Santos conditionally exercises option on Beehive-1

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

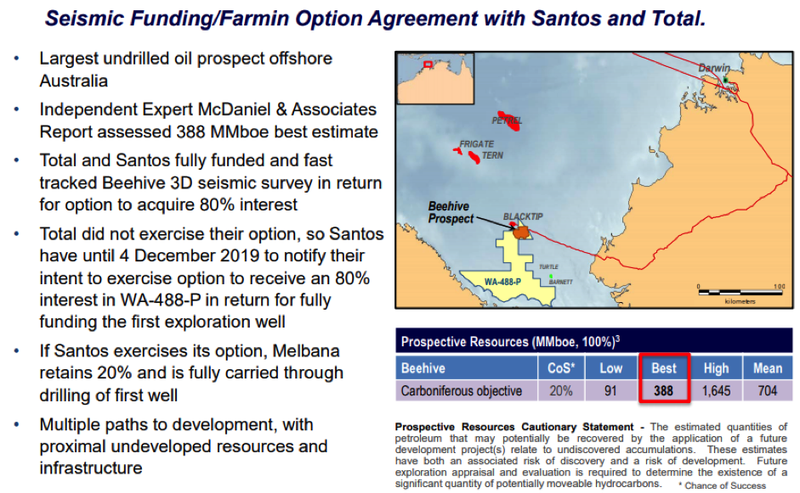

In a promising development for Melbana Energy Limited (ASX:MAY), Santos Limited (ASX:STO) has validly and conditionally exercised its option to acquire an 80% interest in the Permit containing the Beehive prospect.

The parties agree that upon the satisfaction of the conditions Melbana will transfer an 80% interest in the permit in return for the transferee(s) funding 100% of the cost of the Beehive-1 well.

Santos is in active discussions with several parties with respect to participation in the Beehive-1 exploration well and these discussions are ongoing.

As such, it has been agreed that Santos is not required to submit an application for the transfer of an interest in the permit until it has successfully concluded a farm out for some of its right to acquire that interest.

Santos working on rig availability

Santos has also indicated that the work it has done on identifying rig availability suggests the drilling of the Beehive-1 exploration well would possibly not occur prior to the end of the current permit year (December 2020).

As such, an application for an extension to the current permit year should be made subsequent to Santos successfully farming out some of its participating interest in the permit.

Melbana has agreed to allow Santos until March 4, 2020 to complete a farm-down of its right to acquire an 80% interest in the permit.

If the farm-down is successful, the parties would then collaborate to secure the necessary extension to the current Permit year to align the drilling of the Beehive-1 well with rig availability.

Should Santos be unable to conclude a farm-down by March 4, 2020, or if it is not possible to subsequently extend the permit year, the exercise of the option will not become unconditional and will expire and Melbana would retain a 100% interest in the permit.

Santos agrees to fund environmental permit

In consideration for Melbana affording Santos more time to conclude a farmdown, Santos agrees to complete at its expense an application for an environmental permit (EP) for the drilling of the Beehive-1 exploration well.

This commitment by Santos to produce an EP, along with its identification of a firm rig slot for drilling the well, should assist with the application for any extension request to the current Permit year.

Melbana would remain free carried for its 20% interest in this exploration well should the above conditions be satisfied and the option exercise becomes unconditional.

Targeting upper end prospective resource of 1.6 billion BOE

Underlining the potential transformational impact that Santos’ involvement would have should the prospective resource be proven, Melbana chairman Andrew Purcell said, “Santos' decision to farm-down its large equity interest in Beehive is entirely consistent with its recently stated strategy of optimising its portfolio through acquisitions, disposals and farm-outs, particularly in northern Australia where it is working to reduce its equity in the Barossa Field and Darwin LNG to 50% or less.

‘’We’re pleased to continue to work co-operatively with Santos given the commitment they’ve shown to Beehive - a prospect with 388 million barrels of oil equivalent (BOE) of prospective resource (best estimate) and potentially 1.6 billion BOE of prospective resource (high estimate) which, if proven, would prove transformative for each of our companies and for northern Australia.

‘’This variation to our agreement with Santos takes us a critical step closer to drilling the largest undrilled structure in Australia.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.