OEL issues formal notice to spud offshore Philippines well targeting 112MMbbl

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Australian oil and gas explorer Otto Energy (ASX:OEL) has issued a formal to notice to Maersk to mobilise its ultra deepwater drill ship Venturer to the location of its maiden offshore Philippines well, Hawkeye-1.

The ship is expected to set sail by Friday, July 31st, with drilling to commence just a few days after.

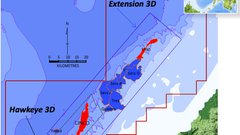

Hawkeye-1 sits within OEL’s SC55 Block and is targeting a potential pocket of oil below a gas cap with a medium success case of 112 million barrels of oil, with around 74 million barrels net to the company’s 63% interest.

Taking advantage of a low oil price and discount drilling rates, OEL estimates the Hawkeye-1 well will cost between $30-$35M, around half of previous rates when oil fetched over $100 a barrel.

OEL is fully funded for the drilling event, with former JV partner BHP Billiton contributing AUS$24.5M and current JV partner Red Emperor Resources (ASX:RMP) paying in close to AUS $6M.

Maersk given sailing orders to spud well

This Friday, July 31st 2015, the Maersk Venturer is due to begin sailing from the Malaysian port Labuan to the SC55 Block offshore the Philippines. Once it arrives on station, it’s anticipated to take one to two days to commence spudding Hawkeye-1.

The prospect sits in 1,700m of water with the very top of the target structure 1,000m below the mudline. It’s anticipated that the drill will reach this zone around 15 days after the spudding, with a total of 23 days expected between spudding and rig release.

OEL is expected to give weekly drilling updates and any hydrocarbon shows could be reported immediately, promising a steady news flow from the imminent drilling event.

Hawkeye-1 could open up a new frontier

OEL has worked up at least nine more hydrocarbon prospects in the vicinity of Hawkeye-1, including the Cinco Prospect, a best estimate prospective resource of 1.6tcf of recoverable gas.

OEL believes that success at Hawkeye-1 could open up a new frontier of oil and gas prospectivity in the southwest Philippines, potentially transforming its company value from it’s current market cap of around $80M.

Capital return to shareholders completed

As it prepares to begin drilling Hawkeye-1, OEL has just paid out a share of the $108M it made from selling its stake in the producing Galoc field offshore the Philippines earlier this year.

OEL’s shareholders approved, by a show of hands, a capital return of A$0.0564 per share with an unfranked Special Dividend of $0.0076 paid simultaneously, drawn from the funds received in the sale.

Galoc is an offshore play in the northwest Palawan Basin that holds 10MMbbl in proven reserves and 23.5MMbbl in proven and probable reserves.

Even after this capital return, there should still be US$43-45M in the company’s kitty – enough cash to fully fund the next two years of planned exploration activities across its current assets.

OEL enters Alaska’s North Slope oil region

In a further development of OEL’s asset portfolio, the company has signed a Letter of Intent to acquire an 8% and 10.8% interest in two areas of Alaska’s prolific North Slope being developed by private oil and gas explorer Great Bear Petroleum.

This move gives OEL onshore assets in both Alaska and Tanzania in addition to its offshore SC55 Block in the Philippines.

Great Bear’s 558,195 net acres on the North Slope are adjacent to both the 25 billion barrel Prudhoe Bay field and the the 5.9 billion barrel Kuparak field. It also borders the Project Icewine area being developed by 88 Energy Limited (ASX; AIM :88E), which is fast tracking a drilling programme for an 8 billion barrel potential target.

OEL will earn a 40% share of a company called Borealis Petroleum Pty Ltd by paying staged capital injections totaling $4M, and receive an 8% and 10.8% interest in two areas of Great Bear’s vast acreage.

When completed, the deal will see OEL participate in 2 oil discovery appraisal wells and 1 exploration well with Great Bear in the 2015/16 drilling season. Great Bear has a three well drilling programme underway presently, with results from the first well called Alkaid-1 due to be released shortly.

Great Bear has spent over $150M shooting 3D seismic and drilling unconventional stratigraphic test wells across its acreage, proving that it holds geological sources for both conventional and unconventional resources – which will be tested by the wells OEL is set to partner in.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.