Energy junior Invictus seeks farm-out partner

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The last 12 months have been transformative for ASX junior, Invictus Energy (ASX:IVZ). The company has moved from a US onshore focus with a small interest in the Gallatin gas-condensate project, to acquiring the highly prospective Cabora Bassa project in Zimbabwe with an 80% interest and operatorship.

IVZ's December quarter update released this week provided some details regarding progress made in the last three months.

However, to really appreciate the company’s worth as what could be considered a significantly undervalued stock based on the value of its acreage, it pays to take a step back to earlier in 2018, when it gained an 80% interest in the Cabora Bassa Project.

Cabora is a world-class conventional exploration prospect with the potential for substantial resource expansion.

The fact that Invictus has secured a dominant acreage position in the broader basin that encompasses the Mzarabani Prospect can’t be understated, given it is the largest seismically defined, undrilled hydrocarbon structure in onshore Africa.

NSAI confirms ‘giant’ prospect

As a backdrop, the world-class potential of the Mzarabani Prospect has been confirmed through an independent report by Netherland, Sewell and Associates, Inc. (NSAI).

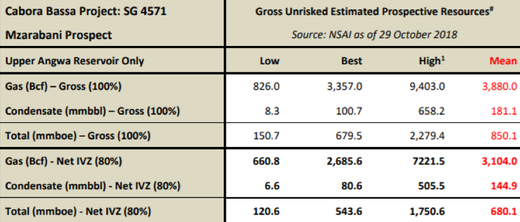

NSAI concluded that the prospect contains 3.9 Tcf (trillion cubic standard feet) of natural gas and 181 mmbbl (million barrels) of condensate, totalling 850 mmboe (million barrels of oil equivalent) prospective resource (gross mean unrisked basis) in the primary target (Upper Angwa Alternations Member) alone.

The size of the primary Upper Angwa target alone in Mzarabani Prospect implies ‘giant’ scale field potential.

Giant fields are conventional oil or gas fields with a recoverable reserve of 500 MMboe or more as, defined by the American Association of Petroleum Geologists (AAPG).

Potential for resource expansion

It’s worth noting that the estimate above excludes the additional potential in the horizons above and below the Upper Angwa, as well as the additional plays and leads that Invictus has identified across its acreage.

Ongoing technical work will be undertaken this year, which will enable Invictus to quantify additional potential — a development that could add further value to what is an already world-class prospective resource base.

The value of the group’s acreage needs to be considered in relative terms.

There aren’t too many companies with a market cap of $15 million that are targeting a resource which is upwards of 3.9 trillion cubic feet of gas.

The coming 12 months also provide an opportunity for Invictus to validate the support for the project offered by the Government of Zimbabwe.

Management is very mindful of this, with MD Scott Macmillan recently saying: “This is a project that can have national significance for Zimbabwe and its people and we are privileged to be able to lead the efforts to drill the first conventional oil and gas exploration well in the country.”

The coming year will be critical for Invictus, as it progresses the Cabora Bassa Project to farm-out and begins preparations for drilling the first exploration well.

Seismic reprocessing yields promising results

During the December quarter, Invictus completed the aeromagnetic data reprocessing which identified numerous leads and play types in addition to the Mzarabani structure, and this data will be incorporated with the seismic interpretation.

The company also acquired additional source rock samples from outcrops located at the western edge of the Cabora Bassa Basin. These samples will be analysed and incorporated into an updated basin model.

Through the IVZ’s continued geological and geophysical studies and the results it has received, significant industry interest has emerged in recent months ahead of the planned marketing program to attract a farm-out partner.

This process could be a market moving development, given that it would provide some de-risking around financial parameters, and is expected to begin following the update to the Independent Prospective Resource Estimate for SG 4571.

Given the big-name players that are currently operating along the east coast of Africa (as shown below), many of which are targeting a similar trend, IVZ may not have too much trouble in attracting a farm-out partner.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.