RLE says 3C gas resource over 1 Tcf present at Cooper Basin wells

Published 13-NOV-2014 20:04 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Real Energy Ltd (ASX: RLE) says strong gas pays at its two drilled wells in the Cooper Basin indicate 3C Contingent Resource in excess of 1Tcf of recoverable gas.

RLE recently completed drilling of its second well in the Cooper, Queenscliff-1, which hit strong gas pays in two gas-saturated formations – Toolachee and Patchawarra – that were also encountered by its maiden well Tamarama-1.

Strong gas pays lead to resource revision

Independent geological studies indicate that a Basin Centred Gas (BCG) play of potentially 10.2Tcf of gas runs through RLE’s 100% owned 2 million acre land bank in the Cooper Basin, one of Australia’s prime oil and gas producing regions.

Tamarama-1 and Queenscliff-1 were designed to test for that BCG and were initially estimated by RLE to hold 300Bcf of 3C.

But Managing Director Scott Brown says the strong results at both wells have led to a sharp upward revision. “We thought it was important to inform the market of the size of our project so far,” he says.

“While it is early days we have made some very important steps on the way to achieving Real Energy’s medium term objective of developing a World Class Tier 1 gas project. To have a 3C contingent resource estimate at this stage in excess of 1Tcf is fantastic for our company.”

Gas saturated Queenscliff-1 results

The company’s maiden well, Tamarama-1 well hit gas pays in two gas-saturated formations – Toolachee and Patchawarra – at its ATP 927P tenement.

It hit 21m of net sandstone gas pay (from gross 44m) in the Toolachee formation and 66m of net sandstone gas pay (from gross 121m) in the Patchawarra formation.

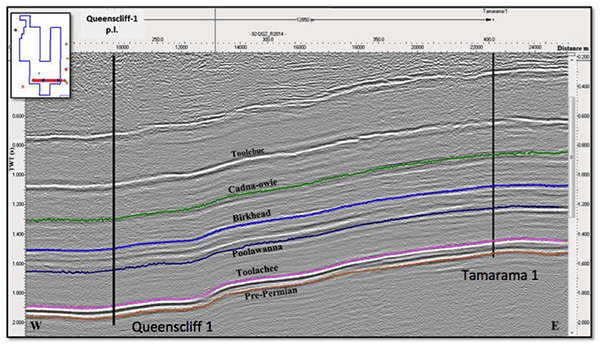

The follow up well, Queenscliff-1, was designed to test the extent of these formations and was drilled 668m down dip of Tamarama-1. It was spudded on October 8th and drilled to a Total Measured Depth of 3,219m.

It encountered gas-saturated readings, measuring 32.5m of net sandstone gas pay (from gross 66.5m) in the Toolachee Formation and 34.8m of net sandstone gas pay (from gross 87.5m) in the Patchawarra Formation.

Seismic Section with Proposed Tamarama-1 and Queenscliff-1 Locations

In addition, Queenscliff-1 also encountered 10m of net sandstone gas pay (from gross 30m) in the Triassic Paning Member of the Nappamerri Formation.

Next steps for RLE

The discovery of strong gas pays at both Tamarama-1 and Queenscliff-1 strengthens RLE’s case for a BCG within its Cooper Basin tenements.

RLE says the positive results of its two wells have paved the way for an even larger drilling programme in 2015, and it’s now working up targets and schedules.

Production testing for both Tamarama-1 and Queescliff-1 is also being planned and should take place in 2015.

Following this testing, RLE says it will engage an independent petroleum engineering firm to prepare a report on its gas resources.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.