Watershed quarter for Leigh Creek Energy

Published 06-MAY-2019 15:06 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Leigh Creek Energy Ltd (ASX:LCK) recently provided an update on developments that occurred in the three months to March 31, 2019, a quarter which is sure to be remembered as a watershed period for the group.

In late March, the company informed the market that it had received a PRMS (Petroleum Resource Management System) of 1,153 petajoules 2P certification at the Leigh Creek Energy Project (LCEP) from Denver-based MHA Petroleum Consultants.

This classification is a result of the success of the Pre-Commercial Demonstration Plant (PCD) at the LCEP, where the PCD produced all targeted commercial gases with commercial flow rates from a single gasifier.

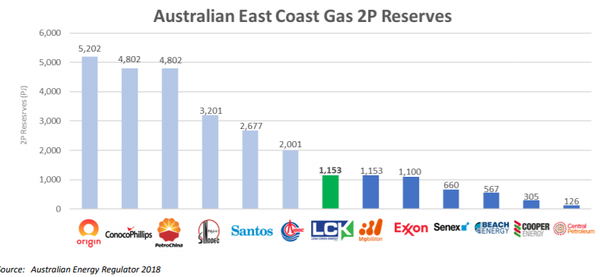

This 2P reserve certification confirms that the gas at the LCEP is of considerable value and has been independently certified as suitable for a commercial project, and now based on the Australian Energy Regulator report (2018) unequivocally represents one of eastern Australia’s largest undeveloped and uncontracted gas reserves.

The comparisons below demonstrates where Leigh Creek sits in terms of its peers.

Interestingly, many of the smaller companies above that don’t measure up to LCK in terms of resource size trade on superior valuations, suggesting that the slight retracement from a recent strong rally (see below) in the March quarter could be the precursor to another share price surge.

Those that do have superior reserves are mainly multibillion-dollar multinational groups.

A recent commercial transaction between Origin Energy and Australia Pacific LNG (APLNG) implied a purchase price of $1.79 per gigajoule, setting a benchmark price for gas transactions that are currently uncontracted and still in development.

Interestingly, this suggests Leigh Creek could be sitting on a resource valued in excess of $2 billion - not bad for a company with a market capitalisation of $150 million, suggesting there is significant scope for a rerating based on the value of the company’s assets.

PCD delivers world-class gas heating value

The PCD was a success with the research and commercial objectives having been met.

In particular, it confirmed that the syngas produced is of sufficient quality and quantity to support a commercial project.

The peak flow achieved was an impressive 7.5 million cubic feet per day.

Management also confirmed that the PCD achieved a gas heating value (energy), representing one of the highest for air-blown syngas achieved anywhere in the world.

Subsequent to the end of the March quarter, the company commenced the decommissioning of the PCD.

Once completed over the next month, this will significantly reduce the level of cash burn.

The environmental monitoring will remain ongoing until successful decommissioning has been demonstrated.

Cost recovery through PCD lease, sale, service

Leigh Creek signed a Heads of Agreement (HoA) with South African based African Carbon Energy Pty Ltd (Africary) for the negotiation of one or several of the Lease Agreement, Sale and Purchase Agreement and the Service Agreement.

This will enable the PCD to be in the first instance leased by Africary and the granting of an option for Africary to purchase the PCD for use at its Theunissen underground coal gasification project in South Africa, and for Leigh Creek to provide advisory services to Africary.

If the agreements are signed, this will mean that LCK will be able to recover the majority of its engineering and plant costs of the PCD and to also have an early path to revenue.

Consequently, the company is in good financial shape as it looks to advance negotiations with potential joint venture partners on investment structures and the full funding solutions for a commercial facility at Leigh Creek.

As at March 31, 2019 the company had cash of $6.6 million, as well as some head room with its research and development working capital debt facility.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.