Artemis ready to embark on drilling campaign at Carlow Castle

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in diversified metals explorer, Artemis Resources (ASX:ARV), a company that is being increasingly viewed as a prospective cobalt play surged 35% last week, and based on management’s commentary on Monday it would appear there is the possibility of more upside.

Of course, it should be noted that share trading patterns should not be used as the basis for an investment as they may not be replicated. Those considering this early stage stock should seek independent financial advice.

Impressive assay results have been returned from a sampling program covering an area of approximately 3.5 square kilometres, only a relatively small section of the 32 square kilometre Carlow Castle project.

3000 metre drilling campaign to commence at the end of the week

Management noted on Monday when advising that a fast -tracked 3000 metre drilling program would start at the end of the week, that high-grade cobalt grades up to 1.12% had been returned from surface sampling.

There were also impressive gold and copper grades of 35.3 grams per tonne and 3.21% respectively returned from the Quod Est area.

In relation to these developments, ARV chairman, David Lenigas said, “This recent surface sampling program around the many old shafts covering an area of about 3.5 square kilometres returned grades of up to 1.12% cobalt, 8.2% copper and 35.3 grams per tonne gold, while clearly showing the cobalt potential in the area”.

He also highlighted that the Carlow Castle resource remains open in all directions. Another factor working in ARV’s favour is the fact that the Radio Hill sulphide processing facility is only 20 kilometres from the mine site and is accessible by public roads.

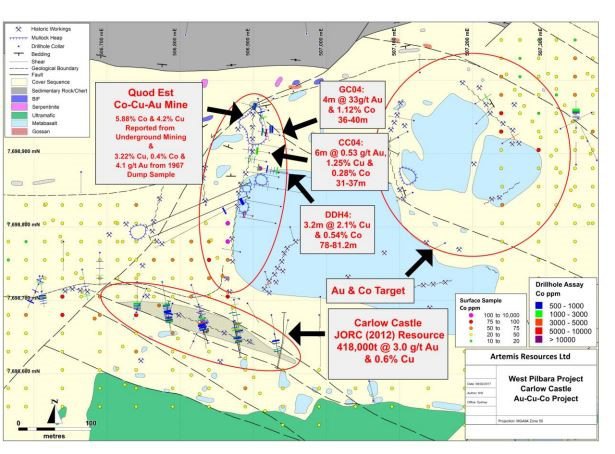

This drilling programme is designed to test for the extensions of known cobalt mineralisation where previous drilling intersected rich sulphidic interval assaying 4 metres @ 33.6 g/t gold and 1.12% cobalt from 36 metres downhole in GC04; Drill hole DDH4 intersected 3.2 metres at 2.1% copper and 0.54% cobalt from 78m downhole; and drill hole CC04 intersected 6 metres at 0.53 g/t gold, 1.25% copper and 0.28% cobalt from 31 metres downhole depth (see the map below).

The Carlow Castle Project is located only 10km South east of Roebourne in the Pilbara Region of Western Australia and the tenor of mineralisation and large 32 km2 100% owned tenement makes the Project a valuable asset for Artemis who also owns the surrounding tenements.

Also working in Artemis’ favour is the minimal exploration conducted at Carlow Castle as companies focused on the gold and/or copper mineralisation as single commodities.

The review by Artemis shows that an integrated approach to mineralisation and an expansion of exploration is required to better define the Project, with work to date highlighting a potentially material asset that has remained under explored.

In more recent times drilling has identified a JORC (2012) Inferred Mineral Resource (Figure 3) of 418,000 tonnes at 3.0 g/t Au and 0.6% Cu, for total contained metal of 40,000 ounces of Au and 2,500 tonnes of Cu.

Shares up more than 100% in a fortnight

ARV’s share price run actually started in mid-February when ARV informed of high-grade cobalt at its Carlow Castle project located near Karratha in Western Australia.

At this point management released information on mineralisation that was gleaned from past exploration results and its own shallow drilling which yielded grades in excess of 1% cobalt and assays of 5.88% at the Quod Est mine.

Friday’s share price close of 11.5 cents implies a gain of more than 100% in the space of two weeks.

Again, past performance is no indication of future performance and share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

At that stage management flagged its intention to fast track the imminent extensive drilling campaign with a view to gaining a better understanding of mineralisation and expanding the resource, this time taking into account the substantial impact of cobalt mineralisation, a mineral that is currently fetching close to US$50,000 per tonne.

Some analysts believe that the supply demand dynamics for cobalt in the coming 12 months may see it replace lithium as the market darling metal, particularly given it is also used in the manufacture of new age batteries.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.