South Pacific appoints technical team for PNG project

Published 27-SEP-2016 15:24 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

South Pacific Resources is a very high risk stock. Getting mining projects up and running in countries such as PNG is no simple feat for political and social reasons, and there may be challenges ahead. You need to fully inform yourself of all factors and information relating to this company before engaging with it.

South Pacific Resources (ASX: SPB) has engaged Tamarind Management Sdn Bhd, a private oil and gas company based in Kuala Lumpur to provide support in developing its recently acquired license reservations in PNG.

Importantly, Tamarind has substantial experience in developing assets in that region and is headed up by high-profile personnel that have had past experience with leading energy services groups such as Schlumberger.

As well as having extensive technical and commercial experience, the group was previously backed by Blackstone Energy Partners LP with a capital commitment of US$800 million to facilitate exploration of oil and gas opportunities in Southeast Asia.

The agreement which is subject to ASX and shareholder approval involves a minimum cash outlay, dependent on a capital raising event and with an incentivised share option scheme based on the achievement of key development and corporate milestones.

On this note, Tamarind will be allotted 20 million options structured on progressive terms to align with the achievements of significant commercial and technical milestones. These milestones are dated between 12 months and 36 months and will be determined by the group’s share price achieving share price levels up to 15 cents per share with exercise prices ranging between 8 cents and 15 cents per share.

Remember that share prices do fluctuate and past performance should not be taken as an indication of future performance. Caution should be exercised in assessing past performance if considering this stock for your portfolio.

This arrangement clearly aligns the performance of SPB’s management and its technical team with the interests of shareholders, and as such should be seen as a positive development.

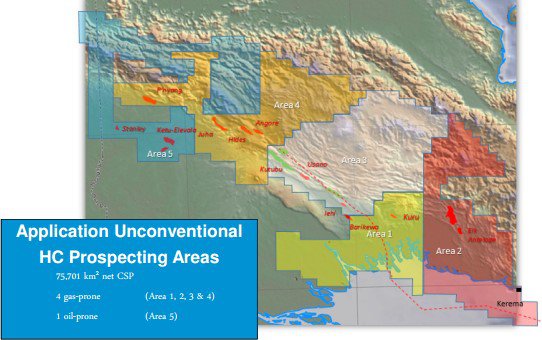

The company’s shares opened 10% higher on Tuesday morning, perhaps indicative of this development receiving a tick of approval. However, they are still shy of the 9.5 cent mark struck in mid-July after the company announced that five unconventional oil and gas reservations had been awarded in PNG, effectively securing 75,000 square kilometres of highly prospective acreage.

Discussing developments leading up to the recent acquisition of license reservations, SPB director, Dominic Martino said, “SPB has achieved a leading prospective unconventional oil and gas acreage position in PNG following a number of years of technical assessment and engagement with stakeholders in the PNG oil and gas sector”.

Receipt of the license reservations occurred following the introduction of a new Unconventional Oil and Gas regime in PNG in February 2016.

Ian Angell, Chief Executive of Tamarind anticipates that the group’s experience in PNG and its wider oil and gas capability should leave it well-placed to maximise the longer term value of the prospective unconventional acreage held by SPB.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.