Real Energy announces upbeat news on Tamarama

Published 19-JUN-2017 15:15 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Real Energy Corporation (ASX: RLE) informed the market on Monday morning that it is now witnessing a stronger and faster build-up of pressure and more gas flowing to surface from the Tamarama-1 well.

Estimated cumulative gas and fluid recovery to date at Tamarama-1 is 85 mmscf of gas and over 13,500 barrels of fluids. These are mainly frac fluids with additional water volume being interpreted to come from the coal seam into beds within the Toolachee and Upper Patchawarra formations sections.

While this is promising news for the Tamarama-1 well in its own right, it is also significant in terms of RLE’s strategy of commercialising its Windorah Gas Project which has estimated total mean gas in place of 13.76 TCF.

What this means for Real Energy’s Windorah Gas Project

From a broader perspective, RLE controls nearly 5000 square kilometres of highly prospective territory in the Cooper Basin. The company has established a maiden 3C gas resource of 672 billion cubic feet from two discoveries, being Tamarama-1 and Queenscliff-1.

While RLE’s current resource is yet to be contracted, there is strong interest from gas buyers, prompting the company to continue to pursue a low risk/high return Basin-centred gas play rather than taking the riskier road in targeting shale prospects.

It is also worth noting that Windorah is shallower than some of the surrounding troughs, a feature which should assist RLE in developing a comparatively low cost project. The fact that all acreage is close to infrastructure also works in the company’s favour.

Given ongoing exploration results and RLE’s successful negotiation of a Memorandum of Understanding (MOU) with Santos it could be argued that management’s increasing confidence regarding the commercialisation of the broader Windorah Gas Project is well-founded.

Further positive news was reported regarding gas sales into the domestic market with Managing Director, Scott Brown saying today, “Gas sales agreements are likely as we begin the commercialisation of the Windorah Gas Project, and our company hopes to be a key part of the broader gas supply solution that delivers certainty and dependable energy supply to Australian industry”.

Brown said that he expected to provide an update on gas sales agreements in the near term, a potential share price catalyst for a stock that brokers see as undervalued.

Given RLE is debt free with $6 million in cash, producing assets, an important MOU with Santos and the prospect of near-term domestic offtake agreements, its enterprise value of $14 million (market capitalisation: $20 million) appears well below fair value.

Broker views Real Energy as a potential ten-bagger

Analysts at Hunter Capital Advisors have a high opinion of RLE. The broker’s current valuation of 16 cents per share represents a premium of more than 80% to this morning’s opening price of 8.7 cents.

However, it appears that investors have been buoyed by today’s news with its shares increasing more than 5% in the first half hour of trading.

It should be noted that share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

This could be the start of a more substantial rerating if Hunter Capital is on the mark.

The broker initiated coverage of the stock in May, saying, “As the company matures its 2C resource into reserves, we believe the stock will rerate with its valuation increasing to 52 cents per share on a 50% risk weighting”.

The broker is also of the view that there could be significant upside from this point if the company matures its current 3C resource of 672 billion cubic feet to reserves. Hunter Capital currently values the 3C resource at 38 cents per share.

Of course broker projections and price targets are only estimates and may not be met.

Supply demand dynamics work in Real Energy’s favour

According to Hunter Capital, the timing of RLE’s transitioning from exploration to development and distribution is fortuitous. The broker recently noted that gas-powered generation (GPG) is vital to continued security of electricity supply as the National Electricity Market (NEM) transitions to lower emission targets.

It highlighted that a reliable supply of gas for GPG is critical at a time when withdrawal of coal-fired generation in the NEM is increasing reliance on GPG to maintain reliable and secure electricity supply and meet emissions target reductions.

To meet electricity supply needs, Hunter Capital said the NEM requires either increases in gas production to fuel GPG, or a rapid implementation of alternative non-gas electricity generation sources.

The broker highlighted that if neither occurs, the Australian Energy Market Operator (AEMO) projects that declining gas supplies could result in electricity supply shortfalls between 2019 and 2021 of approximately 80 gigawatt hours (GWh) to 363 GWh across South Australia, New South Wales, and Victoria.

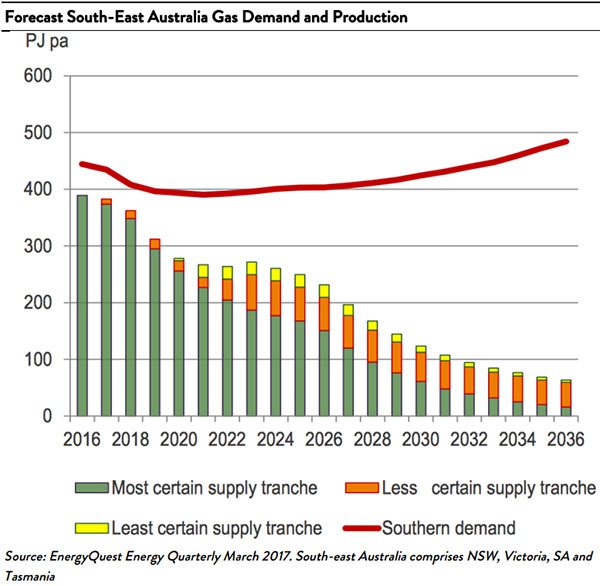

The following chart highlights supply demand dynamics out to 2036, taking into account both certain supply and prospective supply with the demand curve and the ever increasing gap painting a promising picture for RLE.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.