Artemis paves the way for quick transition to producer

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

It is a major milestone for smaller mining companies when they reach the stage of determining that they have a valuable asset in the ground. However, one of the most challenging aspects in making the transition from explorer to producer is financing and building the plant that will convert ore in the ground to a saleable product.

Artemis Resources (ASX:ARV) has reaped the benefits of exploration success at its Western Australian based Carlow Castle cobalt/gold/copper project in 2017. This has been reflected in its share price which has increased more than three-fold since the start of February.

However, the Carlow Castle project has now taken on a whole new dimension with management announcing on Thursday that it had acquired all of Fox Resources’ Radio Hill mining, plant and tenement assets in the Karratha area for a nominal cash payment of $2 million plus 20 million ARV shares at 10 cents per share.

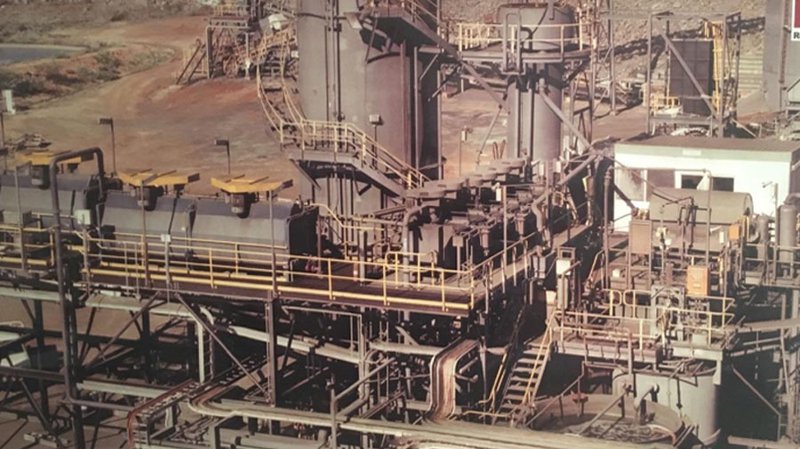

The Radio Hill plant is located only 20 kilometres by road from the Carlow Castle project. With the stroke of a pen ARV has seized the opportunity to dispense with up to $100 million in upfront capital expenditure and financing costs, while paving the way for a much swifter transition to production.

Of course, those considering this stock shouldn’t make assumptions regarding exploration outcomes, nor should they base investment decisions on performances to date and should seek independent financial advice.

The Radio Hill operations are located 35 kilometres south of Karratha, and its nickel, copper and cobalt processing plant has a proven capacity of 425,000 tonnes per annum. With ARV shaping up increasingly as a prominent cobalt play the fact that the Radio Hill plant has historically produced cobalt is highly significant.

Circa $100 million in assets, permitting and negation of financing costs for $4 million

As a guide, the build cost for a plant such as Radio Hill would be at the upper end of a range between $50 million and $100 million. This doesn’t include the associated infrastructure such as mining equipment, along with tailings pits.

Add to those costs the likes of studies and permitting and it is evident that ARV’s $4 million investment is a game changing development for the group.

However, the other aspect which is difficult to quantify, but just as important in terms of valuing the assets acquired by ARV is the de-risking process. As milestones such as financing packages, completion of feasibility studies and permitting are achieved, brokers usually upgrade valuations and price targets, generally resulting in significant share price accretion.

ARV has essentially ticked a number of boxes all in one hit, each of which would normally draw a positive share price response. Whether the Radio Hill acquisition results in an immediate share price rerating remains to be seen, but it won’t be missed by analysts when they crunch the numbers in establishing a net asset valuation.

And then there is the established resource base with exploration upside

Radio Hill has an existing nickel/copper sulphide resource of circa 4 million tonnes grading 0.5% nickel and 0.9% copper which remains in the existing underground workings and mine development, and down plunge along the basal contact.

There are also stockpiles of mined material of around 300,000 tonnes, as well as processed tailings that may have reprocessing value with recent developments in technology. However, the stockpile and tailings material is non-JORC compliant, but is the result of historic mineral processing of nickel and copper ores from Radio Hill since commencement of operations in 1986.

Gaining exposure to copper and zinc at the right time

Management highlighted that exploration potential also exists at Radio Hill with drilling results indicating the prospect of a larger nickel/copper resource.

On this note, the Whundo West, Whundo Ayshia and Whundo deposits are of interest at a time when copper prices are increasing and zinc is trading near long-term highs of circa US$1.30 per pound.

While some of the resource estimates are not JORC 2012 compliant, as a guide production from the West Whundo open pit resulted in oxide and supergene copper zinc ores being mined between April and December 2006 with a total of 7400 tonnes of ore grading 5.91% copper.

Exploration in 2007 identified a resource of 1.7 million tonnes grading 1.1% copper and 0.9% zinc.

Ayshia appears highly prospective for zinc with an early stage non-JORC 2012 compliant indicated and inferred resource of more than 600,000 tonnes, including 344,000 tonnes grading 3.3% zinc in the indicated category.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.