Elixir’s news of potentially giant gas resource makes for share price tonic

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Elixir Petroleum Ltd (ASX:EXR) were up more than 10% at one stage on Monday after the company released information regarding a potentially giant gas resource within its wholly owned Nomgon IX Coal Bed Methane (CBM) Production Sharing Contract (PSC), located in the South Gobi Desert in Mongolia.

Importantly, the report independently validates the world-class potential of the Nomgon IX CBM, leaving Elixir’s management very much buoyed by the size of the prize.

Elixir’s Managing Director, Dougal Ferguson, highlighted the fact that the company should be in a position to capture further important data in the first half of 2019, saying: “This is a fabulous result and the culmination of a lot of work uncovering data from various sources and collating that information into a meaningful piece of work.

“The company is quickly building its technical database and hence its understanding of this extremely large CBM PSC.

“What has now been independently verified is the huge potential of the area and there is now a clear pathway forward, starting with the 2D seismic acquisition scheduled for May 2019.”

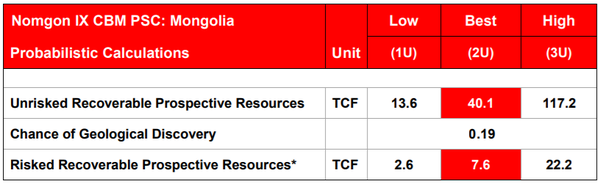

The findings were determined by an Independent Prospective Resources Report recently completed by ERC Equipoise (ERCE) — the results are outlined below:

The estimated resource is expressed in both unrisked and risked recoverable prospective resources in order to provide potential investors with the varying degrees of likelihood regarding possible resource recovery.

More specifically, they relate to the estimated quantities of petroleum that may be potentially recovered by the application of a future development targeting undiscovered accumulations.

These estimates have both an associated risk of discovery and a risk of development.

Further exploration, appraisal and evaluation are required to determine the existence of a significant quantity of potentially movable hydrocarbons.

Prospective resource assessments in this release were estimated using probabilistic methods in accordance with 2018 SPE-PRMS standards.

The data used to compile the independent prospective resource report includes gravity and magnetic data, detailed field mapping information and interpretation of relevant core hole logging from within the PSC.

The report was compiled and interpreted by Elixir and was reinterpreted and validated independently by ERCE on behalf of Golden Horde, which Elixir intends to acquire following receipt of shareholder approval on November 28.

Methodology for determining prospective resource

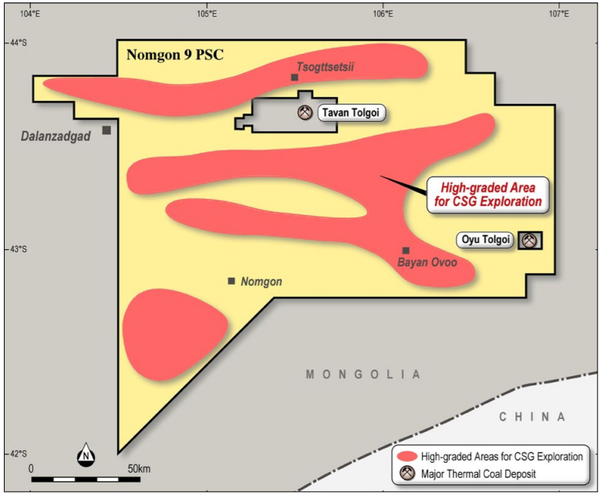

ERCE has determined prospective areas for CBM production by combining elements from surface geology and gravity maps.

The areas where Permian and older sediments outcrop were excluded from the prospective areas.

High definition and low definition gravity maps were provided by Elixir, and the prospective areas were defined where there are gravity lows and where there are no outcrops of Permian and older sediments.

Other input parameters used to calculate the Gas Initially In Place (GIIP) number include net coal thickness, coal density, gas content, ash and moisture content.

These input ranges were primarily sourced from core holes within the Tavan Tolgoi area — one of the world’s largest coal deposits.

It is located within the PSC, but excluded from the PSC itself.

Correlations with the US and Australia

ERCE applied a recovery factor range based on recovery factors estimated from US CBM formations.

The US has multiple producing CBM regions, so a suitably wide range for recovery factor can be derived to apply to an undeveloped CBM resource.

The range also captures typical recovery factors seen in Australian CBM developments.

The chance of development was not applied to the risked recoverable prospective resources but is estimated by ERCE to be 50%.

Ten years to explore 30,000 square kilometres

As a backdrop, the Nomgon IX CBM PSC has a 10-year exploration period and covers an area of around 30,000 square kilometres.

Its close proximity to the Chinese border would be a distinct advantage if progressed to commercial production, being ideally placed for future gas sales into the extensive Northern China gas transmission and distribution network.

In addition to Chinese gas demand, Mongolia currently has no gas production and there is a strong political desire to replace high emission coal power and heat generation with low-emission, clean burning, gas-fired generation.

With the potential to find and develop multiple TCFs of gas from CBM in the PSC area, it is feasible that both the Mongolian and Chinese markets can be supplied with Mongolian CBM.

Following completion of the environmental impact assessment (EIA), the exploration program will commence with 2D seismic acquisition, currently scheduled for May 2019.

The objective of the seismic program is to identify locations for the initial CBM drilling campaign later in 2019.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.