ADV drills high with jumbo aspirations in Canada

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

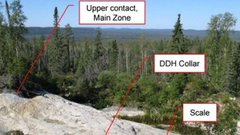

Ardiden Ltd (ASX:ADV), an Australian graphite junior, has discovered lucrative jumbo flake at its fully owned Manitouwadge Project in Ontario, Canada, situated less than 100km from the US border. ADV hopes its operations in Canada will help accommodate the growing demand for graphite in North America, largely fuelled by growing use of lithium-ion batteries.

ADV began its drilling programme at Manitouwadge in early November 2015, and updated the market with a positive drilling update later that month.

ADV has now completed its 2000m drilling program, reporting high grade assay results as high as 12.65% Total Graphitic Content (TGC) and potential for super jumbo graphite flake size reaching as high as 4200 microns, according to findings by Vancouver Petrographics, a Canadian resource analysis company. Widths of up to 41.6m (true width ~30m) of graphitic gneiss were intersected during drilling which remains open along strike and at depth.

In a statement, ADV hailed its drilling programme “a resounding success, with all objectives achieved, and results often exceeding initial expectations”. Since the announcement to the ASX earlier today, ADV has gone into a trading halt expected to end on 7 January 2016, upon the release of a key announcement.

ADV operates several prospects in Ontario, namely Silver Star North, Silver Star South and Thomas Lake. ADV is currently focusing on Silver Star North with today’s assay results encouraging ADV to expedite its drilling programme with a view of targeting a maiden JORC resource sometime in 2016.

The Star of the show

The Silver Star North Project will “now become the initial target for delineating a maiden JORC compliance resource” according to ADV, and the junior explorer is encouraged by the fact that this project only accounts for 5% of the electromagnetic strike length first identified at Manitouwadge.

Exploration completed so far shows strong electromagnetic anomalies along 10km of the potential 19.3km strike length previously identified. The remaining 9.3km “remains highly prospective for additional discoveries during 2016 field programs”, according to ADV.

In a statement to the ASX, ADV said, “The results from the final 2015 drilling program are highly encouraging and have significantly enhanced and continue to support the potential of the Manitouwadge Project to be developed into productive graphite resource.”

Other prospects

Previous metallurgical testing taken from drill core at the Thomas Lake Road Prospect confirmed that up to 80% of the graphite is jumbo or large flake in size, and low cost gravity and flotation beneficiation produces graphite product of 96.8% TGC for jumbo flake and 96.8% TGC for large flake.

When compared to neighbouring graphite projects such as Zenyatta Ventures’ Albany Project (inferred 20.1 tonnes at 2.20% TGC) and Northern Graphites’ Bissett Creek Project (inferred 24 tonnes at 1.74% TGC), ADV is on course to attain graphite grades that are “comparable or better than similar North American graphite projects,” according to ADV.

The ASX-listed junior graphite explorer has a market capitalisation of $7.2 million and is fully funded through the next phase of drilling expected to begin in early 2016.

The market for graphite dependent products including lithium ion batteries (in which graphite is used as the anode) for the battery storage market (for utilities, business, households and electric vehicles) is expected to experience transformational growth over the next decade. Other growth markets for high quality graphite include expandable graphite, nuclear grade graphite and graphene/graphene oxide which all demand significant market premiums.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.