The Icewine cometh: 88 Energy poised for extensive drilling in 2019

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

As 2018 draws to a close, oil junior 88 Energy Ltd (ASX:88E | LON:88E) has provided vital information on developments across its operations on the North Slope of Alaska — and a number of the issues that it touches on could have a significant share price impact early in 2019.

Of particular interest will be the expected closure of a farmout deal in the March quarter relating to the group’s Project Icewine conventional operation.

On this note, managing director, Dave Wall, said: “By shifting the self-imposed year-end deadline for the Icewine conventional farm-out, we are maximising the chances of achieving the best deal possible for our shareholders and we remain highly encouraged by the level of activity and the quality of the parties active in the dataroom.”

Honing in on Project Icewine

In the first half of 2019, 88E will employ new age technologies to gain a better understanding of the production prospects of Project Icewine.

Prominent oil and gas services company, Baker Hughes (part of the GE group), has been engaged, bringing global experience from both longstanding and burgeoning unconventional plays to provide integrated geological, structural, petrophysical, and geomechanical interpretations for evaluation of the HRZ shale.

The initial review is now complete and is consistent with the prior work done.

Given the rapid advancement of unconventional assessment technologies over the past several years, Baker Hughes has recommended several new state-of-the-art lab tests to augment the current body of work.

From a geological perspective, the main thrust of the work being undertaken is to better understand the producibility of the formation by advanced electron microscope analysis, which will allow for a spatial understanding of landing zones in a horizontal lateral.

This work incorporates an integrated producibility, frackability and geohazards model to find optimal placement for a lateral well in addition to a completion and stimulation program.

The important takeaway, though, is that the HRZ shale remains prospective and will continue to be a focus for 88 Energy in order to unlock its considerable value for shareholders.

Work currently underway is expected to be complete in the first half of 2019, ahead of commencing farm-out proceedings.

Exploration on multiple fronts

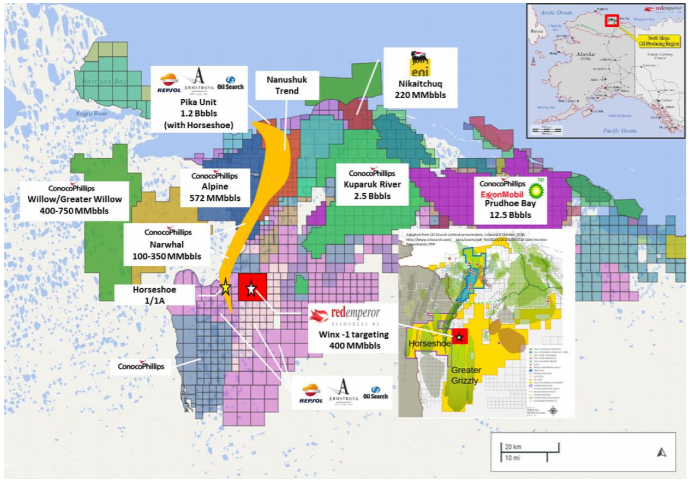

Exploration at the group’s western leases will also swing into gear in the first quarter with drilling of the Winx-1 well on schedule for commencement in February.

Winx-1 is located about six kilometres east of the Horseshoe1/1A well that significantly extended the highly successful Nanushuk play fairway to the south.

The well will target multiple stacked potential objectives, including the Nanushuk, which is the primary target.

Wall also noted that the company would be looking to further investigate the potential of the Yukon leases, which contain the recently defined Cascade prospect.

Inversion of the modern 3D seismic which was acquired in early 2018 and used to delineate Cascade is now underway, with results expected in February 2019.

Cascade was intersected by the Yukon Gold-1 well, drilled in 1993, which penetrated the prospect in a down-dip location in reasonable quality, hydrocarbon saturated sandstone.

The up-dip portion of the prospect can now clearly be identified as a channelised feature and is likely to contain thicker sands of higher quality.

In summing up the coming six months, Wall said: “The first quarter of 2019 is shaping up to be an important period for the company with results expected from ongoing analysis related to the HRZ shale, the drilling of the Winx-1 exploration well, further definition of the potential of the Yukon Leases and, of course, the Project Icewine conventional farm-out.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.