2017 shaping up as a year of promising newsflow for Peninsula

Published 21-NOV-2016 12:40 P.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

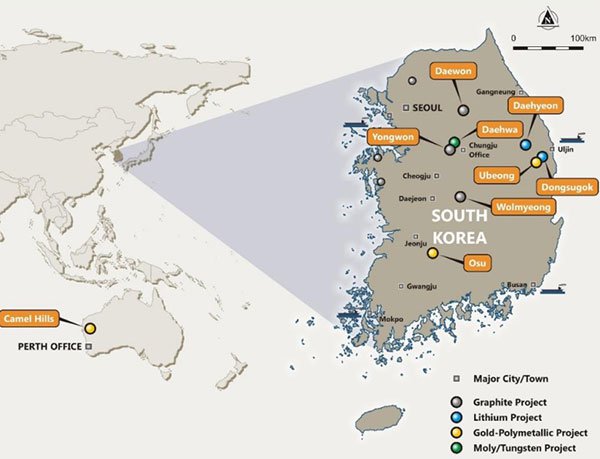

South Korean focused mining exploration group, Peninsula Mines (ASX: PSM) informed the market on Monday morning that it has made progress in terms of identifying projects that can be fast tracked to the drill target definition stage.

With multi-commodity assets it will be interesting to see how PSM stages its exploration campaign as they cover graphite, lithium, zinc-silver and gold. Importantly, there is the potential to negotiate offtake agreements with end users in South Korea, facilitating an economical and relatively simple route to market.

As indicated in comments made by Chief Executive, Jon Dugdale, 2017 is shaping up as an exciting year for the group as he said, “The company has generated multiple opportunities for discovery over a range of commodities, all with a very positive outlook and offtake potential in-country and it is now time to progress our key projects to the drill target definition stage and focus our efforts during 2017”.

The group has made progress on each of its four assets, but it is easier to look at these in isolation even though they are all situated in South Korea.

It should also be noted that PSM is an early stage exploration play and anything can happen. Investors should seek professional financial advice if considering this stock for their portfolio.

Yongwon graphite project

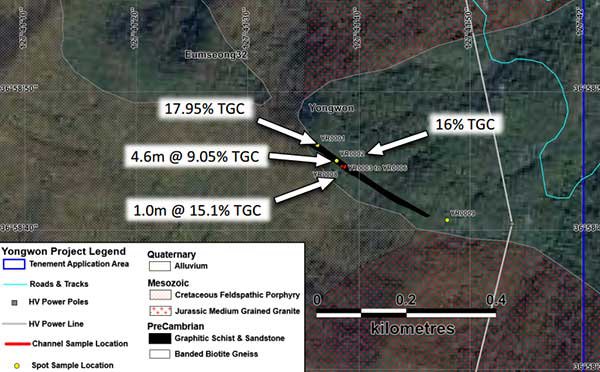

Channel sampling is underway at the Yongwon graphite project with a view to defining drilling targets once metallurgical results are optimised. In late October the company was granted a three-year exploration right over the Eumseong 32-1 tenement sub-block, a 68 hectare area encompassing all the known graphite mineralisation at the project.

The company has the option to extend the exploration period to 6 years subject to a supplementary application to the Ministry. The most significant news regarding this project is that an accelerated exploration campaign has led to the identification of jumbo-sized graphite flakes.

A 10 metre wide graphitic zone has been exposed and sampled with the objective of determining the width and grade of graphite mineralisation at surface.

Encouragingly, a detailed EM geophysical program has been completed along the identified strike length producing strongly conductive responses, effectively extending the zone of interest to more than 400 metres and demonstrating continuity at depth.

Importantly, the EM results indicates only shallow holes will be required for drilling purposes, limiting costs and delivering earlier results.

Early channel sampling results included 4.6 metres grading 9.05% total graphitic carbon (TGC), including 1.7 metres @ 11.9% TGC.

The end game for PSM is to optimise graphitic concentrate grades and generate a product that will be suitable for lithium-ion batteries and/or high-value expandable graphite applications.

With South Korea being the global leader in the manufacture of lithium ion battery technology this could be a crucial project in terms of generating cash flow to fund exploration and development across the group’s other assets.

Tonggo lithium prospect

Strongly anomalous lithium results identified through infill stream sediment sampling are believed to be associated with a corridor of pegmatites approximately 100 metres wide and continuing for a distance of up to 3 kilometres, associated with a northeast-southwest trending magnetic low evident in regional KIGAM magnetics.

PSM is now preparing to progress to ridge and spur soil sampling across the anomalous pegmatite trend with the objective of locating lithium (lepidolite/spodumene) bearing zones that may represent drilling targets.

Ubeong zinc silver project

Management is upbeat regarding the prospects of its Ubeong zinc silver project given the exceptionally high grades produced from previous rock chip and channel sampling in the Chilbo mine area which included zinc grades between 12.7% and 39.7%.

This has prompted the group to fast track exploration with an initial geophysical program including an EM trial over the Chilbo mine workings designed to detect massive sulphide bodies.

Detailed ground magnetics will also be undertaken to define the magnetic limestone-skarn unit and to locate structures that may host mineralisation. Soil sampling and mapping will also be undertaken along the entire 10 kilometre strike length.

Dugdale highlighted that there are several potential outcomes that could occur from these initiatives including the location of further outcropping mineralisation that will assist approval and grant of tenement applications, as well as the defining of drill targets for new high grade zinc silver rich massive sulphide bodies.

Osu gold project

Regarding the group’s Osu gold project, channel sampling has been completed across a 30 metre mineralised zone, results of which are being compiled. These will enable the company to develop a drilling program which is being fine-tuned to target the high grade veins/shoots within the upper 100 metres vertically below the channel sampled vein zones.

Dugdale highlighted that previous exploration had delineated individual veins within this zone with assays up to 0.14 metres grading 20.3 grams per tonne gold and 153 grams per tonne silver.

Drilling of up to 3 holes is being targeted for early December.

Looking across all of PSM’s assets, Dugdale said, “The ultimate objective is to progress key projects towards resource definition and ultimately development, possibly across multiple projects and commodities given the diversity offered by our portfolio”.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.