Elixir to spud first corehole in days

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

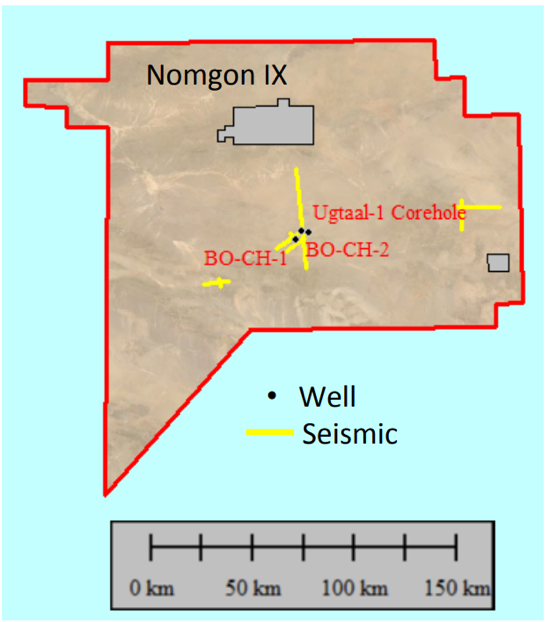

Elixir Energy Limited (ASX:EXR) today provided an update on its 2019 drilling program at its gigantic 30,000km2 Nomgon IX coalbed methane (CBM) production sharing contract (PSC) on the Mongolia-China border.

The company has kicked off its fully funded multi-well drill program beginning with the spud of the BO-CH-1 chip-hole followed by the BO-CH-2 chip-hole.

Most importantly, the company advise that the Ugtaal-1 core-hole is due to spud in just days — it is awaiting the rig that is currently drilling the BO-CH-1 chip-hole.

While the core-holes are the focus of the drilling campaign, these chip-holes provide an affordable source of additional data to complement the seismic that is currently being interpreted. They provide a quick and cost effective way of evaluating subsurface and can confirm general geology and coal continuity and will continue to provide useful data for years to come.

The chip-holes will not only be used to gain valuable information about the general geology and confirm coal continuity, but they let Elixir confirm the existence of coal that the recently acquired 2D seismic program indicates should be there.

As of Sunday 27 October 2019, The BO-CH-1 chip-hole was drilling ahead at 583 metres. The target depth is deeper than was originally planned due to the intersection of various coal seams that encouraged Elixir to drill the well right through the thick Permian section to basement.

Once this has been reached the well will be logged and then the rig will move to spud Ugtaal-1.

The BO-CH-2 chip-hole spudded on 23 October 2019 and was drilling ahead at 189 metres on Sunday morning.

Two rigs are being used for the program in which the wells are being drilled by Mongolian drilling company Erdendedrilling LLC under a turn-key contract.

Elixir’s Managing Director, Mr Neil Young, said “We are looking forward to the spud of our first corehole in a few days’ time. As foreshadowed, the results of the low-cost stratigraphic chip-holes will be integrated into our overall assessment of the geology of the region.”

The PSC comes with an independently certified risked 'best case' prospective resource of 7.6 Tcf and an un-risked ‘best case’ prospective resource of 40 Tcf. Once drilling in complete, the next step towards a proof of concept is a detailed analysis of coals intersected will be undertaken, including desorption and permeability.

As previously stated by management, Elixir will provide continue to weekly updates such as this as drilling progresses.

Well testing boosts Petro Matad

Elsewhere in Mongolia, London-listed Petro Matad (AIM:MATD) closed up 100% last Thursday after announcing results of well testing operations at its Heron-1 oil discovery in the north of Block XX, eastern Mongolia. Block XX is adjacent to the producing Block XIX, operated by PetroChina.

As is the case Elixir Energy, Petro Matad is also solely focused on exploring in Mongolia (EXR for gas; MATD for oil). Both own very large acreage positions — in the millions of acres — which is enormous in global terms, although Elixir’s PSC is much newer than that of MATD and still has many years to run.

MATD revealed that one of two zones in the Heron-1 discovery well flowed crude at a peak rate of 821 barrels per day in testing last week.

The discovery’s DST2 zone flowed light 46 degree API crude naturally without the need for artificial lift or stimulation. The DST1 zone did not flow naturally, but MATD noted that the well proved an oil column of at least 70 metres.

Mike Buck, the CEO of Petro Matad said, “The test results at Heron-1 are even better than we expected given that the well is deep in the basin centre. The data gathered will now be analysed and used to secure tenure of a development area in Block XX with a view to transitioning Petro Matad from explorer to producer with revenue generation.

“I am delighted that the Petro Matad team has been able to achieve this result having put in so much effort. We look forward to progressing to the next phase of the Company's development.”

These “better than expected” results saw the share price bounce back after a disappointing result from drilling at the Red Deer-1 well in September, during which no hydrocarbon bearing zones were identified. The company at that time explained that red Deer-1 did carry a lower chance of success than MATD’s other wells — Heron-1 and Gazelle-1.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.