Presidential meeting could accelerate key pipeline for AVD’s Peru gas play

Published 15-JUL-2015 12:22 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

High-level talks between the governments of Peru and Bolivia could see accelerated development for a major pipeline connecting Antilles Oil & Gas NL’s (ASX:AVD) onshore gas project to export terminals on the Peruvian coast.

AVD is pursing a two-pronged strategy for oil exploration, simultaneously exploring for deep water assets in the Antilles Region of South America and The Caribbean, while targeting near-term production onshore Peru.

AVD MD David Ormerod recently spoke to CommSec analyst Tom Piotrowski on the company’s plans for growth via resource discoveries in the following interview:

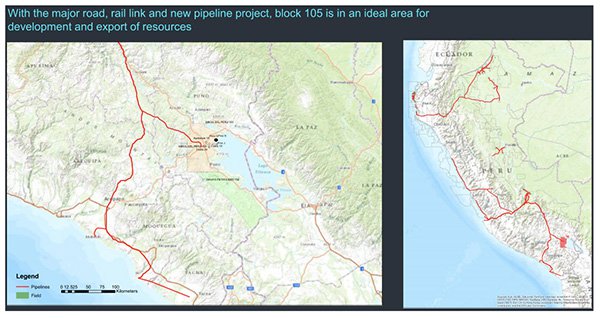

The company’s flagship asset in Peru is Block 105, situated in the Titicaca Basin. The company plans to bring Block 105 into production to underwrite its offshore exploration activities.

Geologic surveys show one section of Block 105 containing 29.6 million barrels in prospective resources, and the company is primed for an imminent exploration programme there.

Pipeline could hold the key for Block 105

A key attrition for AVD at Block 105 is its proximity to the producing Pirin Oil Field and its extensive network of railway and pipeline communications, including access to the South Peru Gas Pipeline project, also known as the Camisea Project (SPG).

When completed, the 1,000km long SPG will carry gas from the inland jungle region of Camisea over the Andes Mountains and into the coastal export terminals of the Peruvian coast.

AVD’s upcoming drilling programme at Block 105 should see a well sunk into an equivalent section holding the Camisea gas project’s reservoirs.

AVD plans to shoot seismic surveys over the prospective resource and the wider area in the lead up to the drilling of pinpoint targets.

This creates an opportunity for AVD to work up significant gas resources it can then feed into the SPG, whose demand is predicted to be 500MMcfg/d with a possible expansion to as much as 800MMcfg/d.

Pipeline talks could push ahead development

In a major development for the SPG, the Presidents of Peru and Bolivia met on the 23rd of June 2015 for high level talks during which the pipeline project was discussed.

Both leaders agreed to study ways that Bolivia – a landlocked nation – could gain access to the pipeline to export gas from its domestic resources industry, a move that could boost the link’s supply and accelerate its development.

The SPG is under construction now and scheduled to be completed by 2019 – but the addition of Bolivia as a possible project partner could accelerate that timetable, giving AVD access to an export link much faster as it works to develop its onshore oil and gas resources in Peru.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.