by first-pass rock chip sampling that returned an impressive single significant lithium dioxide grade of 2.7%.

The following is a list of results from samples taken from EPL 5751 which have confirmed the existence of pegmatites outcropping at surface, with the largest observed to date exceeding 300 metres in length.

Imminent exploration activity a potential share price catalyst

Management intends to conduct an exploration program that will locate all pegmatites within the license. On this note, Tunks said, “This will be followed by nonintrusive rock chip sampling and broad-based sampling to examine the geochemistry of the pegmatites”.

These developments could place the company in a strong financial position to fund its exploration initiatives with $8.4 million in cash ($6.4 million) and receivables.

Tunks confirmed that the work will commence in mid-January 2017, which should result in relatively near-term news flow regarding exploration results, a potential share price catalyst.

The company’s shares have already performed well over the last 12 months and this week’s intraday high of 18 cents is close to the three-year high of 19 cents, suggesting that a move beyond this level could interest technical analysts.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.