Sacgasco prepares to drill what could be a game changer

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Sacgasco Limited (ASX:SGC) has released promising results from an Independent Prospective Resources Report of the Borba Prospect, located in the Sacramento Basin of California.

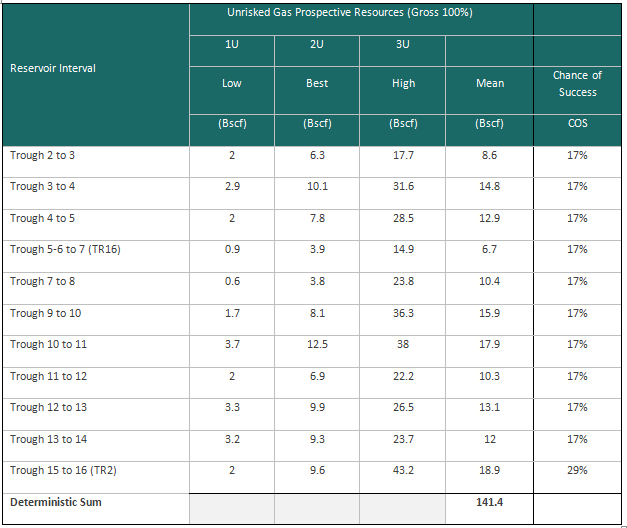

The report, completed by ERC Equipoise Pte Ltd (ERCE), has assessed a Mean Unrisked Prospective Resource of 141 Bcf (Gross 100% JV) and 74 Bcf (Net SGC Entitlement Share after Royalty) of recoverable Natural Gas for the Borba Prospect.

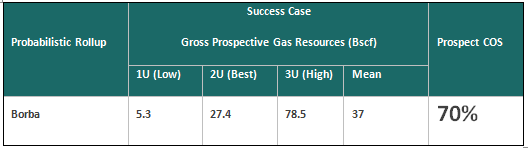

The chance of intersecting at least one gas zone has been estimated at a relatively high 70%.

The rig relocation is near completion, and the Borba 1-7 well is expected to spud this week.

Given the high chance of success and management’s extensive experience in this region, this is a much-anticipated project.

While the 70% chance of success determined by ERCE makes this a highly prospective target, management assesses the chance of development as 80%.

Given the group has vast experience in drilling wells and operating producing projects, the chance of development assessment adds significant validity to the independent resources report.

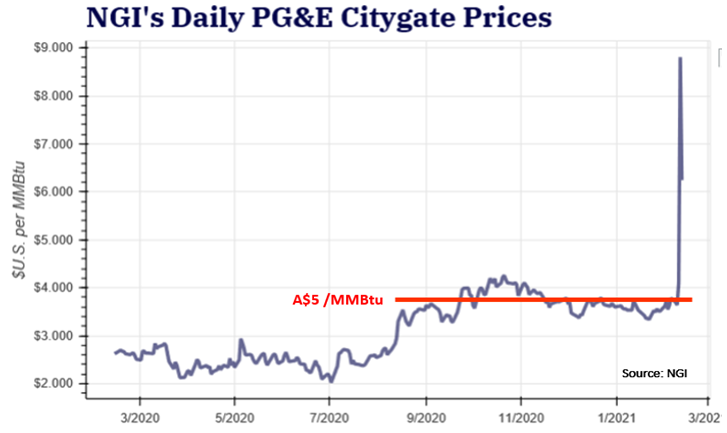

Providing even more investor interest is the macro environment with natural gas prices on the US West Coast having spiked considerably in recent months as indicated below.

