Profiting at $30 oil – it’s possible with the right plan

Published 22-APR-2016 13:42 P.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

You can still turn a dollar in the oil game – but you’ve got to have the right business plan in the right place at the right time.

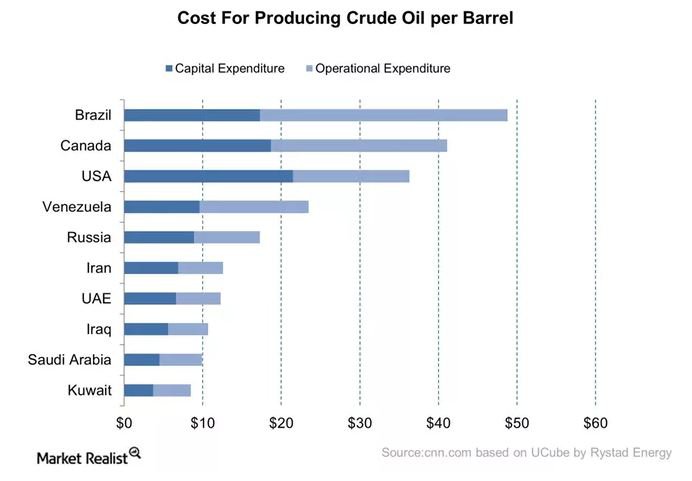

Ever since OPEC began a de-facto trade war with the US a couple of years ago, oil producers have been cutting production, costs, and staff as quickly as they were adding them during the height of the so-called ‘shale gale’.

But, any hopes OPEC had of totally crippling the US oil sector have been dashed, and while several producers have fallen by the wayside there are still those stubborn enough to keep on drilling.

Some of it comes down to drilling commitments on leases, but a lot of the resilience shown in the US oil sector has to do with the perfect storm of drilling costs created during the aforementioned shale gale.

The shale boom brought a surplus of drilling equipment, personnel, and know-how – which all lowered the price of production to the point that in certain parts of the US you can still make a profit on oil drilling – but you still need to be smart about it.

American Patriot Oil & Gas (ASX:AOW) has been one of the companies to benefit from the lowering of prices, and has found itself in the right place at the right time.

AOW’s CEO, Alexis Clark, told Finfeed that despite the oil slump it was still attracted to the US oil sector.

“We are attracted to the US because of the significant number of low risk oil opportunities available which fit with our business model which focuses on low cost acreage in proven oil fields with the opportunity to JV [joint venture] with proven US operators,” he said.

He said that aside from being able to find world class crews at minimal cost, the structure of land ownership incentivised landowners to allow drilling.

“The US is the best place in the world to find these types of opportunities and because of the property rights system including the unique mineral ownership structure whereby the mineral rights (oil royalties) are owned by the landowners means they are incentivised to develop and lease their acreage,” Clark said.

This is in contrast to Australia where mineral rights, even on private property, are owned by the Crown – meaning landholders aren’t exactly incentivised to invite oil and gas drillers on their land.

AOW itself has emerged as one of the more interesting stories in the ASX oil and gas space – and perhaps one of the only listed oil plays which has received two takeover offers.

It is currently mulling over an offer which effectively values the company at $35 million, but has also knocked back a previous “lowball” transaction at asset level for $20 million.

“We rejected the first bid primarily due to the lowball opportunistic nature of the bid for the assets which we believe substantially undervalued the company assets and also the fact the bid was made at the asset level,” Clark said.

“The tax implications of buying the assets of the company would mean the after tax return would be lower for American Patriot shareholders.”

AOW is following the path other junior oil companies have trodden in the past – namely finding farmout deals for its assets which include the joint venture partner ponying up the bill for drilling.

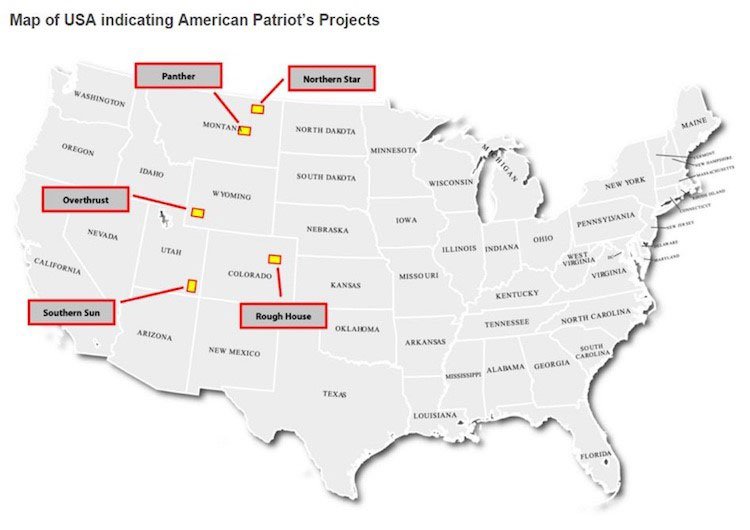

It holds a number of oil and gas leases in four states of the US, with the Northern Star project in Montana and the Rough House project in Colorado considered the leading assets.

Location of AOW’s projects

It enters an asset for a low cost, works them up from a technical perspective, and then farms out in a deal which still leaves them with a working interest – but transfers the drilling cost to the joint venture.

It also goes after acreage which isn’t producing, but has production nearby – in a classic ‘nearology’ play.

For example, its Rough House project isn’t producing on its acreage, but right next door Night Hawk Energy is producing 2000 barrels of oil per day from same assets AOW is hoping to tap.

In a lot of ways, its gameplan mirrors that of Ambassador Oil & Gas – which was sold to Drillsearch in mid-2014.

But, the gameplan wouldn’t work in the Australia of today, where industry appetite for oil drilling is seriously on the wane.

But, for the likes of AOW – the good times can still roll, and assuming it isn’t taken over, it’s looking to do more deals in the second half of this year.

“Assuming American Patriot is not sold further drilling and testing at no cost to AOW on the key Northern Star project in the next three to six months has the potential to unlock significant shareholder value,” Clark said.

“In addition to this we have the first conventional wells in the Rough House project in Colorado in the 2H 2016 where we are free carried by Running Foxes petroleum.

“Finally we are looking at new JV’s on our Panther project in Montana which are expected to close in 2H 2016.”

He said the US is one of the few places in the world where its gameplan can still work – because the low-cost nature of the jurisdiction meant that there were still plenty of drillers to do deals with.

Shareholders are starting to pick up on the play too.

Earlier this year it managed to close out on a share purchase plan to raise $6.05 million, with the offer finishing oversubscribed.

“To receive such overwhelming support from both existing shareholders and new investors for the SPP is a significant endorsement of the AOW strategy,” Clark said.

“Investors are clearly attracted to the AOW business model and the fact we have already received two bids for the company assets in less than 6mths delivering on the business model which we said we would.”

The AOW model is a demonstration of how junior players can build scale without necessarily putting up the dough in times of an oil price contraction.

But, by getting in and making the model work in a low-price oil environment, AOW is hoping to capture any upside to the oil price – which isn’t guaranteed but would be welcomed.

“We expect the market will move into balance in 2H16, setting the stage for a fundamental -but protracted -price recovery due to the significant inventory overhang potentially up to US$60-70/bbl over a period of time,” Clark said.

“In 2H16 we expect that the combination of demand growth and non-OPEC mainly US production declines will bring the market into balance. Importantly AOW’s projects are significantly profitable above US$30bbl.”

In any case, what AOW demonstrates is that with the right gameplan it is still possible to put together a compelling offer – no matter what the oil price.

– James McGrath and Jonathan Jackson

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.