Real Energy's Project Venus is in a prolific gas producing region

Published 13-NOV-2019 14:22 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Real Energy Corporation Limited’s (ASX:RLE), appointment in October as a joint venture preferred bidder for the Queensland Government’s coal seam gas acreage in the highly prospective Walloon Fairway near Miles in Queensland was a defining moment for the group.

Real Energy’s 50/50 joint venture partner is Strata-X Energy (ASX:SXA), a company that is actively engaged in oil and gas exploration and development.

The joint venture partners had to engage in a competitive tender process in order to be appointed as preferred bidders for acreage PLR2019-1-11.

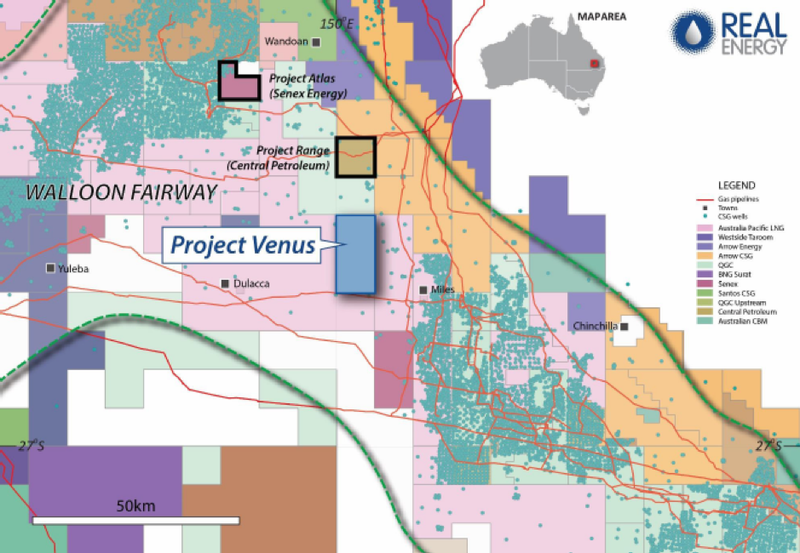

This acreage which has been attributed the name Project Venus by the joint venture partners is situated in a prolific gas producing region where more than 4000 wells have been drilled.

The large number of wells, as well as the high profile companies that have been involved in their development (see Legend) is shown below.

Of note, are projects being developed to the north by Central Petroleum (ASX:CTP) and Senex Energy (ASX:SXY).

From a share price perspective both of these companies have performed strongly in the last six months.

Share price re-ratings can occur quickly

Shares in Senex increased 50% from 28 cents in June to hit a high of 42 cents in September after the company commenced drilling project Atlas at the start of August and quickly moved to first production on 8 October.

Management expects completion of the combined Project Atlas and Roma North work programs to result in the group’s Surat Basin production to be in the vicinity of 18 petajoules per annum by fiscal 2021.

Central Petroleum’s share price increased 60% over the same period.

The success of Central Petroleum and in particular Senex demonstrates how quickly success can be realised in the CSG industry.

Unlike slow burn offshore drilling projects that are extremely costly in terms of exploration and development, as well as often presenting challenges in transporting the resource to users, CSG projects are cost and time efficient.

Furthermore, as evidenced by Senex’s contracted sales agreements with major Queensland users such as CSR and Orora, gas from Venus could be efficiently hooked up to existing infrastructure and delivered to high demand east coast markets.

Pilot program to underpin investment decision

While the area surrounding Venus has been heavily explored and has already produced at high levels, there are still substantial untapped resources.

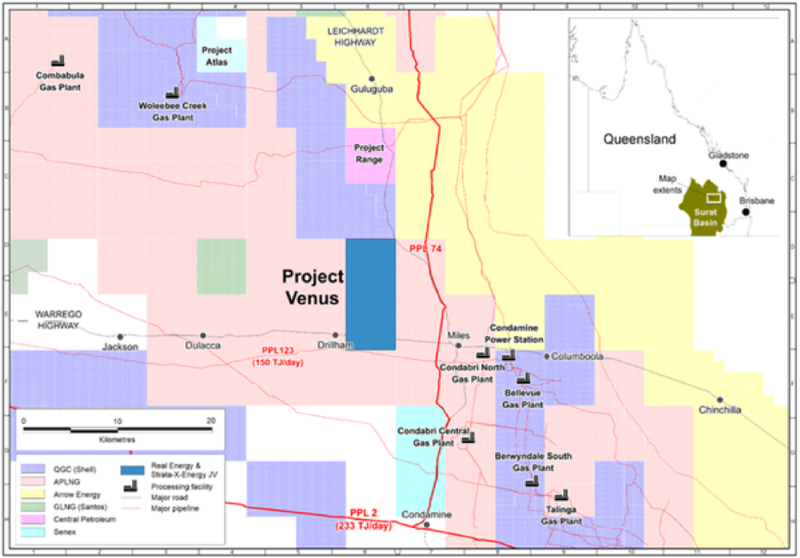

As the map shows, project Venus is located in close proximity to producing wells and projects under development, but the Venus joint venture will have the first tilt at transitioning the area to a commercially viable producer.

Venus is immediately adjacent to gas infrastructure and all of the acreage is prospective for CSG.

There are several previously drilled CSG and conventional wells located within and around the acreage that confirm this, including a fully cored well within PLR2019-1-11 which had coal seams with gas contents of up to 13 cubic metres per tonne.

From a broader perspective, Real Energy noted that 2P reserves in nearby CSG fields totalled more than 1200 petajoules.

High-quality Walloon coal is from 350 metres in a north-easterly direction to 700 metres deep to the south-west with outstanding coal seams thicknesses of up to 34 metres.

The joint venture will initially drill and test pilot CSG wells with a view to proving commercial gas flows in the north-east area.

This is expected to provide sufficient flows for a financial investment decision foundation project.

The size of the prize is significant, suggesting that the upside potential isn’t recognised in Real Energy’s share price which currently implies an enterprise value of $8.5 million.

Windorah Gas Project offers further upside

It is worth noting that this project is in addition to the company’s existing acreage which has a certified estimated total mean gas in place of 13.8 trillion cubic feet and a 3C gas resource of 770 million cubic feet.

In terms of determining fair value, K1 Capital updated its research on Real Energy in July, attributing a base case value of 16 cents per share, implying upside of 400% relative to the group’s current share price.

Further highlighting the company’s undervalued position, subsequent to K1’s report, Real Energy substantially upgraded its Windorah Gas Resource, including an uptick in the 3C Contingent Resource to 770 billion cubic feet, significantly higher than the 672 billion cubic feet referenced in K1’s report.

Consequently, there is no doubt that Real Energy is punching well above its weight, and should promising news flow from the Venus project trigger a swift rerating, the upside could be substantial.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.