IPB catalysts on the horizon as it considers a range of options at Gwydion

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in IPB Petroleum (ASX:IPB) have been adversely affected by volatility in the oil price over the last six months.

While global uncertainty and specific events in relation to oil supply/demand dynamics have affected large players in the sector, it is often smaller companies such as IPB that are hit hardest.

Though this has been a bitter pill for shareholders to swallow, the good news is that IPB’s share price recovery is in full swing, having increased more than 50% in the last two months.

However, with multiple share price catalysts on the horizon, a return to its 12 month high, implying upside of about 100% can’t be discounted.

While it is impossible to predict what the oil price will do, it is worth noting that there was a strong overnight rally of 2.4%, 12 months to the day after the start of a plunge from nearly US$80 per barrel to US$52.50 per barrel.

This happened in the space of two months, not unusual for the commodity which has a habit of swinging significantly, both in positive and negative directions.

Consequently, if this month’s rally of about 7% is the forerunner to a sustained recovery it could represent another share price catalyst for IPB.

However, even in the absence of a rally in the oil price, IPB’s operational outlook and the inherent value of its assets are worth examining as they would appear to support a valuation well above what is implied by the current share price.

IPB takes advantage of subdued industry conditions

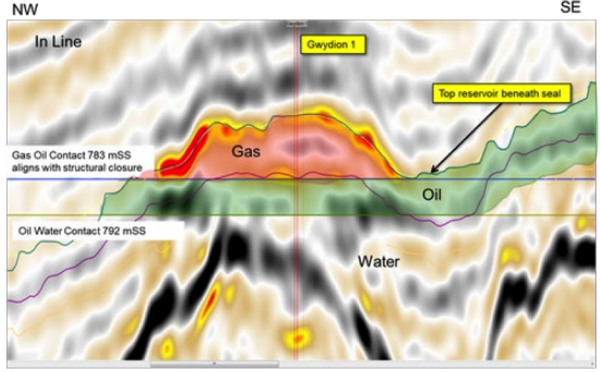

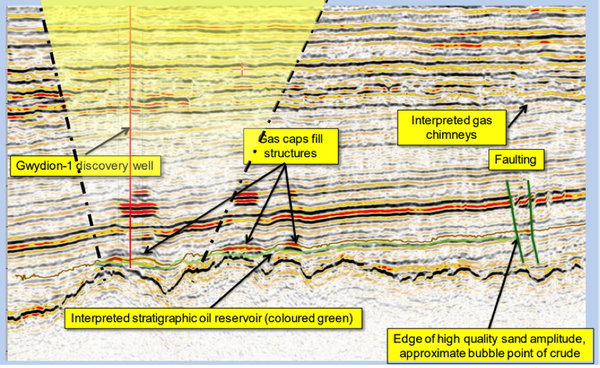

Over the last 12 months, IPB Petroleum has focused its attention on its core Gwydion asset, WA-424P offshore Western Australia and the appraisal of the oil discovery through the drilling of a well at Idris.

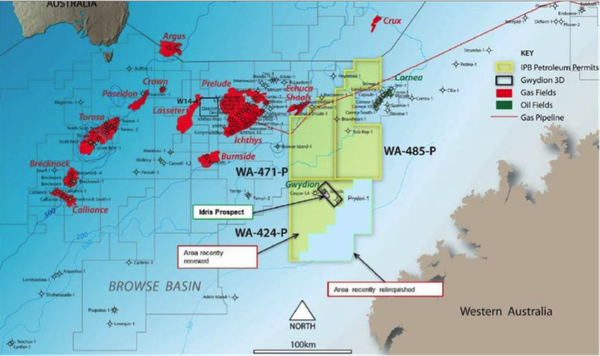

From a broader perspective the principal activities of IPB Petroleum centred on conventional hydrocarbon exploration and associated activities relating to its three exploration permits along the southern margin of the Browse Basin offshore north-west Australia as shown below.

Note that permits relating to certain assets held in that region have been relinquished as management has taken the decision to focus on prospects that offer greater visibility in terms of monetisation.

Reservoir stimulation work completed in April

As part of a renewed farmout strategy, IPB has continued to have positive contact with potential farmin partners and their representatives in both Australasia and the Middle East during the last quarter of the year and since year end.

Interest has been developed as a result of the detailed technical and commercial studies completed on the Gwydion oil discovery and proposed Idris appraisal well throughout the year.

In particular new reservoir simulation work was completed in April 2019 and more rigorous project costings were developed throughout the year and these have contributed to increased interest and confidence in the technical feasibility of the proposed extended drilling, logging and testing program (DTL Project), and a future full field development contingent on success at Idris.

Although likely to be technically feasible, the proposed DLT project remains subject to a number of key milestones including regulatory approval, with NOPTA (National Offshore Petroleum Titles Administrator) requiring the application for a production licence and successful financing.

After management met with NOPTA, the regulator clarified that IPB Petroleum would be required to apply for a production licence if it wished to conduct well tests for an extended period and recover petroleum for sale.

IPB progressing dual strategy

In order to progress the DLT project, the company will therefore be required to apply for a production licence over the Gwydion oil discovery.

Management is progressing a dual strategy aimed at preferentially attracting a new farminee to drill Idris and potentially develop the field should the well be successful.

A fall back strategy would be to conduct the proposed DLT Project following an application for a production licence and debt funding.

Permit WA-424-P was renewed in June 2018, and as part of the proposed renewal terms, an exploration well is required to be drilled during the first three years of the WA-424-P Renewal period.

The renewal period also offers a further two optional secondary term years, providing a total permit renewal period of up to five years.

While the company has a range of options, management said that it has been ‘pleasantly surprised’ by the interest shown internationally in its Gwydion-Idris opportunity.

Further, based on solid technical and commercial work completed over the last 12 months, the company is confident of a positive outcome in relation to this project.

In terms of debt financing, IPB appointed Atoll Financial, an experienced cross-border finance house to arrange debt finance to fund the WA-424-P DLT program.

This provides IPB with the option to raise the required funds by way of a debt issue with the assistance of Atoll through its network of authorised international financial intermediaries and institutions in the Middle East and elsewhere.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.