Real Energy taps Halliburton for frac job

Published 20-NOV-2015 09:50 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Real Energy (ASX:RLE) has confirmed that it has tapped Halliburton to conduct a five-stage frac job at the company’s Tamarama-1 well in the Cooper Basin.

The frac is targeting the Toolachee-Patachawarra formations below 2300m and is scheduled to take place in the March quarter next year.

Tamarama-1 is one of two wells which sit on the ATP 927P permit in the Cooper Basin, with un-fracced flow rate from Tamarama-1 measuring 400,000 cubic feet of gas per day.

However, with the Toolachee and Patchawarra formations flowing much higher rates of gas when they are fracced at other places in the Cooper, the proof will come when the Tamarama-1 well is fracced.

According to independent analysis, the contingent resource of the permit range from 77 billion cubic feet of gas on the more sure 1C category to 672Bcf on the 3C category.

On a prospective basis, the permit is thought to hold a recoverable resource of 5.4 trillion cubic feet of gas. The permit also has an in-place figure of 13.7Tcf, which was up 141% on previous estimates.

RLE managing director Scott Brown said the frac job may prove transformational for the company.

“The results from the multi-stage fracture stimulation being undertaken at our maiden basin centred gas well, Tamarama-1, will provide us with significant operational and commercial information which will form the basis for further development upside,” he said.

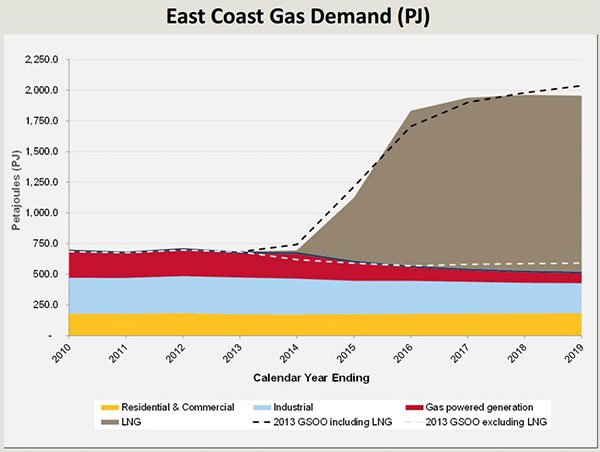

“The company is well placed to take full advantage of the growing demand of east coast gas, and this well stimulation program will further build on the excellent exploration results we have received to date at out 100 [per cent] owned ATP927P acreage.”

Further RLE analysis

RLE has pitched itself as part of the solution to the looming east coast gas crisis, which was given a kick along yesterday when the Australian Competition and Consumer Commission approved Shell’s $98 billion takeover of BG Group.

The deal, which needs regulatory clearance in several countries, has the potential to throw a hand-grenade into the east coast gas market.

Already, the east coast gas market is expected to be short as LNG projects in Queensland not only suck up coal seam gas reserves but also take gas from third parties by offering Asia-linked pricing, which is higher than domestic pricing.

East coast gas demand profile

BG Group has the QCLNG project, one of the Queensland LNG projects sucking up demand.

Shell had a joint venture with PetroChina on the Arrow Energy, which had the highest uncontracted supply of CSG in the country.

While it was hoped by domestic players that Arrow’s gas would find its way to the domestic market, the deal means that it is more than likely that the gas will be used to fuel expansion at QCLNG.

The ACCC found that the gas from Arrow was never likely to service the domestic market, but local buyers such as Incitec Pivot will still be ruing the deal anyhow.

Incitec Pivot currently has a letter of intent with RLE for the supply of 100 petajoules of gas over 10 years should RLE be able to prove up supply.

The east coast market dynamic has led to an environment where heacy users of gas such as Incitec Pivot have been keen to ink supply deals with emerging oil and gas explorers in the hopes that they would be able to secure a long-term supply of gas.

These deals will often be for a set price, giving the industrial player more comfort on the deal in an environment where gas prices are expected to rise despite a decline in oil prices.

For the explorer, it provides a more immediate path to commercialisation before exploration work has been done, giving it certainty.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.