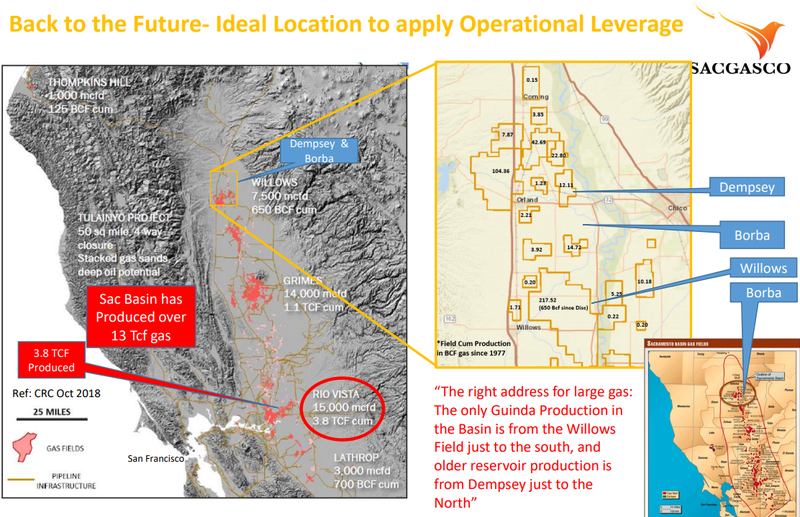

On-trend from 650 billion cubic feet Willow Gas Field

By way of background, the Borba Prospect lies just north of the Willows Gas Field (650 Bcf produced) on an extensive prospective Sandstone trend for Natural Gas in the North Eastern Sacramento Basin.

From a geological perspective, the potential traps mapped by Sacgasco along this trend range from Channel Sands wrapping around structural highs to stratigraphic traps created by sandstones onlapping onto structural highs.

The interpretation of the 3D data reveals traps that are significantly larger than the Borba Prospect with multi-Tcf-potential.

Success at Borba 1-7 is expected to open-up these plays for follow-up evaluation within the Borba AMI and within JV AMI on-trend with Borba.

Consequently, the upcoming drilling program has broader ramifications than one-off drilling results which alone can produce strong share price reratings.

However, if investors join the dots and look to the potential for success beyond the immediate drilling campaign Sacgasco’s share price could experience a sustained rally.

On the score of opening up future plays, Borba’s close proximity to the high profile Willows Gas Field as indicated below will come under the spotlight.

Well to test over 5000 feet of gas saturated sediments

In discussing the upcoming drilling campaign and drawing parallels with other major discoveries, Sacgasco’s managing director Gary Jeffery said, “Borba is a beautiful example of Discovery Thinking, and as we have stated, Borba is a play opening well to open-up a multi-TCF natural gas trend in the Northern Sacramento Basin.

‘’This well will test over 5000 feet of gas saturated sediments with 11 or more mapped reservoir intervals in one well, resulting in a high probability of success.

‘’It is worthwhile comparing the recent drilling at West Erregulla in the Perth Basin (the Little Brother of the Sacramento Basin) where a similar high COS of discovery and development of 69% was predicted ahead of the successful well results, high pressure, high-rate gas flows and market excitement, albeit from significantly deeper reservoirs while incurring higher costs and depending on a smaller gas market.

‘’It is also instructive to compare drilling Borba, onshore at a cost of less than A$6 million practically connected to a massive local gas market, to the recently drilled Ironbark well offshore the Northwest shelf, drilled for a single target in deep water at a cost of reportedly over $80 million.’’

The following ERCE table breaks down the multiple reservoir intervals to be tested, and this was used to establish an independent estimate of the unrisked gross prospective resource of 141.4 billion cubic feet.

Management says 70% chance of success, 80% chance of development

The Borba 1-7 well has been planned to test the presence of hydrocarbons in all 11 assessed layers.

Using the risking matrix in the table above, ERCE has aggregated, to a prospect level, volumetrics based on the risks and volumetric distributions of each reservoir layer.

To calculate this overall Chance of Success (COS), ERCE has made assumptions regarding the dependency of risk elements between each reservoir layer.

Management noted that the resulting volumetric distributions and risks were created by “Rolling Up” the risks and assuming success in at least one drilled interval.

The result determined the Success Case prospect COS of 70% as outlined below.

Management highlighted that an assessment of the Chance of Development was beyond the scope of the ERCE report and the capability of ERCE based on the information provided to them.

As experienced operators in the region, management assesses the Chance of Development to be 80%.

All prospective reservoirs in the Borba area of the northern Sacramento Basin produce high quality dry gas, so the hydrocarbon phase is expected to be commercially lucrative natural gas.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.