Red Emperor on the march in Alaska following approval of drill permit

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Alaskan oil explorer, Red Emperor Resources NL (ASX|AIM:RMP), has received a permit to drill its Winx-1 exploration well in Alaska.

Full approval, without comment, was given by the Alaska Oil and Gas Conservation Commission (AOGCC) on January 16, paving the way for Red Emperor to mobilise the drill rig in early February, with spudding to occur on schedule mid-late February.

The cashed up Red Emperor acquired some of the most prospective oil and gas holdings on Alaska’s renowned North Slope and is testing a potential company-making 400-million-barrel target. It has entered into definitive agreements with consortium partners, 88 Energy (ASX:88E) and Otto Energy (ASX:OEL), to participate in the drilling of a highly prospective Nanushuk oil trend exploration well on the Alaska North Slope.

Red Emperor is on track to complete construction of the approximately 18 kilometre ice road required for drill rig mobilisation with 50% already done. Construction of the ice pad, from which the Nordic Rig#3 will drill the Winx-1 well, will follow.

Winx is a 3D seismic defined conventional oil prospect located in Alaska’s Nanushuk play fairway. It has a gross mean unrisked prospective resource of 400 million barrels (126MMbbls net to Red Emperor) and is adjacent to the Horseshoe 1/1A discovery well drilled by the Armstrong/Repsol JV in 2017.

Cautionary Statement: The estimated quantities of petroleum that may potentially be recovered by the application of a future development project(s) relate to undiscovered accumulations. These estimates have both an associated risk of discovery and a risk of development. Further exploration, appraisal and evaluation is required to determine the existence of a significant quantity of potentially moveable hydrocarbons.

Red Emperor is well-placed in the region

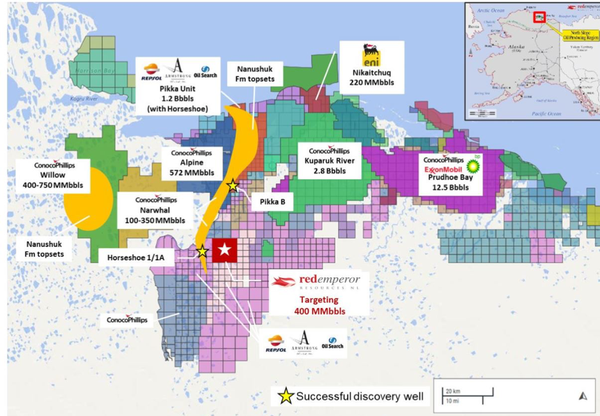

The oil renaissance on the North Slope is being led by some of the world’s biggest energy companies. Prudhoe Bay and Kuparuk River are still producing, having pumped out over 15 billion barrels of oil since 1977, but it is recent discoveries made by the likes of Armstrong, Repsol and ConocoPhillips (NYSE:COP) that have Red Emperor feeling confident.

Even moreso after news that the first exploration/appraisal well of the season, Pikka-B, has successfully encountered hydrocarbons in the Nanushuk formation with Oil Search (ASX:OSH) describing the results as “very encouraging”.

The following map illustrates Red Emperor’s position in the region in relation to major players on the Nanshuk Fairway.

The connection between Red Emperor and Oil Search goes deeper. Oil Search’s US$850 million acquisition of nearby acreage includes one of the largest conventional oil discoveries in the last 30 years. The play could be as big as 3 billion barrels and a good portion of that oil lies immediately adjacent to RMP’s blocks. RMP is targeting the same sands and formation as this discovery, less than 3 miles away.

Oil Search has also mapped two further Nanushuk trends abutting the southern boundary of RMP’s blocks and one to the east and is planning further exploration.

RMP has been on a roll, up 57% since December 20 and currently at 7.2 cents.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.