Melbana seals binding deal for Santa Cruz oil field

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Melbana Energy (ASX:MAY) has provided an encouraging update on its activities in relation to the Santa Cruz oil field — a region that has been in production since 2006.

Importantly, the Santa Cruz oil field — which was initially estimated to have a resource of up to 100 million barrels of recoverable oil — provides MAY with an accelerated pathway to becoming an oil producer and booking reserves in Cuba.

MAY secured the exclusive rights to assess the Santa Cruz oil field in March this year.

As part of these rights, the company had the option to negotiate a long term binding Oil Recovery (IOR) Production Sharing Contract (PSC) from the national oil company of Cuba, CubaPetroleo.

MAY has completed its initial assessment, yielding a number of promising opportunities to enhance production from the designated area.

In addition, it has now finalised a binding contract with CubaPetroleo, which is subject to standard Cuban regulatory approvals. This provides MAY with a long-term right to share in any enhanced production from the Santa Cruz oil field.

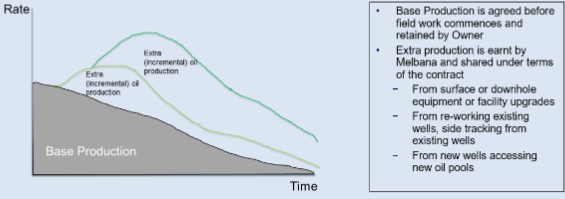

Under an IOR contract, additional production above an agreed base production rate is shared, as show in the graph below.

Generally speaking, the commercial terms are consistent with exploration PSC terms, like those that apply to MAY’s Block 9 PSC, with provisions in place for cost recover and sharing profit oil.

The Santa Cruz IOR PSC is split into multiple phases, with an initial desk-based technical study followed by an implementation phase.

The initial study phase will last no longer than eight months, at which point MAY may elect to proceed to the next implementation phase, which includes a minimum program of two side-track wells from existing well bores to fresh geological targets.

To expedite oil production as soon as possible, the company has engaged a Canadian consultant with extensive Cuban IOR experience to identify possible streamlining opportunities.

MAY CEO, Robert Zammit, spoke on the announcement:: “Securing the Santa Cruz IOR opportunity is a key plank in our strategy to become a producer in the near term.

“I am pleased that we have identified potential opportunities to enhance production at Santa Cruz and that we have had CubaPetroleo’s support to complete our commercial negotiations promptly and lock in the opportunity.

“Our ability to identify the enhanced oil opportunities in Santa Cruz was greatly accelerated given our learnings from Block 9.”

This update comes just days since the last positive development on MAY's radar. Earlier this week, the ASX small cap clinched an agreement with its farm-in-partners — French oil and gas major, Total, and Australia's Santos — to accelerate planning for the Beehive-1 exploration well in offshore Australia, to ensure that it's ready to drill in the September quarter of 2020.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.