Real Energy seeking enhanced productivity at Tamarama wells

Published 18-SEP-2018 10:00 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

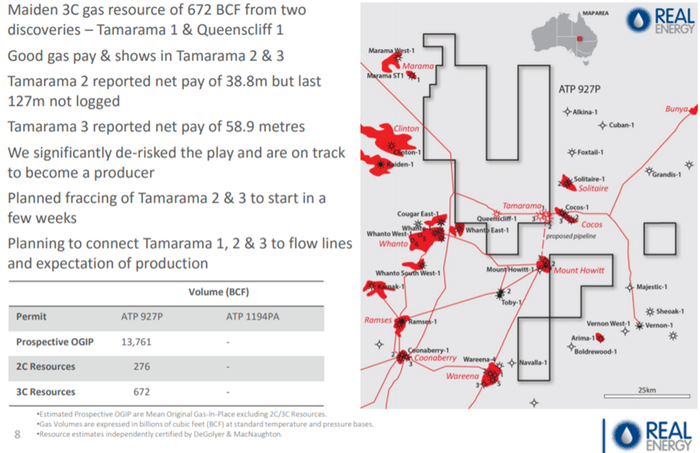

Cooper Basin focused oil and gas company, Real Energy Corporation Ltd (ASX: RLE) has informed the market that fracture stimulation of the company’s Tamarama-2 and 3 wells, located in ATP 927P, Cooper Basin, Queensland will commence within two weeks.

Real Energy is focusing initially on the Toolachee and Patchawarra formations which are well-known throughout the basin for holding and producing substantial gas resources.

Seismic interpretation in conjunction with existing petroleum well data has determined that the Toolachee and Patchawarra formations are significant across much of the company’s acreage. This has resulted in an independent assessment by DeGolyer and MacNaughton, which estimates a mean-case prospective resource in place of 13,761 bcf.

Of course, RLE remains a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

New technology to enhance productivity

Tamarama-2 and Tamarama-3 incorporate new well designs to enable enhanced productivity through better alignment between the hydraulic fracture and the wellbore.

This ‘alignment flow technology’ has resulted from extensive ongoing research at the University of Queensland aimed at improving hydraulic fracturing designs in this area of the Cooper Basin.

Underpinning the new technology is a theory that better alignment with the wellbore, perforations and the hydraulic fracture with the prevailing stress direction, an optimised hydraulic fracture and enhanced flow should be achievable.

Having conducted reservoir modelling to maximise the design of the fracture stimulation, Real Energy’s technical team now expects to conduct a three-stage fracture stimulation in Tamarama-2 and a four-stage fracture stimulation in Tamarama-3 in the Toolachee-Patchawarra formation sections at depths below 2300 metres true vertical depth.

Reservoir modelling points to large resource

The reservoir modelling using the acquired stress and permeability data and enhanced fracturing designs indicate the well’s initial production should exceed 3 million standard cubic feet per day in both Tamarama-2 and Tamarama-3 wells. In dollar terms, and based on current East Coast gas pricing, this equates to potential daily revenue of at least $52,800 if these flow rates are maintained. These wells would be put on production with Tamarama-1 which would add further gas volumes. Highlighting the broader significance of this development, Real Energy’s managing director Scott Brown said, “The fracture stimulation of Tamarama-2 and Tamarama-3 is an important step for Real Energy as we move towards commercialising the Windorah Gas Field.

“We believe we will be able to prove commercial flow rates with these wells which will form the basis for a much broader field development program.”

If Tamarama-2 and Tamarama-3 are a success based on the approach to fracture stimulation that RLE is taking, it is likely that they will use the same completion techniques to commercialise their gas field. .

“Real Energy is very well-placed to take full advantage of the growing demand for Australian east coast gas, and this well stimulation program will build further on the excellent results we have received to date at our 100%-owned ATP927P acreage.”

Real Energy have a lot of near term value catalysts that may improve RLE’s share price, off the back of these successful fracs and flow backs. Real Energy’s acreage has a certified Estimated Total Mean Gas-In-Place of 13.76 TCF and a Maiden 3C gas resource of 672 BCF so the Company has potentially a huge resource to exploit.

Investors appear to have warmed to Real Energy ahead of these developments with its share price increasing approximately 10% in less than a week. However, Tuesday’s closing price of 7.6 cents still represents a sharp discount to K1 Capital’s base case valuation of 21 cents per share and Breakaway Research’s share price target of 32 cents per share.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.