Multiple share price catalysts in the mix at Elixir’s Nomgon Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

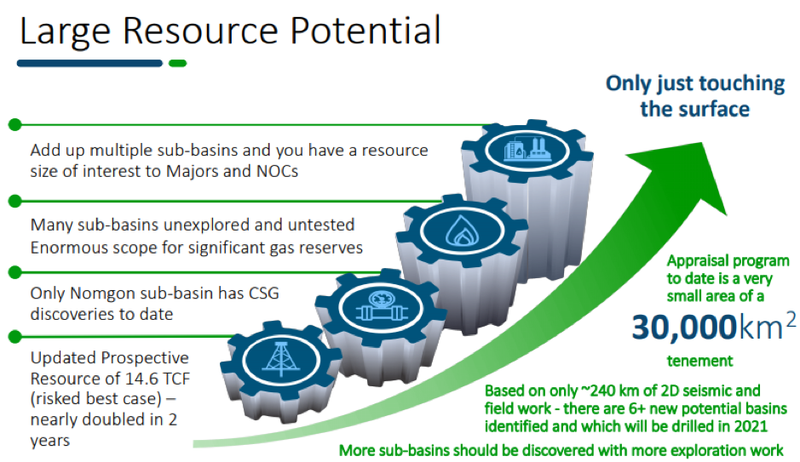

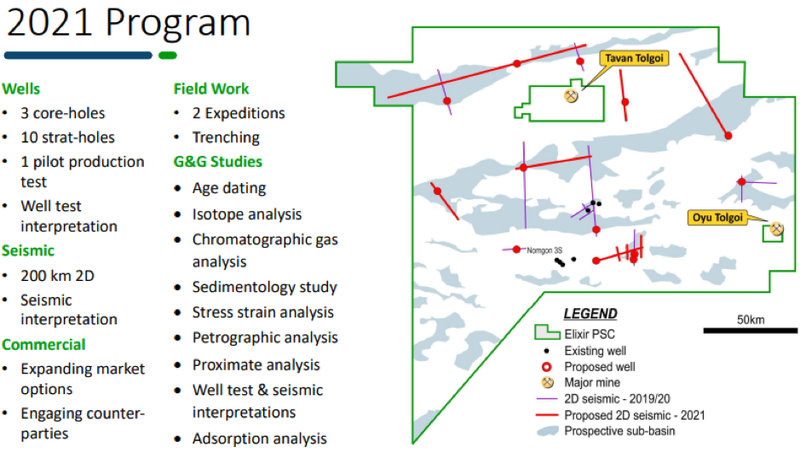

As Elixir Energy’s (ASX:EXR) largest seismic acquisition program to date commences, management has provided an update on the current exploration/appraisal program underway across its 100% owned Nomgon IX CBM PSC in Mongolia.

Given this backdrop and the fact that the exploration wells in two new sub-basins are due to spud later this month, it isn’t surprising to see the company’s shares trading at an eight-year high as its much anticipated program delivers a raft of new data that could support a significantly higher valuation.

Management said that drilling and seismic programs were progressing despite some COVID-19 lockdowns that were occurring in Mongolia.

Most importantly, the first well in the 2021 drilling program, Yangir 2, has just been finished.

The Yangir depocenter has to date proven to be highly fractured and hosting of gaseous rocks, which is encouraging for permeability and gas content respectively, but has made for more complex drilling operations.

The well reached a total depth of 578 metres and in the first 300 metres logged 17 metres of coal - logging beyond 300 metres was not feasible due to hole conditions.

Pipeline specification gas composition

Nine coal samples from 288 to 301 metres were placed in the desorption laboratory and these recorded raw gas contents ranging from 4.2 to 7.0 scm/t (average 5.3 scm/t).

The desorbed gas was chromatographically analysed and contained 99% Methane (on an air and nitrogen-free basis).

Following normal water removal, this gas composition is essentially of pipeline specification.

From a technical perspective, three Injectivity Fall Off Tests (IFOT) were conducted in the well, and whilst it was possible to maintain packer seats, because of the highly fractured nature of the coal and surrounding lithologies, no buildups were possible.

Very high fracture permeability was inferred from this, but not proven.

In providing some detail and relevance around the technical procedures undertaken at Yangir 2, managing director Neil Young highlighted the key takeaways in saying, “Elixir’s ‘rinse and repeat’ model for the repeatable and low cost discovery and appraisal of gas on the Mongolian/Chinese border continues to roll out in 2021.

"Especially pleasing recent news is the pipeline specification gas (and strong gas content) from Yangir-2."

Analysis of the results of Yangir 2 will be completed before planning the next appraisal steps in what appears to be a highly gaseous but structurally complex depocentre.

Just weeks away from targeting a new well

The ErdeneDrilling rig that drilled Yangir-2 now moves some 60 kilometres to the east to the Temee 1S well where the target is coals interpreted from previously recorded/interpreted 2D seismic amplitudes.

Another drilling rig, from a new Mongolian drilling contractor will move to the Cracker-1S well location in the next few weeks, targeting another new depocenter in the north-west of the PSC.

The company’s 2021 2D Seismic Program has also just commenced, comprising of 220 kilometres of 2D seismic, making it the largest Elixir has undertaken to date.

Multiple depocentres are targeted, both new and as follow-ons to the seismic work in previous years.

Management has been undertaking a number of measures in order to maintain a ‘’business as usual’’ approach despite ongoing community transmission of COVID-19 in Mongolia.

These have included vaccinations for staff and contractors, as well as strong isolation procedures in the field, ensuring full compliance with all government directions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.