Invictus ready to start much anticipated exploration program at Cabora

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

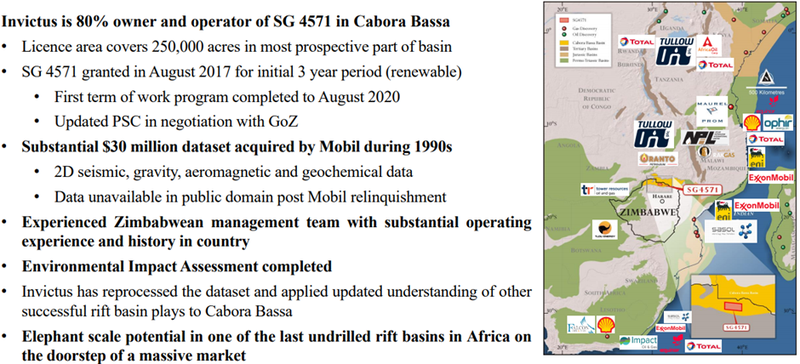

Invictus Energy Limited (ASX:IVZ) is set to commence a field reconnaissance program in the Cabora Bassa Basin in the next fortnight, and the company has completed a further placement for the equivalent of A$220,000 at a share price of $0.066 with the Mangwana Opportunities Fund under a second tranche of the equity funding agreement as announced on April 30, 2020.

The Cabora Bassa Project encompasses the Mzarabani Prospect, a multi-TCF and liquids rich conventional gas condensate target, which is potentially the largest, undrilled seismically defined structure onshore Africa.

The prospect is defined by a robust dataset acquired by Mobil in the early 1990s that includes seismic, gravity, aeromagnetic and geochemical data.

Following the approval of the Environmental Management Plan, easing of COVID-19 related restrictions and the completion of the final cultural ceremonies in the Muzarabani and Mbire Districts, the company will commence field operations in the Cabora Bassa Basin.

The licence area (SG 4571) covering 250,000 acres was granted in August 2017.

Commenting on significance of the upcoming exploration program and the encouraging premium implied in terms of the placement price, managing director Scott Macmillan said, “We are extremely pleased to commence our activity on the ground in the Cabora Bassa Project having now received all of the necessary approvals and restrictions in the country being eased.

‘’The company has a window of opportunity to carry out a reconnaissance program prior to the onset of the rainy season so that we can map out the routes for the planned seismic acquisition campaign next year.

‘’This exercise will enable us to map out the optimal route ahead of the survey which will reduce the acquisition time and maximise efficiency of the survey.

‘’The company is also pleased to have completed a second tranche of funding from the Mangwana Opportunities Fund at a premium of 10% to the previous closing share price.

‘’The funds will be used for the upcoming field program and general working capital.”

Shares surge ahead of exploration program

As the much anticipated exploration program has drawn closer, shares in Invictus have surged, more than doubling in the last two months.

The reconnaissance program and baseline survey consist of the traversing of the proposed infill seismic lines for a planned acquisition campaign in the 2021 dry season.

The program will capture details such as topography, existing access roads, drainage, vegetation cover, soil types, rock exposures, sampling of any natural oil and gas seeps, areas of development (constructions and cultivation), plus any sites of cultural, religious or historic importance.

The duration of the program is expected to be approximately 30 days and is in the final stages of planning and will be completed before the wet season.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.